Last week, while wishing my newsletter subscribers at Capital Wave Forecast and Short-Side Fortunes a happy New Year, I warned them that 2015 isn't going to be a happy-go-lucky year.

The one prediction I emphasized over and over was that market volatility would be extreme.

We already saw that yesterday with the Dow Jones Industrial Average down 331 points and oil (based on West Texas Intermediate pricing) dipping below $50 for the first time since April 2009.

There are many reasons why volatility will be our constant companion in 2015. And there will be many opportunities to profitably trade volatility - both on the way down and on the way up.

There are many reasons why volatility will be our constant companion in 2015. And there will be many opportunities to profitably trade volatility - both on the way down and on the way up.

So today, I'm going to start showing you how to profit from volatility across all the asset classes that are going to make or break investors in 2015.

Let's get started ensuring you folks are among the investors who make it...

Market Volatility and the Problem with Manipulation

Extreme volatility is the inescapable by-product of manipulation of free markets. After years of central bank manipulation of interest rates and price discovery, the free-market pricing of assets becomes grossly distorted.

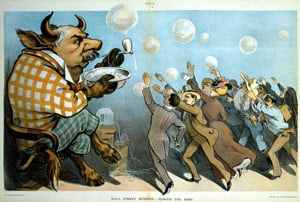

The root of the problem with central bank manipulation is that capital allocation itself becomes distorted as speculators chase assets that central bank policies benefit. And when the world's biggest and most powerful central bank, the U.S. Federal Reserve, openly articulates a policy to lift equity prices in order to make households "feel" more wealthy watching stocks make new highs, you know the fix is in and manipulation itself is a policy prescription.

Of course, there's a problem with central bank manipulation. A really, really big problem.

Central banks have very limited tools. The blunt instruments by which they manipulate interest rates don't have any effect on markets, regardless of asset classes, once markets take it upon themselves to do whatever they do.

In other words, central banks have no way of stopping market panics, corrections, or outright collapses.

If you don't believe that, allow me to offer you some proof....

Perhaps you too drank the Fed's Kool-Aid of the past five years and watched stocks soar. If so, remember that it was then-Fed Chair Ben Bernanke who in 2007 said the housing market wasn't overheating.

Just remember, when that dam broke only a few months after Bernanke said all was well and good and the economy was on a good track, stocks crashed and the U.S. economy spiraled down into the Great Recession.

And there wasn't a thing the Fed could do about it.

To add insult to injury, also recall that it was the Fed's low interest rate policies - that is, manipulation - that caused the mortgage and housing bubble and credit crisis.

Now it's nearly six years later. And the manipulation over these past years makes what the Fed did back in the 2000s look like child's play.

We're going to pay the price in 2015.

Market volatility is going to make a lot of investors very, very sick and the unsuspecting broke.

But not us.

Mercurial Money

Volatility is the ultimate tool if you know how to wield it. And I do.

I've made a career trading volatility across all asset classes.

Now, in 2015, I'm going to teach you how to make a fortune playing the extreme moves that will break some of the world's governments, some of the biggest mutual funds in the world, and everyone who dares to stand in the way of the oncoming locomotive.

I will make recommendations here on what you should buy and sell, and I will explain my recommendations. You just have to figure out if you want to take the advice or to wait and see if I'm right.

That's all you'll have to do.

More from Shah Gilani: Remember credit default swaps (CDS)? They're the risky derivatives traded that, during the 2007-2008 financial crisis, took down Lehman Brothers and almost AIG. Well, they never went away completely. And they're becoming popular all over again. Here's how Wall Street manipulators are using CDS to make huge profits once again...

About the Author

Shah Gilani boasts a financial pedigree unlike any other. He ran his first hedge fund in 1982 from his seat on the floor of the Chicago Board of Options Exchange. When options on the Standard & Poor's 100 began trading on March 11, 1983, Shah worked in "the pit" as a market maker.

The work he did laid the foundation for what would later become the VIX - to this day one of the most widely used indicators worldwide. After leaving Chicago to run the futures and options division of the British banking giant Lloyd's TSB, Shah moved up to Roosevelt & Cross Inc., an old-line New York boutique firm. There he originated and ran a packaged fixed-income trading desk, and established that company's "listed" and OTC trading desks.

Shah founded a second hedge fund in 1999, which he ran until 2003.

Shah's vast network of contacts includes the biggest players on Wall Street and in international finance. These contacts give him the real story - when others only get what the investment banks want them to see.

Today, as editor of Hyperdrive Portfolio, Shah presents his legion of subscribers with massive profit opportunities that result from paradigm shifts in the way we work, play, and live.

Shah is a frequent guest on CNBC, Forbes, and MarketWatch, and you can catch him every week on Fox Business's Varney & Co.