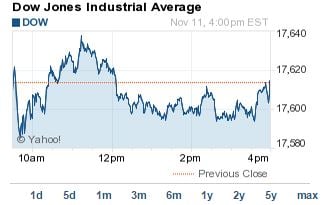

The Dow Jones today reversed earlier losses to end the trading session ahead marginally on a quiet Veterans Day. The S&P 500 Index also struck a new record close - again.

The Dow Jones today reversed earlier losses to end the trading session ahead marginally on a quiet Veterans Day. The S&P 500 Index also struck a new record close - again.

U.S. cable companies and service providers lagged for a second consecutive day after U.S. President Barack Obama called for government regulators to introduce Net Neutrality measures as soon as possible.

Today's Scorecard:

Dow: 17,614.90, +1.16, +0.01%

S&P 500: 2,039.68, +1.42, +0.07%

Nasdaq: 4,660.56, +8.94, +0.19%

What Moved the Markets Today: With the bonds markets closed, the Dow Jones and S&P 500 saw little movement. The only notable announcement in today's trading session came during a FOX Business interview with Federal Reserve Bank of Boston President Eric Rosengren. Rosengren said the U.S. central bank should stay patient about raising interest rates. Rather than link a rate hike to a specific date, Rosengren argued that the Fed should focus on obtaining the economic results it has been seeking, which includes inflation rising to 2%.

Now check out the day's most important market notes:

- Banks Behaving Badly: Global regulators are poised to levy hefty fines against multiple banks tomorrow following an investigation into manipulation in currency trading. The UK Financial Conduct Authority said it will announce settlements totaling at least 1.5 billion pounds ($2.4 billion). U.S. regulators will also reveal the conclusion of their investigations tomorrow morning. JPMorgan Chase & Co. (NYSE: JPM) and Deutsche Bank AG (USA) (NYSE: DB) have set aside at least $1 billion each for expected settlements.

- Singles' Day: Shares of Alibaba Group Holding Ltd. (NYSE: BABA) retreated from its record highs, despite the company reporting nearly $9.3 billion in sales on the Chinese shopping holiday "Singles' Day." The holiday, which was created to celebrate or lament being single in China, is the largest 24-hour online shopping event in the world. Alibaba expects the Chinese holiday to become a global phenomenon within the next five years. (Editor's Note: Is BABA stock a buy at $114? Money Morning Tech Specialist Michael A. Robinson weighed in today on FOX Business' "Varney & Co." Watch the video here.)

- Sales Surge: Shares of Groupon Inc. (Nasdaq: GRPN) surged more than 5% this afternoon on news the company issued a bullish quarterly sales outlook. The company also announced the release of an app called Snap. The mobile app rewards customers for purchasing featured grocery or retail products each week.

- CEO Woes: Shares of Juniper Networks Inc. (NYSE: JNPR) dropped more than 5.5% on news the company's chief executive has resigned. Shaygan Kheradpir, who was CEO for less than a year, stepped down after Juniper's board of directors completed a review of his conduct while negotiating with a customer. Company veteran Rami Rahim has replaced Kheradpir.

- Building Boom: Shares of D.R. Horton Inc. (NYSE: DHI) gained 2% on news the company saw fourth-quarter net sales jump 38% to $2.4 billion the same period last year. The homebuilder reported diluted per-share earnings of $0.45, up from $0.40 in the same quarter of 2013. The jump suggests a broader rise in demand for the housing sector.

Now our experts share some of the most important investment moves to make based on today's market trading - for Money Morning Members only:

- How to Profit from a Stronger U.S. Dollar: The U.S. Federal Reserve concluded its asset purchases last month, but Japan and the United Kingdom are still buying, full swing. Meanwhile, the European Union is just looking to get started with its stimulus efforts. That's sent the U.S. dollar into a major run-up, with the euro and yen on the losing side. This adds up to a global currency conflict. And Money Morning Resource Expert Peter Krauth, a 20-year commodity guru and portfolio advisor, has identified a very rare, very lucrative opportunity...

- How to Profit from Unrest in Hong Kong: Most investors haven't got a clue about what Hong Kong's riots represent, let alone the investment potential that's being unleashed there. As a result, they're going to miss out on some really terrific profit opportunities. But before we get to the best way to play this, understanding what's driving the unrest is our key...

- How to Get a Piece of Wall Street Profits Without the Wall Street Corruption: There's simply no limit to how far Wall Street will go to make a buck. It's no wonder. With corporate offenses and "bad behavior" routinely going unpunished, perpetrators have developed a sense of impunity. But we can strike back against banks that are behaving badly. And here's how we're going to play a non-bank investment against a rigged services industry...

About the Author

Garrett Baldwin is a globally recognized research economist, financial writer, consultant, and political risk analyst with decades of trading experience and degrees in economics, cybersecurity, and business from Johns Hopkins, Purdue, Indiana University, and Northwestern.