Analysts look to the gold price history as a tool to make predictions about the yellow metal's direction. Investors can use this history as well, to better understand the complexities of the gold market.

Analysts look to the gold price history as a tool to make predictions about the yellow metal's direction. Investors can use this history as well, to better understand the complexities of the gold market.

A good place to start when examining the gold price history is the 1970s. Up until the early '70s, gold prices hardly fluctuated by more than a dollar or two.

You see, the U.S. dollar used to be pegged to gold, and international currencies used to be fixed to the U.S. dollar. Under the Bretton Woods system of international finance exchange, the dollar could be converted to gold at an agreed-upon, fixed rate of $35 per ounce. And the United States was committed to backing every dollar overseas with gold.

But U.S. President Richard Nixon, who was in office from 1969-1974, decoupled the dollar from gold in 1971 due to various economic pressures. The move helped end the Bretton Woods system, and, more importantly, it allowed gold prices (and other currencies) to float freely with the forces of supply and demand.

And this had a major effect on where gold went after that...

Gold Price History: 1970-1980

The 1970s was a very bullish period of time in the gold price history. Nixon's economic measures sent gold from its fixed price of $36.02 an ounce to an average price of $615 an ounce in 1980.

In 1973, U.S. President Gerald Ford made it legal for private citizens to possess gold. Other countries soon followed.

In 1976, the International Monetary Fund's Jamaica Agreement created floating exchange rates and forever established fiat currencies that were not backed by gold.

Also during this decade, there was an oil crisis and long lines at gas stations. The economy was weak. The "Misery Index" (total of the inflation rate and unemployment rate) hit an all-time high of 21.98% in June of 1980. Looking back, all of the conditions were in place that led to a more than 15-fold increase in gold prices over this 10-year period of time.

Then, the '80s happened...

Gold Price History: 1980-2001

The next two decades turned out to be bad ones for goldbugs. From the highs of more than $800 per ounce in 1980, gold dropped to an average of $383 in 1990, and $271 in 2001.

The prolonged bear market for gold can be attributed to a few different factors.

First, U.S. President Ronald Reagan instilled confidence in the economy and led America out of recession. Second, the U.S. Federal Reserve hiked interest rates and brought down inflation, which stimulated the economy and helped to drive stock prices higher. Third, the Berlin Wall came down, creating a more positive outlook on personal financial prospects and causing safe-haven investments like gold to decline.

And finally, when U.S. President Bill Clinton took office, technology exploded. So did the stock market. For 20 years, gold remained in a bear market.

Gold Price History: 2002-2014

Starting in 2002, gold prices rose for 10 straight years, reaching an all-time high of $1,895 per ounce on Sept. 5, 2011. Two wars, rapidly growing U.S. debt, and the biggest recession since the Great Depression all pushed the price of gold higher.

Starting in 2002, gold prices rose for 10 straight years, reaching an all-time high of $1,895 per ounce on Sept. 5, 2011. Two wars, rapidly growing U.S. debt, and the biggest recession since the Great Depression all pushed the price of gold higher.

After that, prices retreated due to profit-taking and a recovering economy. In 2013, gold saw a dramatic 28% drop.

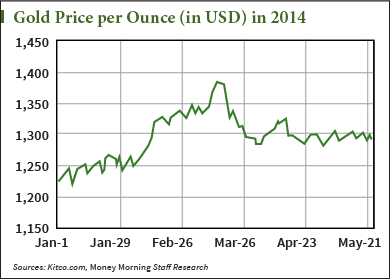

The yellow metal rebounded from December to mid-March 2014, packing on $200 an ounce (17%).

And last week, gold tumbled to its lowest level in four months, to $1,243.00. Quoted at $1,247.75 on Wednesday morning, gold prices are still hovering around last week's low.

As for where gold prices are headed next, the long-term forecast calls for $2,500, even $5,000 an ounce, in the years ahead.

While it might not go up in a straight line, gold is headed higher.

Money Morning recently detailed for our Members the importance of owning gold now - and delivered a two-part "cheat sheet" that outlines the right amount of gold for your portfolio. You can get that gold investing guide - for free - here.

Related Articles:

- The National Mining Association: Historical Gold Prices