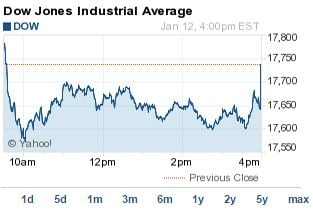

The Dow Jones today plunged 96 points after crude oil prices crashed more than 4% this afternoon. With Saudi Arabia unwilling to cut production, oversupply concerns continue to cripple the price of oil.

The CBOE Volatility Index (VIX), the market's fear gauge, was up more than 11% on the day.

Today's Scorecard:

Today's Scorecard:

Dow: 17,640.84, -96.53, -0.54%

S&P 500: 2,028.26, -16.55, -0.81%

Nasdaq: 4,664.71, -39.36, -0.84%

What Moved the Markets Today: The S&P 500 energy index fell 2.8% Monday after Goldman Sachs Group Inc. (NYSE: GS) slashed its oil forecast for 2015. The bank cut its WTI-NYMEX 2015 crude forecast to $47.15 a barrel, down from $73.75 a barrel. It also forecast Brent crude prices to settle at $50.40 a barrel, down from $83.75 a barrel. The forecast piggy-backed news that billionaire Saudi Prince Alwaleed bin Talal said in an interview with FOX Business that crude oil prices will never top $100 per barrel ever again.

Now check out the day's most important market notes:

- Stocks to Watch: Shares of Bristol-Myers Squibb Co. (NYSE: BMY) surged more than 4.4% in intraday trading on news the company's potential treatment for a common type of lung cancer has shown positive results in a phase 3 trial. The company terminated the trial for its treatment Opdivo earlier than expected after an independent committee concluded the drug offered superior efficacy results compared to the popular chemotherapy drug docetaxel.

- Energy Shakeup: Goldman Sachs also made headlines today after the firm downgraded shares of Schlumberger Ltd. (NYSE: SLB) from "Buy" to "Neutral." The announcement sent SLB shares down 3.9% on the day. Meanwhile, Goldman upgraded shares of Chesapeake Energy Corp. (NYSE: CHK) after the bank expressed optimism over the energy giant's capital efficiency under CEO Robert Lawler. Goldman Sachs stock was down 1.2% today.

- Stretching Profits: Shares of Lululemon Athletica Inc. (Nasdaq: LULU) jumped nearly 8% this afternoon on news the company hiked its fourth-quarter revenue and profit outlook. The company expects revenue to reach as high as $600 million for the quarter ending on Feb. 1. This is a jump from a previous quarterly revenue forecast of $570 million to $585 million.

- An Apple a Day: Apple stock slipped nearly 2.5% this afternoon, despite news the iPhone is now the second most popular camera device on earth. The iPhone camera is second only to devices made by Canon Inc. (NYSE ADR: CAJ). But the real Apple news centered on supplier concerns this afternoon. Shares of SanDisk Corp. (Nasdaq: SNDK) cratered 13.88% on news the memory-chip provider to Apple Inc. (Nasdaq: AAPL) had slashed its quarterly revenue estimate.

- Merger Mania: Shares of Fiat Chrysler Automobiles NV (NYSE: FCAU) rose more than 1.6% after company CEO Sergio Marchionne beat back rumors that the company was in merger talks with another automaker. Even though Fiat isn't looking to deal right now, the CEO called for increased consolidation and challenged the industry to develop new products for consumers.

- Retailer Rush: Shares of discount chain Dollar Tree Inc. (Nasdaq: DLTR) slipped roughly 0.7% intraday on news the company plans to sell nearly 300 stores. The divesting goal is part of regulatory requirements in order for the company to purchase its rival Family Dollar Stores Inc. (NYSE: FDO). Dollar Tree said it has identified potential buyers for the locations. Shares of Family Dollar were down 1.67% on the day.

Now our experts share some of the most important investment moves to make based on today's market trading - for Money Morning Members only:

-

[epom key="ddec3ef33420ef7c9964a4695c349764" redirect="" sourceid="" imported="false"]

This Investing Tactic Could Help You Beat the Market by 21.97% in 2015: This year will offer investors countless opportunities, perhaps more than ever before. But few of us are set up to take full advantage of them. That's because most people's portfolios are totally out of whack. But there's good news. Money Morning Chief Investment Strategist Keith Fitz-Gerald has a stunningly simple investing strategy that can help you achieve significantly higher returns - 21.97% higher annually on average, in fact. And it only takes 20 minutes a year! Here's how to do it...

- The Perfect "Anti-Trend" Play: Between its crushing debt, aging population, lack of a workable immigration policy, and decades of abysmal fiscal policy, Japan is in trouble - thus Money Morning's Keith Fitz-Gerald recommended shorting the currency via ProShares UltraShort Yen(NYSE Arca: YCS). It's returned more than 116% since the Japanese yen was at 76 to the dollar. But it's far from the only way to play Japan at the moment...

- How to Invest Like a CEO - and Beat the Market by 40%: After digging into a recent survey on CEOs, Money Morning Tech Specialist Michael A. Robinson figured out exactly where today's leaders will be spending their dollars in the next five years. And he wants to show you how to invest like a CEO to take advantage of those long-term spending trends. Here's how to "follow the money" to find some great foundational plays...

About the Author

Garrett Baldwin is a globally recognized research economist, financial writer, consultant, and political risk analyst with decades of trading experience and degrees in economics, cybersecurity, and business from Johns Hopkins, Purdue, Indiana University, and Northwestern.