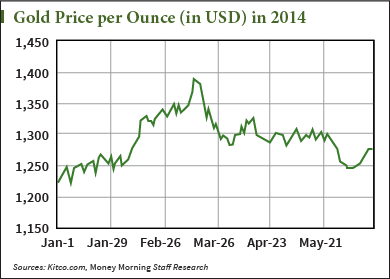

Gold prices posted their best one-day performance in nine months yesterday (Thursday) with a 3.4% surge, and they are following it up with another gain today. Our up-to-date gold price chart shows June's rally after May's record lows.

As of mid-day today, gold for August delivery was up 0.12% to $1,315.70 an ounce on the Comex division of the New York Mercantile Exchange – about a $42 increase on the week. Spot gold traded around $1,315.40 Friday afternoon.

Our new gold price chart reflects the yellow metal's rally from around $1,200 an ounce to almost $1,400 early in 2014. For the last two months, gold sank below the $1,300 mark and has struggled to come back. This week's late gains finally broke the slump, and gold prices rocketed past the $1,300 threshold to put them on track for a 3% weekly gain – their biggest since mid-March.

Here's the top market news that's affecting gold prices right now…

Top Stories Affecting Gold Prices Now

Geopolitical tension in Iraq and Ukraine and a weaker dollar are contributing to the upward surge in gold prices. The safe-haven investment tends to enjoy gains when fear is in the air.

But that's not the only reason gold prices skyrocketed this week.

The Federal Open Market Committee held its fourth meeting of 2014 on Tuesday and Wednesday. Chairwoman Janet Yellen said in a press conference thereafter that the nation should expect faster growth in the economy in 2015 and 2016. She also announced the Fed will continue to reduce bond buying by $10 billion.

"Here's what's most interesting: Official CPI (Consumer Price Index) stats show inflation is up 2.1% year over year," Money Morning Resource Specialist Peter Krauth said on Friday. "Should it continue at this rate, we'd see 3% by late this year."

That's important information for goldbugs.

With the strong inflation reading, many expected the central bank to say it might start raising interest rates earlier than expected, according to The Wall Street Journal. That would be bad news for gold prices, which typically weaken when interest rates go up because investors seek out higher-yielding assets.

But Yellen flat-out dismissed rising inflation. She called the data "noisy" and reiterated that the Fed won't raise interest rates until sometime in 2015.

"Besides the Iraq insurgence and U.S. dollar weakness, I think Fed action may actually be one of the big reasons why gold shot up yesterday, gaining nearly $44 in a single day, good for a 3.4% gain," Money Morning Resource Specialist Peter Krauth said on Friday.

Thursday's record gold price gain isn't the only notable news for the yellow metal.

"The big move yesterday was more importantly accompanied by big buying volume," Krauth said. "Also, the gold price closed way over both the 50-day and 200-day moving averages, making for strong technical momentum."

Both gold and silver have seen strong price action since early June. Krauth noted that it's still early, but these might be signals that inflation is becoming entrenched.

Time to Buy Gold?

Money Morning Chief Investment Strategist Keith Fitz-Gerald said in May that the case for owning gold has never been more clear.

Here's why now is the time to make sure the yellow metal plays a part in your portfolio…

"Many investors are asking themselves if now is the time to buy gold. I think that's the wrong question," Fitz-Gerald said. "What they should be asking themselves is if they can afford not to buy gold."

Fitz-Gerald highlighted the fact that central banks are trillions of dollars in the hole, so they are buying gold as a means of supporting their currencies. According to the World Gold Council (WGC), in 2013 net purchases totaled 369 tonnes. That represents 12 consecutive quarters in which the central bankers have reported net inflows.

And recent gold news corroborates Fitz-Gerald's bottom line…

You see, Fitz-Gerald also stressed that consumers in India and China – who jointly represent three out of every five people alive today – generally believe that gold is going to increase in price over time. Yet few actually own it, according to the WGC and U.S. Global Investors.

"As the economic development in these two countries continues at a rapid pace, overall demand will increase, even if it falls off in developed countries like the United States and in the European Union," Fitz-Gerald said. "Already the statistics are proving this point. Consumer demand in China rose 32% in 2013 to a record 1,066 tonnes, while in India, demand rose 13% to 975 tonnes."

Indeed, we reported earlier this week that demand out of India and China are expected to send gold prices soaring in the second half of 2014.

Barron's agrees.

"We expect the weak physical demand seen in Asia of late to pick up again in the second half of the year, which should result in a rising gold price, especially since the headwind from ETF investors is likely to further abate," analysts Barbara Lambrecht and Michaela Kuhl said to Barron's earlier this month. "We are confident that gold demand in India will pick up noticeably as compared with the first half year and last year once the import restrictions have been eased. China is also likely to demand more gold again in the coming months."

As Asian demand picks up, look for our gold price chart to include an upswing in the latter half of the year.

Money Morning recently delivered for our Members a two-part "cheat sheet" that outlines the right amount of gold for your portfolio. You can get that gold investing guide - for free - here.

Related Articles:

The Wall Street Journal: Morning MoneyBeat: Gold's Perplexing Rally

Barron's: Gold Headed to $1,400 on Asia Demand?