The Winklevoss Bitcoin ETF is still awaiting regulatory approval from the U.S. Securities and Exchange Commission, but now we know that when the time comes it will debut on the Nasdaq exchange.

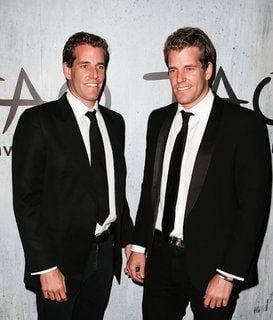

Cameron and Tyler Winklevoss - the twins who gained notoriety by successfully suing Facebook Inc. (Nasdaq: FB) founder Mark Zuckerberg for $140 million for stealing their idea for a social network - filed an amendment to the SEC last Thursday noting that shares of the exchange-traded fund would trade on the Nasdaq exchange.

Cameron and Tyler Winklevoss - the twins who gained notoriety by successfully suing Facebook Inc. (Nasdaq: FB) founder Mark Zuckerberg for $140 million for stealing their idea for a social network - filed an amendment to the SEC last Thursday noting that shares of the exchange-traded fund would trade on the Nasdaq exchange.

We still don't know how far the SEC itself has gotten in the approval process, but most observers expect the Winklevoss Bitcoin Trust - the fund's official name - to be approved by the end of the year.

"The fact that the SEC has allowed the S-1 to progress this far is an indication that it may actually happen," Gil Luria, an analyst with Wedbush Securities, told The New York Times.

The twins say their Bitcoin ETF is intended to make it as easy to invest in Bitcoin as buying any stock.

"Our goal with this whole thing was to make it as similar to the gold ETF as possible," Cameron Winklevoss told The New York Times. "We're trying to reduce the friction of purchasing Bitcoin and securing it."

Winklevoss was referring to the popular SPDR Gold Trust ETF (NYSE Arca: GLD), the shares of which are structured to track the price of a tenth of an ounce of the yellow metal.

To duplicate that structure, the Winklevoss Bitcoin ETF will buy one bitcoin for every five shares of the fund. The Winklevoss Bitcoin Trust is thought to hold about 200,000 bitcoins, which would peg the share price at about $87.

The Winklevoss Bitcoin ETF is just one sign of growing Wall Street interest in Bitcoin.

SecondMarket, which operates a Bitcoin hedge fund for wealthy investors, is seeking approval to offer the fund to retail investors. And in March Fortress Investment Group, Benchmark Capital, and Ribbet Capital announced they were buying stakes in San Francisco-based Pantera Bitcoin Partners, which runs its own Bitcoin hedge fund.

Here's why that matters...

Why the Winklevoss Bitcoin ETF Would Make a Difference

Many investors have been watching Bitcoin from the sidelines, unsure whether to jump in early on what could be a lucrative opportunity, or to simply avoid a new and unproven type of investment.

The bad news and scandals have given investors plenty of reasons to stay away. Bitcoin has been associated with illegal drugs (Silk Road), restricted by governments (China), and suffered the collapse of its biggest exchange (Mt. Gox).

And yet Bitcoin has proven resilient. Despite a more than 60% drop in the Bitcoin price from its November highs, it has stabilized in the past two weeks around the $450 mark, which is still about 400% above where it was one year ago.

The arrival of the Winklevoss Bitcoin ETF, as well as the availability of SecondMarket's hedge fund to retail investors, would help reassure skittish investors that investing in Bitcoin is safe.

And that will prove a catalyst for the Bitcoin price, as new investors help drive new demand. One reason the Bitcoin price has fallen so much in recent months is that the restrictive actions of the Chinese government has drastically curtailed Bitcoin trading in China.

"Once Wall Street starts putting money into Bitcoin - we're talking about hundreds of millions, billions of dollars moving in - it's going to have a pretty dramatic effect on the price," SecondMarket Chief Executive Officer Barry Silbert told Entrepreneur magazine.

What do you think of Bitcoin - passing fad or game changer? Tell us on Twitter @moneymorning or Facebook.

Major investors aren't the only ones getting behind Bitcoin - several other key Wall Street players have also given their stamp of approval lately. You may be surprised at who's supporting Bitcoin now...

Related Articles:

- The New York Times:

- Entepreneur Magazine:

SecondMarket CEO: Wall Street Will Put 'Hundreds of Millions' into Bitcoin

About the Author

David Zeiler, Associate Editor for Money Morning at Money Map Press, has been a journalist for more than 35 years, including 18 spent at The Baltimore Sun. He has worked as a writer, editor, and page designer at different times in his career. He's interviewed a number of well-known personalities - ranging from punk rock icon Joey Ramone to Apple Inc. co-founder Steve Wozniak.

Over the course of his journalistic career, Dave has covered many diverse subjects. Since arriving at Money Morning in 2011, he has focused primarily on technology. He's an expert on both Apple and cryptocurrencies. He started writing about Apple for The Sun in the mid-1990s, and had an Apple blog on The Sun's web site from 2007-2009. Dave's been writing about Bitcoin since 2011 - long before most people had even heard of it. He even mined it for a short time.

Dave has a BA in English and Mass Communications from Loyola University Maryland.