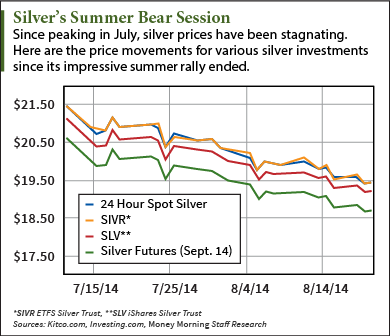

Silver prices are having a tough session, and traders who saw August as a month to rebound from a bearish July are wondering why silver is going down.

This week, the bid price for 24-hour spot silver is trading down $0.17 for a 0.7% loss. Its closing price as of yesterday was $19.415 an ounce, a 0.8% drop on the year. Silver began trading down on the year this past Friday for the first time since June.

And in August, silver prices have fallen 4.7%, making for the second-worst month of trading on the year, compared to March when the white metal fell 6.9%. Unless there is some sort of rally before month's end, this could be the worst August for silver since 2008, when prices fell 22.9%.

Silver futures contracts are down $0.10 on the week to $19.49. This is a 4.8% drop on the month, and a loss of about a dollar.

This decline in physical and paper silver is also reverberating in silver exchange-traded funds. The flagship silver ETF, the iShares Silver Trust (NYSE: SLV), which is backed by physical silver bullion in JP Morgan Chase & Co. (NYSE: JPM) vaults in New York and London, is down $0.13 on the week to $19.18 and $0.98 on the month. A close alternative to SLV, the ETFS Silver Trust (NYSE: SIVR) is down $0.17 on the week and $0.89 on the month, trading at $18.69.

Here's why prices are falling, and why we're still bullish...

Silver Will Reverse Its Fortunes

While it's true that silver is suffering from one of its worst months on the year, it has done this before, and the last time this happened it preceded a bull rally. And what's more encouraging is that in both instances the drivers were similar...

The most obvious explanation for silver's descent can be found in the futures markets. Since the end of July, speculators have been building up their short contracts - paper bets on silver price declines.

This steady increase in shorts puts downward pressure on prices, and silver has been in a particularly big hole because at the end of July, the number of short contracts for silver was at its lowest levels on the year and its lowest number since February 2013.

On July 29, speculators held 12,603 short positions, according to data from the Commodity Futures Trading Commission (CFTC). This figure is well below the average on the year of about 26,600 contracts, and significantly smaller than in June when short contracts hit a record high of around 49,000.

"When there are few shorts, that leaves the price vulnerable to renewed short selling," managing partner at CPM Group, Jeffrey Christian, wrote in an email to Money Morning.

Since then, speculators have been building up from that floor. Short contracts stand at around 21,600. The last time short contracts built up from a nadir in 2014, it took 16 weeks for them to peak and silver lost $3.20, and 17%.

At the moment silver is in a similar cycle.

While that may sound discouraging, these pullbacks are expected in the silver market.

As soon as silver shorts build to a peak, you can expect another bull run. The last bull run this year, marked by a mass liquidation of shorts and a building of fresh long positions, lasted from early June to mid-July, and silver gained 14.3%.

What's Moving Silver Now

Silver has thus far this week been down 0.7%, which is still its best week on the month, though it is yet to be seen how it will finish trading by the end of the day (Friday).

On Monday, silver gained $0.03 to cushion the blow it took last Friday, when for the first time since June it traded down on the year.

But Monday's meager gains couldn't backstop its almost $0.18 dive on Tuesday. On this day, the Bureau of Labor Statistics released the newest Consumer Price Index numbers, which showed prices gained a slight 0.1%. With little upward pressure on prices, silver lost its value as a hedging vehicle against inflation and a weakening dollar, and investors shied away from alternative investments such as precious metals.

On that same day, gold fell $2 to $1,295.20 an ounce.

On Wednesday, the U.S. Federal Reserve released the minutes from its July Federal Open Market Committee (FOMC) meeting, and they revealed that the policy-setting Fed members were becoming less concerned about disinflation, and silver got a slight $0.05 bump from inflation-minded investors.

Though that was short-lived, as prices fell $0.04 yesterday (Thursday).

Silver prices are likely to move today as Fed Chairwoman Janet Yellen makes her speech as a culmination of the Jackson Hole, Wyo., economic symposium.

More on Precious Metals: Money Morning recently delivered for our Members a two-part "cheat sheet" that outlines the right amount of gold for your portfolio. You can get that gold investing guide - for free - here.