There are three upcoming IPOs this week. According to Renaissance Capital, a manager of IPO-focused ETFs, they're expected to raise a combined $380 million.

There are three upcoming IPOs this week. According to Renaissance Capital, a manager of IPO-focused ETFs, they're expected to raise a combined $380 million.

Last week, the IPO calendar ended its three-week lull as three healthcare companies hit the market. All three IPOs saw a first-day pop of 30% or more.

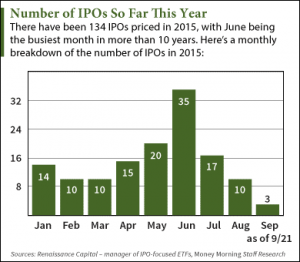

The IPO market has been markedly slower compared to last year. There have only been 134 deals so far in 2015, down nearly 40% from the same period in 2014. Most new issues have been healthcare firms.

This week offers more variety as a financial company, biotech, and consumer firm make their market debut.

Here's everything you need to know about the three upcoming IPOs this week...

Three Upcoming IPOs This Week

Boulevard Acquisition Corp. II is a special-purpose acquisition company (SPAC) formed by private equity firm Avenue Capital Group. It is the second SPAC to be taken public by Avenue Capital after Boulevard Acquisition Corp., which recently became AgroFresh Solutions Inc. (Nasdaq: BLVDU). Formed in 2015, Boulevard Acquisition Corp. II serves the same purpose as its predecessor and was created solely to pursue an acquisition in any industry. The company is set to raise $350 million by offering 35 million shares for $10 each. It is valued at $438 million and will hit the market sometime this week.

Money Morning Members: Keep reading for the rest of the upcoming IPOs this week. For those new to Money Morning, sign up to keep reading - it's completely free...

Oasmia Pharmaceutical AB (Nasdaq: OASM) is developing formulations of widely used cancer drugs for humans and dogs. The Swedish biotech takes existing cancer drugs and aims to make them safer and easier to administer. Founded in 1999, Oasmia already trades on the Stockholm Stock Exchange and has lost 16% of its value since the beginning of the year. The company is set for a $23 million deal by selling roughly 3.4 million American Depository Shares (ADSs) - shares of a foreign-based company available for purchase on a U.S. stock exchange - at a $5.75 to $7.75 price range. Oasmis commands a $200 million valuation and will begin trading sometime this week.

[mmpazkzone name="in-story" network="9794" site="307044" id="137008" type="4"]

Boxlight Corp. (Nasdaq: BOXL) manufactures and sells classroom materials. These include display products, standard projectors, interactive projectors, interactive LED panels, and audio systems. The Georgia-based company posted $31 million in sales between June 2014 and June 2015. It previously filed for a $20 million deal but has since cut it in half. Boxlight will raise $10 million by offering 2.2 million shares at a price range of $8 to $10. It commands a market cap of $58 million and will debut sometime this week.

Follow us on Twitter at @AlexMcGuire92 and @moneymorning.

Like us on Facebook: Money Morning.

How to Safely Profit from Any IPO: Investing in newly issued stocks can seem like an exciting way to earn huge profits. But with institutional investors and other Wall Street "VIPs" cheating the market for quick gains, the IPO process is a rigged game nowadays. That's why we've outlined the three best IPO investing rules to follow for any new stock. Check them out here...