The DJIA added another 305 points Tuesday. The cause? Oil prices surged once again.

The DJIA added another 305 points Tuesday. The cause? Oil prices surged once again.

Soaring auto sales and hopes for a Greek debt deal also lifted stocks today.

Today's Scorecard:

Dow: 17,666.40, +305.36, +1.76%

S&P 500: 2,050.03, +29.18, +1.44%

Nasdaq: 4,727.74, +51.05, +1.09%

The S&P 500 Volatility Index (VIX), the market's fear gauge, plunged 10.8% on the day.

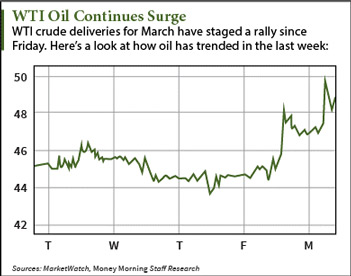

What Moved the Markets Today: Have crude oil prices found a bottom? Some traders seem to think so after oil's record day Tuesday. WTI soared 7%, while Brent surged nearly 6%. Crude prices are up 19% since the news Friday that the number of U.S. oil drilling rigs had its biggest weekly decline in almost three decades.

Higher energy prices helped Caterpillar Inc. (NYSE: CAT), Exxon Mobil Corp. (NYSE: XOM), and Chevron Corp. (NYSE: CVX) all jump more than 2.5% on the day.

Oil-field services companies got a nice pop today. Transocean Ltd. (NYSE: RIG) jumped 7.5%, Seadrill Ltd. (NYSE: SDRL) was up 9.5%, and Seadrill Partners (NYSE: SDLP) was up more than 9%.

Now, check out the other top market stories - plus get our new profit tip for investors:

- Sales Surge: It was a huge day for auto sales, as several manufacturers reported double-digit sales growth in January thanks in part to falling oil prices. Both Ford Motor Co. (NYSE: F) and General Motors Co. (NYSE: GM) saw shares jump more than 2.5% on news the companies saw a sales boost in sport-utility vehicles and trucks.

- Bankruptcy Bust: The New York Stock Exchange is moving to delist RadioShack Corp.'s (NYSE: RSH) stock from the index due to its pending bankruptcy. This follows reports that Amazon.com Inc. (Nasdaq: AMZN) is in discussions to purchase a portion of the struggling retailer's stores, according to Bloomberg.

- Cutting Costs: Greek Finance Minister Yanis Varoufakis plans to meet with European Central Bank President Mario Draghi in Germany tomorrow in a move that could dispel a lot of stress over Europe. The leader of the anti-austerity party, which just assumed power in a recent election, said he's hoping to reach an agreement on the nation's debts. Yesterday he unveiled a number of proposals that would swap outstanding debt for new growth-linked bonds. The news sent The Athens Composite Index surging more than 10% on the day.

-

[epom key="ddec3ef33420ef7c9964a4695c349764" redirect="" sourceid="" imported="false"]

Merger Mania: Shares of Office Depot (Nasdaq: ODP) were up more than 21% on news the company is in advanced discussions to merge with rival Staples Inc. (Nasdaq: SPLS). Staples shares jumped more than 10% on the news. Rumors of a possible deal had been brewing since activist investor Starboard Value LP disclosed large stakes in both office supply retailers in December. According to the filings, the investor holds a 5.1% stake in Staples and a 10% stake in Office Depot.

- Flight Risk: Rising oil prices also produced some losers today, as airline stocks took a big hit. Shares of Southwest Airlines Co. (NYSE: LUV) slipped roughly 3%, while rival Delta Air Lines Inc. (NYSE: DAL) slipped 1.1%. Airline stocks had been soaring as crude prices slipped over the last six months. Higher prices will eat into their profits.

- Earnings Slump: Shares of United Parcel Service Inc. (NYSE: UPS) slipped roughly 0.5% after the company's earnings missed expectations. UPS had a difficult retail season, which has forced CEO David Abney to initiate new efforts to "improve profitability and increase operational efficiencies."

- An Apple a Day: Apple stock retreated marginally from its $119 per share price today. Apple Inc. (Nasdaq: AAPL) announced plans to invest $2 billion in a sapphire plant previously owned by GT Advanced Technologies Inc. (OTCMKTS: GTATQ). At the location, Apple plans to produce scratch-resistant sapphire screens for its devices.

About the Author

Garrett Baldwin is a globally recognized research economist, financial writer, consultant, and political risk analyst with decades of trading experience and degrees in economics, cybersecurity, and business from Johns Hopkins, Purdue, Indiana University, and Northwestern.