Come on, given what's happening in Europe right now, you didn't really expect the financial sector to provide a big boost to the markets today, did you? Well, that's what happens when China decides to loosen monetary policy so much that their banks are getting close to dropping cash out of helicopters. A wealth of strong economic data gave the Dow Jones Industrial Average and S&P 500 nice boosts, while tech stocks pushed up the Nasdaq.

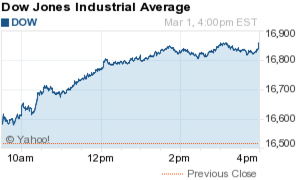

You'll be shocked at what happened in the markets on Tuesday, March 1, 2016.

First up, check out the results for the Dow Jones, S&P 500, and Nasdaq:

Dow Jones: 16,865.08; +348.58; +2.11%

Dow Jones: 16,865.08; +348.58; +2.11%

S&P 500: 1,978.35; +46.12; +2.39%

Nasdaq: 4,689.60; +131.65; +2.89%

Now, here's the top stock market news today...

DJIA Today: Banking Boom, Super Tuesday Vote, and Auto Stocks Surge

[mmpazkzone name="in-story" network="9794" site="307044" id="137008" type="4"]

The banking sector had its best day in weeks, boosted by more economic stimulus from China and strong U.S. economic data - and that came even with Barclays Plc. (NYSE: BCS) offering a horrendous annual report this morning. Shares of Morgan Stanley (NYSE: MS) and Citigroup Inc. (NYSE: C) both surged more than 5%.

Oil prices rose to their highest level in eight weeks thanks to Wall Street's rally. But at the end of the day, we all know it was related - as everything was - to China's stimulus news. Later this week, data will likely indicate another rise in U.S. crude inventories, but that didn't stop WTI prices from gaining 1.9%. In other news, Russian President Vladimir Putin said his nation's oil companies have agreed to freeze production levels; however, Putin also said there has been no formal agreement between oil-producing nations to do the same. Here's more on why oil prices are rallying.

Today is Super Tuesday, a day when 12 states and one U.S. territory participate in primary elections. Democratic front-runner Hillary Clinton and GOP front-runner Donald Trump are widely expected to win a large number of states today, setting up what will likely be one of the most vitriolic U.S. elections in American history. Congratulations, America. Just eight more months of this!

The big talk should have been about the state of the global manufacturing sector. However, that was largely ignored by the surge in banking stocks. That said, this overshadowed data is still going to be there when the sugar high wears off tomorrow.

For the fifth straight month, U.S. manufacturing levels contracted (albeit at a slower pace than during that stretch). According to the Institute for Supply Management, the manufacturing index hit 49.5, up slightly from 48.2 in January. A reading under 50 signals that firms are cutting their business rather than expanding. Firms have cited a stronger dollar, falling oil prices, and weakening exports for the five-month stretch of contraction. However, economists tried to put a bow on the weak data by suggesting steady orders growth and rising inventory levels.

Meanwhile, manufacturing activity contracted in most of Asia and Europe, offering a blow to central planners and bankers who have been tweaking monetary policy in order to stimulate their economies and boost economic growth. China's PMI survey indicated the seventh consecutive monthly decline in February. The news comes a day after the People's Bank of China announced plans to slash its reserve capital ratio for banks.

Expect this data to weigh on the U.S. Federal Reserve's decision on whether to raise interest rates again this year. Although Fed Chairwoman Janet Yellen has suggested the central bank will increase rates gradually in 2016, recent speeches from other Fed members have suggested global economic turmoil and the struggles of financial markets will weigh on their decisions.

Now, let's look at the day's biggest stock movers and today's stock pick...

Top Stock Market News Today

- The automotive sector received a big boost today after reporting very strong vehicle sales for February. Shares of Fiat Chrysler Automobiles NV (NYSE: FCAU) surged more than 7%, shares of Ford Motor Co. (NYSE: F) gained 4.6%, and General Motors Co. (NYSE: GM) pulled into the finish line with a 1.9% gain on the day. The strong sales report beat back concerns about a potential sector-wide slowdown after record sales in 2015.

- Merger mania hit a speed bump today. Global industrial giant Honeywell International Inc. (NYSE: HON) announced it is shelving a $90.7 billion bid for rival United Technologies Corp. (NYSE: UTX). The firm cited UTX's unwillingness to discuss a deal, just one week after UTX flatly rejected an offer. United Tech turned the deal down due to expected regulatory scrutiny, required divestitures, and customer concerns.

- On the earnings side, discount retailer Dollar Tree Inc. (Nasdaq: DLTR) fell short of Wall Street expectations, blaming a "challenging" macroeconomic environment. DLTR began the day off 4% but finished up 2.2% thanks to the broader market rally.

- Shares of Apple Inc. (Nasdaq: AAPL) gained nearly 4% on a day that the tech giant is going to battle against the FBI on Capitol Hill over encryption of consumer cell phones. Today, FBI Director James Comey and Apple general counsel Bruce Sewell both testified before a House Judiciary Committee.

- Finally, here's your stock pick of the day. It's one of the world's most innovative companies. If you were a teenager in the 1990s, this company changed virtually every single aspect of your life - from the music you listen to and books you read to how you shop during the holidays. But they are nowhere near done yet, and this firm is now targeting a $14.4 trillion industry in a way that no company has ever before tackled a challenge. This is huge, and it will send this stock soaring in the years ahead. Read all about this company's staggering technological breakthrough, right here.

What Investors Must Know This Week

- These Four Charts Have Every Wall Street Pro Worried

- Grab Double-Digit Gains with This Tech Overachiever

- The One "Investment" You Can't Afford to Be Without

Follow Money Morning on Facebook and Twitter.

About the Author

Garrett Baldwin is a globally recognized research economist, financial writer, consultant, and political risk analyst with decades of trading experience and degrees in economics, cybersecurity, and business from Johns Hopkins, Purdue, Indiana University, and Northwestern.