With mid-generation baby boomers just entering the retirement wave, their ability to stop working is a hot topic that's getting hotter. Study after study questions the ability of public and private pensions to meet the needs of retirees.

Financial repression through the Fed's Zero Interest Rate Policy (ZIRP) has compounded the problems of underfunded plans and retirement accounts.

And that's on top of publicly funded plans that already face massive shortfalls.

It's all pointing to one clear solution for hopeful retirees...

ZIRP Is Killing Retirement Yields

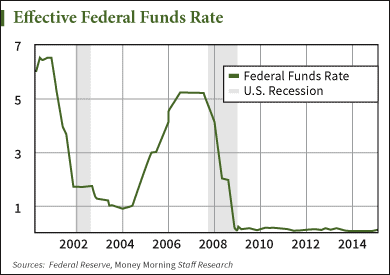

Even after seven years of ZIRP, odds are that even when the Fed does get around to raising rates, it won't be by much. A recent report by global reinsurer Swiss Re says the Fed's ZIRP policy has cost investors $470 billion in lost income through the end of 2013. Why? Low yields are lethal for pension plans and retirees. The effective Federal Funds Rate (shown below) has effectively flat-lined.

Even after seven years of ZIRP, odds are that even when the Fed does get around to raising rates, it won't be by much. A recent report by global reinsurer Swiss Re says the Fed's ZIRP policy has cost investors $470 billion in lost income through the end of 2013. Why? Low yields are lethal for pension plans and retirees. The effective Federal Funds Rate (shown below) has effectively flat-lined.

But hey, that's not the Fed's problem.

Instead, they're much more concerned with the Treasury's ability to pay the interest on its massive debt.

What's more, research by Bridgewater Associates, the world's largest hedge fund, estimates that 85% of public pensions could go bust within 30 years. Public pension funds currently have about $3 trillion in assets, but will need to pay out nearly $10 trillion over the next several decades. To get there, they'll require 9% yields, yet returns in just the 4% range are far more likely.

Consider the Detroit experience: Pension demands were a major contributing factor in the largest public bankruptcy in U.S. history. In the landmark Motown case, Judge Rhodes ruled pension benefits were not entitled "heightened protection in bankruptcy."

Now the state of Illinois is holding its breath, waiting for a Supreme Court ruling on a lawsuit by workers aiming to overturn 2013 pension reforms. If they're successful, it could cost the state $145 billion in increased taxes over the next 30 years.

Arizona's Supreme Court overturned 2011 reforms which were intended to restrict cost-of-living increases. But the system's already underfunded status (at just 67%) was ignored, contributing further to recurring deficits for a number of cities. In New York, the state and municipalities have resorted to deferring pension contributions, so long as they commit to repay later with interest. $3.3 billion in pension payments have been delayed since 2010... in New York State alone.

This is just a disaster in waiting. With historically low rates that show little, if any, sign of a substantial and sustained increase - no matter what the Fed would like us to think - it's all just a vicious downward spiral.

Meanwhile, employers are typically slowing or eliminating their policy of contributing to workers' 401(k) plans, and defined benefit plans are seeing benefits frozen or simply replaced with leaner plans.

According to a paper by the Center for Economic and Policy Research's David Rosnick and Dean Baker, the average American approaching retirement has just enough wealth to carry him/her just past three years.

But it wasn't always so dire.

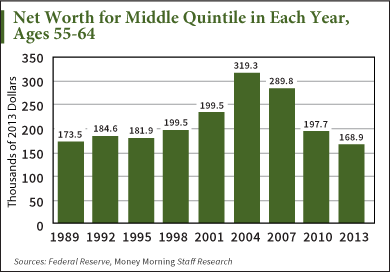

Net worth grew considerably for 20 years, but then the stock and housing crash of 2007-2009 put a distinct end to that, as seen here.

Yet recent work by the Boston College's Center for Retirement Research indicates people still aim to retire sooner rather than later. If they intend to follow through then there are only so many realistic options.

Yet recent work by the Boston College's Center for Retirement Research indicates people still aim to retire sooner rather than later. If they intend to follow through then there are only so many realistic options.

One is to keep working a few extra years, even if just part time. Of course, this lessens the time one needs to depend on savings alone, while simultaneously boosting the level of eventual Social Security benefits.

Whether or not Social Security will be able to pay what it promises, or even pay at all, is another issue altogether. Another vital consideration is health coverage by employers, which was much more widespread decades ago, boosting further the amount retirees need to live on today.

Build Up from Here

Low interest rates, underfunded pension plans, and a lack of savings combined with longer life spans means those preparing for or taking retirement need to save more and earn more... like it or not.

So what can you do to prepare?

Save more by diligently cutting where you can. There's nearly always some room, however little to trim. That will help you deal with the spending. As for income, look for relatively safe yield coupled with strong potential upside from capital gains. Right now I'd favor investment options outside the dollar given that other currencies are relatively undervalued.

WisdomTree International LargeCap Dividend ETF (NYSE Arca: DOL) provides an interesting mix of European and Asian large cap stocks while paying a (relatively) hefty 3.7% yield.

Of course the risk is not on par with treasuries, but the dividend return is commensurate.

Holdings in DOL are well-diversified across most major sectors like telecom, pharma, consumer staples, automotive, and financials. Adding to its stability, it boasts the biggest names within these sectors like China Mobile Ltd. (NYSE ADR: CHL), Novartis AG (NYSE ADR: NVS), Nestle SA (VTX: NESN), Toyota Motor Corp. (NYSE ADR: TM), and HSBC Holdings Plc. (NYSE ADR: HSBC).

DOL has $355 million in assets, incurs an expense ratio of 0.48%, and offers a current P/E of 16.

I expect foreign markets to outperform U.S. equities over the next year or two as they are in a more accommodative mode with QE, whereas the Fed has stopped (officially) and the U.S. bull market is getting long in the tooth. If you add DOL to your holdings, use a hard stop of $44.89 on a closing basis, and a 15% trailing stop to protect your profits.

Retirement looks increasingly challenging going forward, but there are things you can do to ensure you'll enjoy your golden years.

Editor's Note: For more opportunities to bolster your retirement funding (no matter how distant it may be), click here for Chief Investment Strategist Keith Fitz-Gerald's twice weekly, no-cost Total Wealth research.