For Jan. 12, 2016, here's the top stock market news and stocks to watch based on today's market moves...

How Did the Stock Market Do Today?

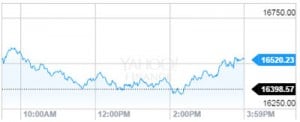

Dow Jones: 16,516.22; +117.65; +0.72%

Dow Jones: 16,516.22; +117.65; +0.72%

S&P 500: 1,938.68; +15.01; +0.78%

Nasdaq: 4,685.92; +47.93; +1.03%

The Dow Jones Industrial Average today (Tuesday) gained 117 points despite another sharp decline for crude oil prices. The markets earned a boost as technology and healthcare stocks rebounded from a rough six days of trading. Shares of Intel Corp. (Nasdaq: INTC) offered a boost to the tech sector - nearly 2% - while shares of Apple Inc. (Nasdaq: AAPL) added 1.5%.

On the economic front, the NFIB Small Business Optimism Index increased to 95.2 in December. The reading surpassed economist expectations and reflects strong growth in job openings and expected increases in capital investment and employment spending. Meanwhile, job openings in the United States held at 5.4 million, indicating a large need for skilled workers in order to boost productivity and meet expected demand in the future.

Top Stock Market News Today

- Stock Market Today: Seven of 10 major S&P sectors were up today, with healthcare stocks leading the markets higher. On the downside, utilities and materials stocks slumped as commodity prices continue to crater. Shares of Alcoa Inc. (NYSE: AA) fell 9% after the company reported mixed earnings on Monday afternoon and failed to indicate that global aluminum demand was set to rise in 2016. The sharp downturn in Alcoa stock is a shaky beginning to the 2016 earnings season and reignites worries about an earnings recession for the S&P 500.

- IPO Troubles: Investors are growing concerned about the stability of companies that recently went public. Shares of Etsy Inc. (Nasdaq: ETSY) hit an all-time low of $6.89 during today's session. The firm continues to see weakness in its industry and is facing increasing pressure from rivals like com Inc. (Nasdaq: AMZN). Etsy's new intraday low has drawn comparisons to other tech IPO darlings that have dramatically underperformed. Shares of Twitter Inc. (NYSE: TWTR) and GoPro Inc. (Nasdaq: GPRO) are both hovering near all-time lows, while Fitbit Inc. (NYSE: FIT) is off more than 60% from its August high. Here's a breakdown of why Twitter stock continues to slump.

- Oil Slump: Crude oil prices traded below $30 for the first time since December 2003. Price settling was delayed for nearly an hour after a flurry of trading activity and confusion in New York. Concerns about oversupply and slowing demand in China are weighing on consumer sentiment and pushing energy stocks to the brink. February's WTI prices were off 3.1% to settle at $30.44 per barrel when the Dow closed. Meanwhile, Brent oil crude - priced in London - fell 2.2% to close at $30.86. Despite the downturn, high-volume energy stocks Exxon Mobil Corp. (NYSE: XOM) and Chevron Corp. (NYSE: CVX) were up 2.1% and 1.7%, respectively.

- On Tap Tomorrow: On Wednesday, the markets will continue to focus on volatile oil prices as the U.S. Energy Information Administration reports weekly U.S. crude inventories. In addition, pay attention to speeches by two members of the U.S. Federal Reserve, Eric Rosengren (Boston) and Charles Evans (Chicago). Companies set to report quarterly earnings include CLARCOR Inc. (NYSE: CLC), HB Fuller Co. (NYSE: FUL), and SUPERVALU Inc. (NYSE: SVU).

Stocks to Watch: SBUX, ANTM, CI, UNH, AET, BURL

- Stocks to Watch No. 1, SBUX: Shares of Starbucks Corp. (Nasdaq: SBUX) gained nearly 3% after the global coffee chain announced sales in China have not slowed down despite concerns about the world's second-largest economy.

- Stocks to Watch No. 2, ANTM: Shares of Anthem Inc. (NYSE: ANTM) gained 5.6% after the health insurance giant hiked its 2016 profit outlook. The news was a big boost to its competitors. Shares of Cigna Corp. (NYSE: CI) added 3%, while UnitedHealth Group Inc. (NYSE: UNH) added 2.5%. Shares of Aetna Inc. (NYSE: AET) gained 3.6%.

- Stocks to Watch No. 3, BURL: Shares of Burlington Stores Inc. (NYSE: BURL) surged more than 14% after the company affirmed its Q4 and full-year guidance at the lower end of its previous forecasts. Despite unseasonably warm weather to start the quarter, the firm said it expects net sales to increase by 3.7%, which was the bottom end of its previous estimates.

What Investors Must Know This Week

- Where We'll Find Our Biggest Profits This Year

- What a Chinese Stock Market Crash Means for Investors

- Your "Buy List" to Profit from Volatility in 2016

Follow us on Twitter @moneymorning or like us on Facebook.

[mmpazkzone name="end-story-hostage" network="9794" site="307044" id="138536" type="4"]

About the Author

Garrett Baldwin is a globally recognized research economist, financial writer, consultant, and political risk analyst with decades of trading experience and degrees in economics, cybersecurity, and business from Johns Hopkins, Purdue, Indiana University, and Northwestern.