Money Morning's "unloved" pick of the week is 3D tissue printing and testing company Organovo Holdings Inc. (NYSE: ONVO).

An unloved investment is one that's been beaten down - but is actually a great value. Investors then get an amazing entry point into a good long-term investment.

Several of Money Morning's experts have made note of the great potential of ONVO stock. Defense & Tech Specialist Michael Robinson first called attention to Organovo stock in July of 2013. Earlier this month, Money Morning Biotech Investing Specialist Ernie Tremblay recommended it.

Organovo Holdings Inc. (NYSE: ONVO) Stock: About the Company

San Diego, Calif.-based Organovo has its roots in organ printing research done in the mid-2000s. The company was formally incorporated in 2007, when current Chief Executive Officer Keith Murphy joined ONVO after leaving Amgen Inc. (Nasdaq: AMGN). The company went public in 2012. Organovo has come up with a way to 3D print samples of human livers that are living human tissue made of human cells. ONVO uses these liver samples to conduct tests of experimental compounds for big drug companies. The method can detect problems that don't show up in animal tissue testing. Organovo stock is a small-cap, with a valuation of just over $500 million. It employs about 60 people.

San Diego, Calif.-based Organovo has its roots in organ printing research done in the mid-2000s. The company was formally incorporated in 2007, when current Chief Executive Officer Keith Murphy joined ONVO after leaving Amgen Inc. (Nasdaq: AMGN). The company went public in 2012. Organovo has come up with a way to 3D print samples of human livers that are living human tissue made of human cells. ONVO uses these liver samples to conduct tests of experimental compounds for big drug companies. The method can detect problems that don't show up in animal tissue testing. Organovo stock is a small-cap, with a valuation of just over $500 million. It employs about 60 people.

Organovo Holdings Inc. (NYSE: ONVO) Stock: Why It's Unloved

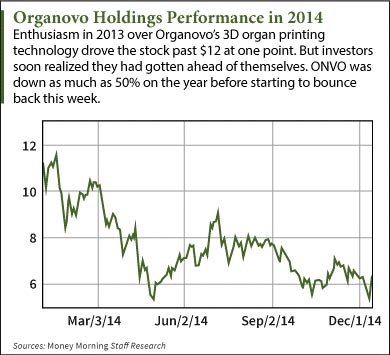

Investors got ahead of ONVO stock in 2013 to the point where it skyrocketed 345%. But, at the time, the technology was more of a promise than a reality.

Investors got ahead of ONVO stock in 2013 to the point where it skyrocketed 345%. But, at the time, the technology was more of a promise than a reality.

Then investors got impatient. As 2013 turned to 2014, Organovo's quarterly losses grew larger. While losses are typical of development-stage companies, the rate at which ONVO was burning through cash raised the possibility that it could run out of money. Investors were also nervous. With 3D organ printing as the company's only business, there was no Plan B if it stumbled.

So investors started unloading ONVO. By April 2014, Organovo stock was down more than 58% from its all-time closing high of $12.75 and more than 50% on the year. Short-sellers also started piling in. This month more than a quarter (25.4%) of ONVO shares were sold short, up nearly 9% from November.

That kind of high "short interest" can signal a negative, but in this case it's a buying opportunity...

Organovo Holdings Inc. (NYSE: ONVO) Stock: Why It's a Buy

On Friday we got our first hint that the short-sellers might be second-guessing their strategy. Beaten up ONVO stock soared 15% to close at $6.33. CEO Keith Murphy was the likely trigger of this spike after he appeared on CNBC Thursday. Murphy described the success ONVO was having in testing drugs for Big Pharma companies. Because Organovo tests on human tissue, the results are more accurate than testing on animal tissue. That, Murphy said, can flag problems early and save millions of dollars that would have been wasted on further development.

The modest rise Friday morning could have caught the attention of the short sellers, who lose money if a stock goes up. That means they need to "cover" their position by buying the shorted stock so they can escape more losses. This "short squeeze" would explain why ONVO stock kept rising throughout the day while the overall market was tanking.

But Money Morning's Tremblay liked Organovo stock before any of that happened. He recommended ONVO two weeks ago. "The possibilities for using this company's products in both medical research and in clinical applications represent limitless income potential - and, I believe, an extraordinary opportunity for the long-term investor," Tremblay wrote in a Dec. 2 column.

Indeed, a report the company published last week said the market for their services will grow to more than $500 million by 2018 with a compound annual growth rate (CAGR) of about 100%. In addition to liver tissue, Organovo is working on the 3D printing of lung, skin, heart, bone, blood vessel, cancer, and kidney tissue.

The potential for ONVO to save Big Pharma huge amounts of money on new drug research means it's likely to get more cash if it really needs it. Organovo has established partnerships with such giants as Johnson & Johnson (NYSE: JNJ), Pfizer Inc. (NYSE: PFE), and United Therapeutics Corp. (Nasdaq: UTHR).

Investing in Organovo Stock (NYSE: ONVO)

Organovo only just began offering its liver drug testing service, so it will take at least two quarters to find out how well the business is doing. That means the stock probably won't move significantly higher until 2015. Remember, even with Friday's gains ONVO stock is down nearly 43% on the year. Long-term however, ONVO figures to far outrun its all-time high.

An Unloved Penny Stock: Last week's pick, Ekso Bionics, designs and builds state-of-the art robotic exoskeletons. In other words, wearable robots. Money Morning Chief Investment Strategist Keith Fitz-Gerald recently visited the company's headquarters, and said it was the "most inspirational visit I've ever made to any company... in any industry... anywhere in the world." Here's why Keith is so impressed...

Follow me on Twitter @DavidGZeiler.

About the Author

David Zeiler, Associate Editor for Money Morning at Money Map Press, has been a journalist for more than 35 years, including 18 spent at The Baltimore Sun. He has worked as a writer, editor, and page designer at different times in his career. He's interviewed a number of well-known personalities - ranging from punk rock icon Joey Ramone to Apple Inc. co-founder Steve Wozniak.

Over the course of his journalistic career, Dave has covered many diverse subjects. Since arriving at Money Morning in 2011, he has focused primarily on technology. He's an expert on both Apple and cryptocurrencies. He started writing about Apple for The Sun in the mid-1990s, and had an Apple blog on The Sun's web site from 2007-2009. Dave's been writing about Bitcoin since 2011 - long before most people had even heard of it. He even mined it for a short time.

Dave has a BA in English and Mass Communications from Loyola University Maryland.