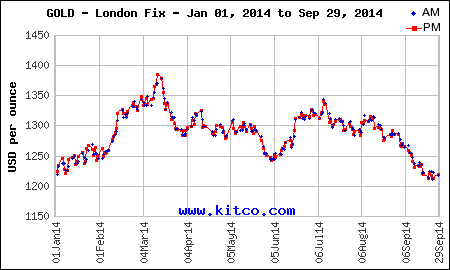

Gold prices today (Friday) are on track to fall to the lowest level since mid-December, as reflected in our new gold price chart:

Click to Enlarge |

Spot gold traded down $21.40 at $1,192.90 an ounce as of 10:45 am EDT. The last time spot gold fell below the $1,200-an-ounce threshold was December 23. Gold futures for December delivery dropped $20.40 to $1,194.70 an ounce, on track for a 0.1% fall in 2014 at close.

Here's what's dragging down gold prices today:

- Fresh, strong economic data: On Friday morning, the U.S. Department of Labor released a stronger-than-expected non-farm payrolls report. Data showed non-farm payrolls rose 248,000 in September and the jobless rate fell to 5.9% - the lowest level since July 2008. That's bad for gold prices because it means the American economy is accelerating...

- ...which strengthened the dollar: The U.S. dollar index - which gauges the greenback's value against six major currencies - hit a four-year high after the jobs data was released. It climbed to 86.59 .DXY, a number it hasn't seen since June 2010. The index is up 8% so far in 2014, and has posted weekly gains for a record 12 consecutive weeks. A higher dollar erodes the value of the yellow metal, which is priced in U.S. dollars.

- ...and could push the Fed to raise rates: The U.S. Federal Reserve has said that it will keep interest rates low for a "considerable time." But the faster the U.S. economy picks up, the sooner the Fed will hike interest rates. Interest rates are important for gold investors because lower rates make gold a more attractive investment. Conversely, when rates go up, investors typically seek out higher-yielding assets.

- Quote of the Hour: "Strengthening payrolls are going to add to the perception that the Fed is going to raise rates sooner," Pension Partners LLC director of research Charlie Bilello said to Bloomberg. "The perception is that a more hawkish Fed is negative for gold."

While gold prices today hover around an eight-month low, one factor that may turn the yellow metal around is mounting Asian demand. Here's an in-depth look at historical averages from India and China that could mean a boost for gold prices this fall...

[epom]