For July 21, 2015, here's how the Dow Jones Industrial Average did today, plus the top stock market news, and stocks to watch based on today's market moves...

How Did the Stock Market Do Today?

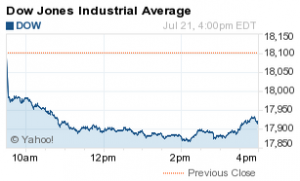

Dow Jones: 17,919.29; -181.12; -1.00%

Dow Jones: 17,919.29; -181.12; -1.00%

S&P 500: 2,119.21; -9.07; -0.43%

Nasdaq: 5,208.12; -10.74; -0.21%

The DJIA today fell nearly 1%, or 180 points, as revenue figures from large caps International Business Machines Corp. (NYSE: IBM) and United Technologies Corp. (NYSE: UTX) pulled down the index. The two stocks accounted for more than 100 points combined in the decline on the day. IBM shares slumped more than 6.2% on news that the company's revenue slipped for the 13th straight quarter. Meanwhile, United Technologies shares fell more than 7% after the company slashed its 2015 profit outlook.

The S&P 500 Volatility Index (VIX), the market's fear gauge, slipped 0.6%.

Top Stock Market News Today

- What Pushed Down the Dow: The Dow Jones Industrial Average slipped below 18,000 after two large caps, IBM and UTX, weighed down the index on weak revenue and weak forward guidance, respectively. Shares of Verizon Communications Inc. (NYSE: VZ) slumped more than 2.5%, dragging down the S&P 500 by seven points. The Nasdaq was down ahead of earnings reports from two of its largest companies, Apple Inc. (Nasdaq: AAPL) and Microsoft Corp. (Nasdaq: MSFT).

- Oil Outlook: Oil prices were up marginally after hitting recent lows on supply concerns. WTI crude futures for September added 0.4% to hit $50.56 per barrel. Meanwhile, Brent oil prices added 0.6% to hit $57.03 per barrel.

- On Tap Tomorrow: On Wednesday, investors will be keeping an eye on existing home sales and an update to domestic crude stocks from the U.S. Energy Information Administration. Companies reporting earnings tomorrow include Abbott Laboratories (NYSE: ABT), AutoNation Inc. (NYSE: AN), Boeing Co. (NYSE: BA), The Cheesecake Factory Inc. (Nasdaq: CAKE), Coca-Cola Co. (NYSE: KO), Discover Financial Services (NYSE: DFS), Las Vegas Sands Corp. (NYSE: LVS), SanDisk Corp. (Nasdaq: SNDK), and Six Flags Entertainment Corp. (NYSE: SIX).

Stocks to Watch: AAPL, HOG, TSLA, LXK

[epom key="ddec3ef33420ef7c9964a4695c349764" redirect="" sourceid="" imported="false"]

- Stocks to Watch No. 1, AAPL: Shares of Apple Inc. (Nasdaq: AAPL) dipped ahead of its post-market earnings report on news that its App Store, Apple Music, iTunes Store, and some other services were offline during a three-hour outage. The company did not specify why its networks were down. The news comes after a rash of outages have affected airline companies, media publications, and even the operator of the New York Stock Exchange in recent weeks.

- Stocks to Watch No. 2, HOG: Shares of Harley-Davidson Inc. (NYSE: HOG) jumped nearly 5% after the company beat Wall Street earnings and revenue expectations. The company reported earnings of $1.44 per share and revenue of $1.82 billion. Despite the positive quarterly results, the company did report that its market share in the United States has fallen below 50%, as Japanese rivals are offering better competition and prices than in the past. Harley has refused to cut its prices but says it hopes to boost sales from a new roster of products it will introduce to the markets next month.

- Stocks to Watch No. 3, TSLA: Shares of Tesla Motors Inc. (Nasdaq: TSLA) slumped 5.5% after the company received a downgrade from "Neutral" to "Sell" from investment bank UBS Group AG (USA) (NYSE: UBS). The bank said that it expects the company's storage and auto divisions to disappoint. UBS said it does not expect that the company will meet the target sales levels that it has set and that assumptions made for its production are "unlikely" to occur.

- Stocks to Watch No. 4, LXK: Shares of Lexmark International Inc. (NYSE: LXK) slumped more than 20.2% after the company reported weak earnings and announced plans to slash 500 jobs. The printer manufacturer reported a second-quarter loss and slashed its 2015 revenue outlook. It also said that it will pause its stock buyback program for 18 to 24 months while it pays down credit costs associated with its $1 billion takeover of Kodak.

Stay informed on what's going on in the markets by following us on Twitter @moneymorning.

What Investors Must Know This Week

- The Top Three High-Return Investments to Buy Today

- Is Netflix Stock a Buy After Stock Split and Earnings Beat?

- The Real Impact of the Iran Nuclear Deal on U.S. Oil Prices

About the Author

Garrett Baldwin is a globally recognized research economist, financial writer, consultant, and political risk analyst with decades of trading experience and degrees in economics, cybersecurity, and business from Johns Hopkins, Purdue, Indiana University, and Northwestern.