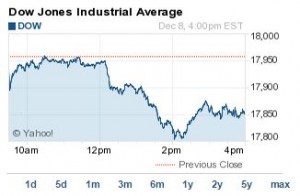

The Dow Jones today plummeted more than 100 points after coming within striking distance of the 18,000 level Friday.

Crude oil prices crashed to a new five-year low, slipping more than 4% on the day after Morgan Stanley (NYSE: MS) slashed its oil forecast through 2018. The investment bank said it expects oil prices to hit a new low in the second quarter of 2015.

The VIX, the market's volatility gauge, soared more than 19% on the day.

Today's Scorecard:

Dow: 17,852.48, -106.31, -0.59%

S&P 500: 2,060.31, -15.06, -0.73%

Nasdaq: 4,740.69, -40.06, -0.84%

What Moved the Markets Today: The markets saw their worst one-day performance since October as the energy sector dragged down stocks and growth concerns reemerged in Japan and China. West Texas Intermediate fell more than 4% to hit $63.13, the lowest price since July 2009. Meanwhile, Brent slipped roughly 4.1% to $66.18, the lowest level since October 2009. Morgan Stanley slashed its Brent outlook by $28 to $70 per barrel for 2015. Prices continue to slide as OPEC's largest producer, Saudi Arabia, refuses to slash production to support global prices.

(Editor's note: Money Morning Global Energy Strategist Dr. Kent Moors weighs in on why the Saudi price war will only temporarily postpone the coming fall of OPEC...)

Now check out the day's most important market notes:

- Tech Sell-Off Continues: This afternoon witnessed a strong sell-off from some of the tech sector's largest gainers of 2014. Shares of Apple Inc. (Nasdaq: AAPL) slipped 2.26%, while GoPro Inc. (Nasdaq: GPRO) shares shed more than 6%. Shares of Sony Corp. (NYSE ADR: SNE) fell 4.56% as the company continues to deal with the fallout of a serious data breach. (Get the most important Apple stock news here.)

- Merger Mania: Shares of Cubist Pharmaceuticals (Nasdaq: CBST) rose 35.29% on news it will be acquired by Merck & Co. Inc. (NYSE: MRK) for $102 per share. The all-cash deal is anticipated to be worth roughly $9.5 billion after assumption of debt.

- Not Lovin' It: Shares of McDonald's Corp. (NYSE: MCD) slumped 3.84% this afternoon on news that same-store sales continue to slide. The global fast-food giant announced November sales fell more than 2.2%. One of the issues for MCD is a strong U.S. dollar. The company also said continued fallout from the Chinese supplier issue has dramatically affected the company's brand reputation.

- Energy Free-Fall: Shares of ConocoPhillips (NYSE: COP) slipped more than 4% on falling oil prices and news the company will slash its Capex spending by 20% for 2015. The company's plans are part of an expected $150 billion in new energy projects that will be put on hold due to declining prices, according to Norwegian consultancy Rystad Energy.

- Steel Stumbles: Shares of United States Steel Corp. (NYSE: X) slumped 6.42% this afternoon. The stock slipped on news ConocoPhillips plans to slash its capital expenditures in the wake of falling oil prices. Investors are concerned because the last time oil prices were at this level, rig counts declined for U.S. Steel's tubular business and operating margins suffered steep drops.

Now our experts share some of the most important investment moves to make based on today's market trading:

- This Country's Huge "Pricing Error" Will Send These Shares Soaring: The Saudis are very frustrated about losing control over pricing power they've held for decades. It's annoying them to no end, in fact. So, they're fighting back the only way they know how to shift the balance back in their favor - by starting a price war with the United States. But Money Morning Chief Investment Strategist Keith Fitz-Gerald says they've made the biggest strategic "pricing error" in the kingdom's history. And in doing so, they've actually cleared the way for America's shale energy boom and opened up a killer opportunity for one company in particular.

- One Stock That Will Profit from a New, Breakthrough Medical Direction: Modern medicine, for all of its sophisticated drugs, complex gadgets, and amazing surgical procedures, rarely cures anything. It treats. It manages. It postpones the inevitable. But return a patient to normal, optimal health? Rarely. So when an innovation comes along that can effect a complete and permanent remission of disease or restore damaged organs to a pristine state, it should cause your keenest investing instincts to perk up and pay attention...

- How We'll Play the 2014 Year-End Rally: Stocks are headed higher through year end for many reasons, but one in particular is telling. It's really simple, yet too many people have overlooked it. Indeed, most wouldn't even give it enough thought. And that would be a big mistake. As Money Morning's Shah Gilani explains, if you understand that one compelling reason, you can pick some winners - and pocket big profits - yourself.

About the Author

Garrett Baldwin is a globally recognized research economist, financial writer, consultant, and political risk analyst with decades of trading experience and degrees in economics, cybersecurity, and business from Johns Hopkins, Purdue, Indiana University, and Northwestern.