Many market analysts are advising investors to sell their dividend stocks now that interest rates are on the rise. But they're wrong.

The rationale seems sound at face value.

Investors flocked to dividend stocks as a source of income while interest rates were at rock bottom. Investing in bonds at the time yielded a return close to 0%.

Now that interest rates are on the rise, some analysts warn that renewed interest in fixed-income securities will put downward pressure on dividend stocks.

However, there are still reasons why you should hold on to dividend payers. Here are four of them.

Why Dividend Stocks Belong in Your Portfolio

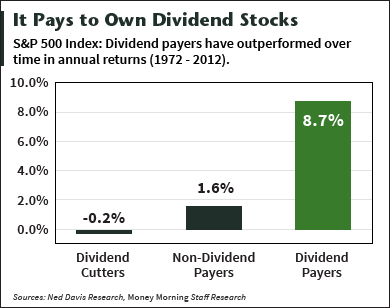

1. High-Yield Dividend Stocks Have Historically Outperformed

The past five years have been good to almost all long-term stock investors. The Standard & Poor's 500 Index has more than doubled.

Those years have been particularly good to those who bought, and held, stocks with high dividends.

The S&P 500 Dividend Aristocrats Index tracks stocks that have increased their dividends every year for the past 25 years. That index has enjoyed a total return of 142% over the past five years, compared to the 104% return of the broader S&P 500.

And dividends are continuing to outperform this year.

Returns in March and April averaged 1.3% and 0.89% respectively for dividend payers, compared with negative 2.3% and negative 2.6% respectively for nonpayers, FactSet reports.

2. Dividends Are a Hedge

Increased market volatility in 2014 has triggered more talk of a stock market correction.

Dividend stocks are a nice hedge against market losses. Even if the share prices dip with a correction, investors still get income.

Just-released: Of the almost 5,000 dividend-paying stocks to choose from, these three companies provide superior payouts and superior long-term growth potential.

3. Companies Raise Their Dividends

If you're thinking about getting out of dividend stocks and into bonds, ask yourself the following question: When was the last time a company raised its interest rate for existing bond investors?

Simply put, that doesn't happen. If you purchase a bond with a 4.5% yield, then that's what you can expect to be your return.

However, if you purchase a stock with a 3.5% dividend yield, it's not necessarily going to stay that way. Good companies tend to raise their dividends. As a result, your income actually increases over time. In fact, check out this list of 25 companies that just raised their dividend payouts last week.

4. There Is Less Volatility with Dividend Stocks

During 2011, when the market was particularly soft, the S&P 500 returned 2%. During that same year, the S&P 500 Dividend Aristocrats Index returned 8.3%.

Even in a market downturn, dividend stocks are less subject to fluctuations. During 2008, the year that all investors would love to forget, the S&P saw a negative return of 37%, while the Dividend Aristocrats Index had a negative return of 22%.

Today's Top Story: The numbers are in, and they're ugly. First-quarter U.S. GDP is only 0.1%, despite the Federal Reserve spending $3.2 trillion to boost the economy. Simply put, the Fed's "growth-buying" scheme is failing...