Haters in Europe continue to force Google Inc. (Nasdaq: GOOG, GOOGL) out of the continent - a trend we told you was coming after a key anti-Google vote in Europe late November....

Haters in Europe continue to force Google Inc. (Nasdaq: GOOG, GOOGL) out of the continent - a trend we told you was coming after a key anti-Google vote in Europe late November....

The tech giant just announced it will pull its Google News service out of Spain starting Dec. 16.

Google will exit Google News in response to an intellectual property law the country passed Oct. 30 - one that so blatantly targeted Google it earned the nickname "the Google tax."

Starting in January 2015, aggregator sites (read: Google, which owns 90% of Web search in Europe) must pay every Spanish publication a fee if the publication's content comes up on the site. The law gives an inalienable right to compensation - in other words, even if a publication wishes to be found in Google News (and of course, most do), Google must pay the sanction. And the sanction can reach as high as €600,000 ($758,000).

"This new legislation requires every Spanish publication to charge services like Google News for showing even the smallest snippet from their publications, whether they want to or not," Google posted on its Europe Blog on Dec. 11. "As Google News itself makes no money (we do not show any advertising on the site) this new approach is simply not sustainable. So it's with real sadness that on 16 December (before the new law comes into effect in January) we'll remove Spanish publishers from Google News, and close Google News in Spain."

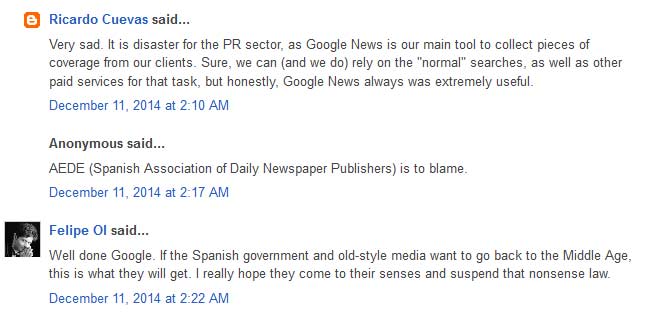

These comments posted to Google's Blog announcement capture the predominant mood there: Spain wasn't the only European country to enact laws that force out GOOG this week...

Spain wasn't the only European country to enact laws that force out GOOG this week...

GOOG Engineering to Exit Russia

Also on Dec. 11, news broke that Google will transfer all of its engineering operations out of Russia.

The nation is set to enact a new law in 2015 that requires citizens' personal data to be stored in local data centers. Companies that fail to follow the rule will be penalized. As Russia's relationship with the West continues to deteriorate, the new local data law came with little surprise - the country aims to give its own tech companies an edge over foreign competitors.

Google accounted for 31% of Web searches in Russia in Q3 2014, up from 4% from Q1. Meanwhile, local search rival Yandex NV (Nasdaq: YNDX) fell 2% to 60%, according to LiveInternet.ru data.

GOOG said it will still keep "a dedicated team in Russia" to support local users, but YNDX shares rallied more than 4% intraday today (Friday) on news of a partial GOOG operations exit.

Earlier this month, we predicted that the EU will force Google to break up in 2015.

On Nov. 27, the European Parliament voted to "unbundle" GOOG's search engine from its other commercial services. While the passed mandate is largely symbolic (only the EU has the power to break up a corporation), the vote increases pressure on the EU to act against Google.

"I have maintained for several years that this course of action was likely," Money Morning Chief Investment Strategist Keith Fitz-Gerald said on Dec. 2. "I don't think it's unexpected - and I think American regulators will ultimately follow along."

Fitz-Gerald - a seasoned market analyst with 33 years of experience - has long followed the potential antitrust issue Google faces in both European and American markets.

"If the EU ever decides to break up Google, American regulators won't want to be upstaged," Fitz-Gerald said.

As bad as that might sound for Google, he believes a breakup would be a good thing for the company - and for investors in Google stock.

Here's why...

Unlocking GOOG Stock Value

Corporate breakups, also called corporate spin-offs, can be extremely lucrative for investors. A Lehman Bros. study found that spun-off companies beat the market by 40% in the first two years. And a Penn State University study found a three-year return of 76% - enough to beat the market by 31%.

"Google is more valuable broken up than together," Fitz-Gerald said. "This is an extremely exciting development because right now, Google is an absolute behemoth - it's like a cruise liner trying to turn in a small harbor. If you unlock it, certain divisions will go screaming ahead."

This is one reason Google stock remains a good long-term buy - even at $521 a share.

"The price of GOOG today is almost irrelevant in the face of its future value for when it's broken up," Fitz-Gerald said. "This is an extremely favorable time to invest in Google, tuck it away somewhere, and wait."

Here at Money Morning, we believe tech investments are an essential step in wealth building. The sector creates some of the richest investors. A company's track record for inventing new technology says a lot about its potential to grow more lucrative - and Google blew us away with some of the top innovations of the year. Here are Google's five best innovations in 2014...