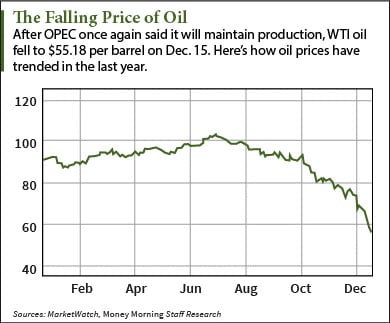

According to our new forecast, the worst of the oil price crash is likely over. Oil prices in 2015 will rebound from the five-year lows hit this year.

The oil price drop over the past five months has been no huge surprise. American oil production surpassed all other countries, including Saudi Arabia, in 2014's first quarter. Daily production exceeded 11 million barrels, according to a Bank of America report from July.

The oil price drop over the past five months has been no huge surprise. American oil production surpassed all other countries, including Saudi Arabia, in 2014's first quarter. Daily production exceeded 11 million barrels, according to a Bank of America report from July.

This competition pushed Congress to revisit the 1975 act that banned crude exports in a hearing on Dec. 11.

OPEC's questionable decision-making is another cause of low oil prices. The organization threatens to drive prices even lower despite its members' strong revenue dependence on oil. Venezuela, for example, garners almost half its revenue from oil exports. It stands on the edge of economic default and can't keep its head above water with an output quota.

But things will change for oil prices in 2015...

[epom key="c81a5fce3be1a0a87a54e5a689304e5b" redirect="" sourceid="" imported="false"]

For one thing, oil is a product that can easily balance itself out.

"As the most fluid commodity in the world, crude has the ability to quickly self-correct, which is why long-time oil veterans aren't worried about the falling prices," Money Morning Global Energy Strategist Dr. Kent Moors noted in our 2015 oil price forecast.

Another catalyst for higher oil prices in 2015 is supply and demand...

According to Moors, the rumored supply glut is not nearly what pundits would have you believe...

And he has a chart that shows just how wrong these "analysts" have it.

Money Morning detailed all of this in its just-released report on oil prices in 2015. The analysis also uncovers two stock picks for 2015's biggest oil trends...