U.S. equities rebounded today (Tuesday) after global stocks saw a massive decline on "Black Monday."

And now, readers are asking us, "How much is the Dow Jones down in 2015?"

And now, readers are asking us, "How much is the Dow Jones down in 2015?"

Thanks to an interest rate cut from China, the Dow, S&P 500, and Nasdaq all jumped more the 2% in morning trading Tuesday.

Still, Monday's massive sell-off has left many investors reeling.

The Dow Jones plunged 1,089 points within minutes of Monday's open, marking the biggest intraday point decline ever. The storied 30-stock benchmark traveled 5,000 points during the day. Some 3,000 of those were logged during the first 90 minutes of trading.

Here are answers to some pressing questions on investors' minds after Monday's massive sell-off.

How Much Is the Dow Down in 2015?

The Dow lost 588.50 points, or 3.57%, Monday to close at 15,871.35. It was the index's worst day since August 2011.

Monday's loss put the Dow's year-to-date decline at 10.95%, in correction mode.

How High Had the Dow Climbed Before the Crash?

The Dow's all-time closing high is 18,312.39, set on May 19, 2015. From that high point, the Dow has now fallen 13.3%.

When Did the Dow's Fall Start?

Downward pressure on the Dow began after the index hit its May 19 high. Monday capped the biggest three-day loss for the Dow Jones ever, with the benchmark giving back 1,477.45 points.

The next biggest three-day loss for the index totaled 929.49 in November 2008. Monday was the fifth consecutive down day for the Dow. Over five days, it has a cumulative loss of 1,673.90.

What Caused the Dow to Drop?

Uneven growth in the United States, concerns over the first interest rate hike from the U.S. Federal Reserve since June 2006, and worries about an economic slowdown in China have all pressured the Dow Jones Industrial Average over the last several months.

But it was Monday's 8.49% drop in Chinese stocks and lack of expected policy action from the Chinese government that fueled yesterday's sell-off.

How Bad Was the Dow's Drop on Monday?

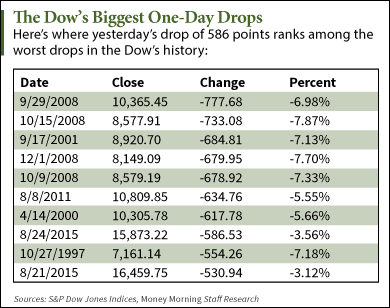

According to S&P Dow Jones Indices, Monday's drop ranks No. 8 on the Dow Jones Industrial Average points-lost list. Here's a look at the top 10 biggest point losses in the Dow's 133-point history.

Are Other Global Markets Falling?

The S&P 500 fell 77.68 points, or 3.82%, to 1,893.21 on Monday. That put the broad-based benchmark's year-to-date decline at 8%. The Nasdaq Composite shed 179.79 points, or 3.82%, to 4,526.25 on Monday. Since the start of 2015, the tech-heavy benchmark is down 4.4%.

The Stoxx Europe 600 sank 5.3% on Monday, its biggest one-day percentage drop since December 2008.

Commodities are also tanking. WTI crude oil ended Monday down 5.5% at $38.26. That was WTI's worst day since July 6, when it shed 7.73%. Monday's low of $37.75 was WTI's lowest level since Feb. 24, 2009, when it dipped to $37.65. Even safe-haven gold slipped 0.53% to $1,553.60 on Monday.

Is This a Stock Market Correction?

A stock market correction is defined as a drop of at least 10% from an index's recent high. With the Dow now nearly 1,900 points off its all-time high set back in May, the Dow has lost 10.3%. That means we are officially in correction territory.

According to investment firm Deutsche Bank, the stock market on average has a correction every 357 days, or about once a year. The last correction was roughly 1,000 days ago, the third-longest streak on record.

What Is a Bear Market?

The definition of a bear market is a decrease of at least 20% from an index's peak.

What Is a Stock Market Crash?

A stock market crash is defined as a sudden and dramatic decline in stock prices across a broad cross-section of a stock market, resulting in a significant loss of paper wealth. Crashes are driven as much by panic as they are by underlying economic factors. Crashes often follow speculative stock market bubbles.

Will the Dow's Decline Impact the Fed's Rate Decision?

Monday's rout likely has the U.S. Federal Reserve rethinking the timing of its first interest rate hike in nearly a decade. It's less likely the Fed will increase interest rates amid uncertain outlook for global growth and inflation.

Where Will the Dow Head from Here?

The Dow rebounded some 333 points, or 2%, to 16,204 in Tuesday's morning session. Many analysts say Monday's rout was indeed "made in China," and that the sell-off was an overreaction.

Experts say there was little change in economic fundamentals to justify such a monumental global slide. However, there is still a great deal of uncertainty in the markets. The Fed, China, and the Eurozone are all wildcards that could send the Dow soaring or swooning.

Stay informed on what's going on in the markets by following us on Twitter @moneymorning.

Protect Yourself from a Total Market Collapse: According to CIA Asymmetric Threat Advisor Jim Rickards, there are five "flashpoints" that signal the death of the U.S. dollar and a complete economic collapse in the United States. Here's how you can protect yourself, and your money, before it's too late...