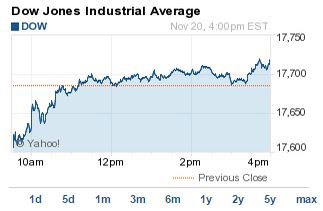

The Dow Jones and S&P 500 hit new record highs Thursday as the energy sector fueled a strong surge in global energy stocks. Oil prices jumped on rumors OPEC may consider cutting production by 250,000 to 600,000 barrels, pulling energy shares up.

Today's Scorecard:

Today's Scorecard:

Dow: 17,718.97, +33.24, +0.19%

S&P 500: 2,052.75, +4.03, +0.20%

Nasdaq: 4,701.87, +26.16, +0.56%

What Moved the Markets Today: The Dow Jones got a boost today from oil and manufacturing. With negative economic data battering Europe and China, energy prices helped fuel an unexpected rally. West Texas Intermediate, priced in New York, jumped roughly $1. Meanwhile, the Philly Fed Index posted 40.8 for November, its highest reading since 1993. The figure blew away analyst expectations of 18.3.

Now check out the day's most important market notes:

- Retailer Rally: Shares of Best Buy Company Inc. (NYSE: BBY) were up more than 9% this morning on news the company beat earnings estimates by a wide margin. The per-share adjusted earnings figures reached $0.32, compared to consensus estimates of $0.25 per share. Best Buy also reported a 2% increase in same-store sales, a strong beat of a 2.2% expected decline. The company now faces its most challenging quarter as the holiday season approaches.

- E-Comm Boost: Alibaba Group Holding Ltd. (NYSE: BABA) shares jumped another 2.5% this afternoon on news that it plans to take its e-commerce marketplace Taobao global. Get the latest news and insight on how to play the Chinese e-commerce giant right here.

- Banks Behaving Badly: Money Morning Capital Wave Strategist Shah Gilani has been covering the shenanigans of Goldman Sachs Group Inc. (NYSE: GS) in the global aluminum trade for more than a year now. Today the bank faced some music on Capitol Hill when Sen. Carl Levin attacked Goldman executives over allegations they manipulated global metal prices. Under pressure, the bank is considering a move to sell its commodities investment group to foreign investors.

- IPO Boom: Online registration site GoDaddy.com is gearing up for its chance to go public. The company said it will likely file in 2015 and expects to valuate itself at roughly $4.5 billion. The world's largest domain company is attempting to file at a difficult time for the web registration process. Just recently, Google Inc. (Nasdaq: GOOG, GOOGL) announced it is exploring a possible jaunt into the web registration industry. Shares of Google were down 0.6% on the day.

- The Real Burger King: Shares of Habit Restaurants Inc. (Nasdaq: HABT) doubled today in the company's debut on the Nasdaq. The company, best known for "charburgers," has achieved the most successful casual fast food restaurant IPO of 2014. The burger joint introduced shares at $18, saw them open at $30, and rocketed to $39.54. That's a 119.67% increase on the day.

Now our experts share some of the most important investment moves to make based on today's market trading - for Money Morning Members only:

- This Play Could Double Again - But There's Much More to It: Money Morning Chief Investment Strategist Keith Fitz-Gerald's recent small-cap stock pick has already doubled. And this human augmentation company is still a great buy - especially if you understand how to use Keith's favorite trading tactic. Here's how to put the power of the "free trade" to work for you to collect even bigger gains.

- How We'll Play the 2014 Year-End Rally: Stocks are headed higher through year end for many reasons, but one in particular is telling. It's really simple, yet too many people have overlooked it. Indeed, most wouldn't even give it enough thought. And that would be a big mistake... As Money Morning's Shah Gilani explains, if you understand that one compelling reason, you can pick some winners - and pocket big profits - yourself.

- How Google Will Dominate the Future: Today tech Specialist Michael A. Robinson reveals why Google is such an intriguing tech investment with enormous upside. This industry leader has somehow combined Warren Buffett's business genius with the futurist brain of Ray Kurzweil, Google's director of engineering. And there's nothing but profit ahead for investors...

About the Author

Garrett Baldwin is a globally recognized research economist, financial writer, consultant, and political risk analyst with decades of trading experience and degrees in economics, cybersecurity, and business from Johns Hopkins, Purdue, Indiana University, and Northwestern.