Healthcare deals dominated the top financial news headlines Monday.

Healthcare was the most targeted sector in deal making last year. It reached its highest annual volume on record as early as Dec. 1 with $437.1 billion in deals.

And 2015 has started with a flurry of activity. Indeed, three of the four healthcare deals announced Monday were for $1 billion or more.

And 2015 has started with a flurry of activity. Indeed, three of the four healthcare deals announced Monday were for $1 billion or more.

What drove pharmaceutical and healthcare deals in 2014 continues to be the catalyst this year: Drug makers are searching for fresh sources of growth as patents expire on many of their most lucrative drugs.

Two other factors driving M&A are heightened competition and tax inversion benefits.

Here's a look at the sector's deal making that topped today's financial news headlines...

Financial News: Monday's Top Deals

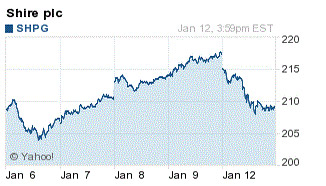

Top Financial Deal News No. 1: Shire Plc. (Nasdaq ADR: SHPG) agreed to acquire N.J.-based NPS Pharmaceuticals Inc. (Nasdaq: NPSP) for $46 per share.

The $5.2 billion all-cash deal gives Ireland-based Shire a rich portfolio of drugs to treat rare conditions. In addition, it shores up the Irish drugmaker's portfolio of therapies for gastrointestinal disorders.

"It is another step in the direction of becoming a biotech," Shire Chief Executive Officer (CEO) Flemming Ornskov said in a statement. Ornskov said combining NPS's two drugs with Shire's existing sales force could ultimately lead to blockbuster sales for both NPS's approved treatment.

The deal is expected to close in Q1 2015.

The transaction is Shire's first big deal since AbbVie Inc.'s (NYSE: ABBV) failed attempts to buy Shire in October amid the Obama administration's crackdown on tax inversions. Shire walked away from the failed deal with a $1.6 billon break-up fee.

Shares of NPS rose 8.5% to $45.50. Shire's shares slipped 1.75% to $213.69.

Top Financial Deal News No. 2: Roche Holding Ltd. (RHHBY) is shelling out more than $1 billion for a majority stake in Foundation Medicine Inc. (Nasdaq: FMI). The move gives Roche access to genomic tests to screen for tumors and cancers.

The deal provides Switzerland-based Roche, the biggest maker of cancer drugs in the world, additional tools to goose sales of its therapies.

Roche will buy 5 million new shares of Cambridge, Mass.-based FMI for $50 each. Roche will also extend an offer to purchase stock from existing investors at the same price to boost its stake in FMI to as much as 56%.

FMI shares more than doubled on the news, hitting a 52-week high of $54.28. Roche shares rose a 1.5% to $35

Top Financial Deal News No. 3: AmerisourceBergen Corp (NYSE: ABC) is buying MWI Veterinary Supply Inc. (Nasdaq: MWIV) for $2.5 billion, giving the drug wholesaler an commanding footprint in the growing animal healthcare arena.

Amerisource, based in Chesterbrook, Penn., is a global distributer of pharmaceutical products to healthcare providers and pharmaceutical and biotech manufacturers. Boise, Idaho-based MWIV sells some 50,000 products, including pharmaceuticals, vaccines, veterinary pet food and equipment.

Amerisource is paying $190 a share for MWI, a 7.3% premium to MWIV's closing price on Friday.

"Animal health is a growing market in the U.S. and internationally, and is a logical extension of our pharmaceutical distribution and services businesses," AmerisourceBergen CEO Steven H. Collis said.

Animal healthcare is a lucrative business, and pharmaceutical companies are taking note. Americans spent an all-time high of $55.7 billion on their pets in 2013, a figure projected to have risen to $60 billion last year, according to the American Pet Products Association.

MWIV shares spiked $15.19, or 9%, to a 52-week high of $191.29. ABC shares rose roughly 1% to $94.35 in morning trading, also a 52-week high.

Top Financial Deal News No. 4: Tekmira Pharmaceutical Corp. (Nasdaq: TKMR) announced Monday it's buying privately held OnCore Biopharma to form a team focused on finding a cure for hepatitis B.

Financial terms of the deal were not disclosed. But Tekmira did say that OnCore will become a wholly owned subsidiary, with OnCore shareholders holding about a 50% stake in Tekmira. The deal is expected to close in the first half of 2015.

Tekmira CEO Dr. Mark J. Murray said the combined company has the potential to advance several promising drugs through clinical testing that uses multiple therapeutic approaches.

Canadian-based Tekmira grabbed headlines and was covered in depth at Money Morning last year for its work with the U.S. Department of Defense on an Ebola vaccine.

In March 2014, Tekmira received "Fast Track" designation from the U.S. Food and Drug Administration (FDA) for the development of TKM-Ebola, its anti-Ebola viral RNAi therapeutic. In August, the FDA modified its clinical hold status on Tekmira's experimental Ebola treatment to partial hold, enabling it for potential use in humans infected with the virus.

Amid the largest Ebola outbreak in history, shares of Tekmira soared a stratospheric 211.85% from January through early October 2014 to $24.86. Shares gave back some gains as Ebola media attention faded.

News of the OnCore deal, however, ignited renewed interest in Tekmira. Shares rose some 25% to $24.64 Monday morning.

Related Articles:

- USA Today: Shire to Buy NPS for $5.2 Billion

- Wall Street Journal: Americsource Bergen to Buy VMI Veterinary Supply for $2.5 Billion

- Bloomberg: Roche Plans $1 Million Stake in Foundation Genomics Firm