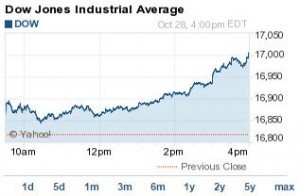

The Dow Jones today added 187 points as U.S. stock markets soared Tuesday, regaining momentum from last week's big performance. The S&P 500 ended the day above its 50-day moving average for the first time in nearly a month. The Nasdaq was up 1.75%. The S&P 500 Volatility Index (VIX), the market's fear gauge, slipped another 10% on the day.

The Dow Jones today added 187 points as U.S. stock markets soared Tuesday, regaining momentum from last week's big performance. The S&P 500 ended the day above its 50-day moving average for the first time in nearly a month. The Nasdaq was up 1.75%. The S&P 500 Volatility Index (VIX), the market's fear gauge, slipped another 10% on the day.

Today's scorecard:

Dow: 17,005.75, +187.81 (+1.12%)

S&P 500: 1,985.05, +23.42 (+1.19%)

Nasdaq: 4,564.29, +78.36 (+1.75%)

What moved the markets: The markets jumped on positive economic data that includes soaring consumer confidence and a bounce-back from energy stocks. Meanwhile, stronger quarterly earnings reports continue to offset analyst concerns about slowing global growth and its impact on corporate revenue. However, it wasn't all good news. The growth rate in housing prices in August slowed for the eighth consecutive month, while capital goods orders fell for a second straight month.

Most notable economic news: U.S. consumer confidence surged in October to its highest level in seven years. According to figures from the Conference Board, the U.S. consumer-confidence level hit 94.5, shattering economists' expectations of 87.0. This is the highest level since October 2007, before the onset of the recession. The growth in confidence has been fueled by falling gasoline prices and improving labor conditions.

Now, here's a breakdown of today's other top stories and stock performances:

- A Profit Play: Shares of Apple Inc. (Nasdaq: AAPL) hit a new post-split record high on news that the company could partner with Chinese e-commerce giant Alibaba Group Holding Ltd. (NYSE: BABA) over Apple Pay. Alibaba Chief Executive Officer Jack Ma expressed interest in a partnership at a tech conference on Monday. Tim Cook, the CEO of Apple, said he plans to meet with Ma in the near future. The optimism comes after two prominent healthcare retailers abandoned Apple Pay in recent days. Shares of Apple were up more than 1.5% on the day. Alibaba stock was up nearly 2% on the day. Get full coverage of Apple stock here.

- Electric Surge: Shares of Tesla Motors Inc. (Nasdaq: TSLA) were up 9.5% on news that the company is unveiling a new customer satisfaction program and after CEO Elon Musk reassured investors over sales growth. Yesterday, Tesla stock slipped more than 5.5% after a report by WardsAuto.com said sales had fallen 26% in nine months.

- Meeting of the Minds: The Federal Open Market Committee meeting kicked off this morning. Tomorrow, the central bank will issue a statement providing guidance on interest rates and its massive bond-buying stimulus. Economic data from Washington to Shanghai has been mixed in recent weeks. Investors will be asking one question: After the recent market slip - down 6.8% in less than one month - what is the likelihood that the Fed extends QE3?

- Shakeup in Germany: Shares of Deutsche Bank AG (NYSE: DB) were up more than 3% on news that the company is replacing its chief financial officer. The firm announced that Marcus Schenck, an investment banker at Goldman Sachs Group Inc. (NYSE: GS), will replace Stefan Krause, who successfully guided the bank through the European Central Bank's recent stress tests.

- Splitting Up: Shares of The Madison Square Garden Co. (Nasdaq: MSG) jumped nearly 11%. The company, which owns both the New York Rangers and New York Knicks, said it is considering a plan that would split its sports business from its entertainment business.

Now Money Morning experts share some of the most important investment moves to make based on today's market trading:

- How to Profit from a Stronger U.S. Dollar: The U.S. Federal Reserve plans to wind down its asset purchases this month, but Japan and the United Kingdom are still buying, full swing. Meanwhile, the European Union is just looking to get started with its stimulus efforts. That's sent the U.S. dollar into a major run-up, with the euro and yen on the losing side. This adds up to a global currency conflict. And our resource expert Peter Krauth, a 20-year commodity guru and portfolio advisor, has identified a very rare, very lucrative opportunity...

- The Profit Opportunity in Hong Kong's Unrest: Most investors haven't got a clue about what Hong Kong's riots represent, let alone the investment potential that's being unleashed there. As a result, they're going to miss out on some really terrific profit opportunities. But before we get to the best way to play this, understanding what's driving the unrest is key...

- How to Get a Piece of Wall Street Profits Without the Wall Street Corruption: There's simply no limit to how far Wall Street will go to make a buck. It's no wonder. With corporate offenses and "bad behavior" routinely going unpunished, perpetrators have developed a sense of impunity. But we can strike back against banks that are behaving badly. And here's how we're going to play a non-bank investment against a rigged services industry...

Money Morning Tip of the Day: One of the greatest tech companies in America is facing an ebbing tide in its relevance. That's what Michael E. Lewitt explains in a can't-miss editorial one of America's most iconic brands. And if you're an investor in this stock, you're going to need to hear the truth about why Warren Buffett may soon walk away from this company very soon.

About the Author

Garrett Baldwin is a globally recognized research economist, financial writer, consultant, and political risk analyst with decades of trading experience and degrees in economics, cybersecurity, and business from Johns Hopkins, Purdue, Indiana University, and Northwestern.