The Dow Jones Industrial Average's third-longest bull market turned seven years old today as the markets prepare for European Central Bank Mario Draghi to expand stimulus efforts to unprecedented levels in order to recharge the bloc's economy. No one has warned him that doing so will damage the euro's value, continue a global race to the bottom for central banks, and just lead right back to where they started once the money faucet goes dry. That said, it doesn't mean we can't make money on Draghi's ill-sighted will. You can get started, right here.

Here's what you might have missed in the markets for Wednesday, March 9, 2016.

First up, check out the results for the Dow Jones, S&P 500, and Nasdaq:

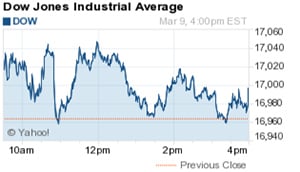

Dow Jones: 17,000.36; +36.26; +0.21%

S&P 500: 1,989.26; +10.00; +0.51%

Nasdaq: 4,674.38; +25.55; +0.55%

Now, here's the top stock market news today...

DJIA Today: Regulators Swarm, Saudi Arabia Begs, and Oil Rallies

The U.S. government's proposed crackdown on prescription drug prices for Medicare recipients pounded the biotech sector today. The iShares NASDAQ Biotechnology Index ETF (Nasdaq: IBB) fell 1.2%, while the Nasdaq's single largest drag, Amgen Inc. (Nasdaq: AMGN), tumbled 2.6%.

The Consumer Financial Protection Bureau asked for borrowers from peer-lending sites like LendingClub Corp. (NYSE: LC) to alert the federal agency of any complaints. The announcement is largely expected to prelude additional regulatory oversight by the federal consumer watchdog. The agency is also targeting private loan lenders on concerns that some "bad actors" are discharging loans prematurely, a decision that could quickly lead to default and ruin a consumer's credit or ability to buy a house.

The big talk today centered on oil prices - and the impact of the low price environment on global producers. Crude prices rallied to another 2016 high after the U.S. Energy Information Administration reported a strong drawdown of gasoline inventories in the United States and traders grew increasingly more optimistic about a possible deal between global producers to freeze output levels. According to various reports, OPEC and non-OPEC nations will meet in Moscow to discuss a deal this month.

That deal was highlighted by big news about the weakening financial condition of OPEC's largest oil producer. According to Reuters, Saudi Arabia has its hand out in search of a bank loan worth between $6 billion and $8 billion. The nation will need to rely on foreign borrowing in order to shore up its financial coffers.

WTI prices added 4.9% to $38.29, while Brent crude prices gained 3.6% to $41.07.

Now, let's look at the day's biggest stock movers and today's top profit play...

Top Stock Market News Today

- It was a big day for Amazon.com Inc. (Nasdaq: AMZN) and its CEO Jeff Bezos. The company announced plans to launch its first television show that will be livestreamed and promote sales of its pending apparel segment and private label sales. The show will take place at 9 p.m. EST and will allow consumers to call in and talk to the hosts. In addition, the firm announced plans to to launch its space exploration vehicles in 2018. AMZN stock was still off 0.1% on the day.

- Merger mania made its mark again today. According to reports, Canon Inc. (NYSE ADR: CAJ) is exploring a purchase of the medical-device division of the cash-strapped Toshiba Corp. (OTCMKTS: TOSBF).

- Here we go again... shares of Chipotle Mexican Grill Inc. (NYSE: CMG) slumped more than 3.4% after four employees at a Massachusetts store grew sick and forced the temporary closure of the location. The damage is done, but the problems are just getting started for shareholders. Here's why Chipotle stock is poised to fall even further than today's levels.

- Shares of Canadian drug company Valeant Pharmaceuticals International Inc. (NYSE: VRX) added 5.8% on news the firm is appointing three new board members as soon as today. One of the board seats will be going to activist investor Bill Ackman's Pershing Square Capital Management.

- Finally, here is your stock pick of the day. While it might be one of the most controversial stocks of 2016, it is also certainly going to be one of the most profitable. That's because the product this company sells is highly regulated, in incredible demand this political season, and the big winner of a record number of sales that occurred in the fourth quarter of 2016. But it's even bigger than that... this company's stock has crushed even technology darling Apple Inc. (Nasdaq: AAPL) on share appreciation since 2009. And it's sure to be an even bigger winner all this year.

What Investors Must Know This Week

- These Four Charts Have Every Wall Street Pro Worried

- Grab Double-Digit Gains with This Tech Overachiever

- The One "Investment" You Can't Afford to Be Without

Follow Money Morning on Facebook and Twitter.

[mmpazkzone name="end-story-hostage" network="9794" site="307044" id="138536" type="4"]

About the Author

Garrett Baldwin is a globally recognized research economist, financial writer, consultant, and political risk analyst with decades of trading experience and degrees in economics, cybersecurity, and business from Johns Hopkins, Purdue, Indiana University, and Northwestern.