There's just no other way to say it - gold prices have been on an exciting rally this month.

What's been driving the gold price recently is the fear trade. I know this because it's not just gold that's been gaining.

We've seen the price of gold, silver, the U.S. dollar, and sovereign bonds all move higher over the past week. At the same time, we've seen global stock markets take it on the chin.

Everyone was initially buying safe-havens like gold and silver due to fear of a possible rate hike at the June FOMC meeting. But even though the Fed left rates unchanged, the dollar kept moving higher.

And the rising dollar is mostly thanks to the Brexit vote next Thursday, June 23, when Britain will vote on whether to stay or leave the EU.

Today, we'll discuss the Brexit's potential impact on gold prices moving forward.

First, here's a recap of gold's gains this week, including the metal's insane performance yesterday...

Why Gold Prices Are Set to Gain 1.5% This Week

The price of gold kicked off this past trading week on a strong note. After rallying above the $1,280 mark in early morning trading, gold prices settled at $1,284 for a gain of 0.6% on the day.

On Tuesday, June 14, the gold price maintained the previous session's gains despite the start of the two-day FOMC meeting. It added 0.2% to settle at $1,286.

But the real action began the next day when the Fed announced it wouldn't raise interest rates. After a bit of sell-off in early morning trading, gold prices exploded above the $1,290 level once the announcement came out. Prices ended up posting a 0.5% gain and closed at $1,292.

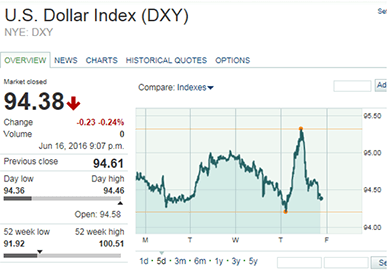

Since the dollar and gold typically move in opposite directions, this chart shows how the U.S. Dollar Index (DXY) has trended over the last five days...

On Thursday alone, the DXY managed to cover a range between 95.36 and 94.46. That massive 90-basis-point fluctuation shows how jittery the markets have been lately.

Interestingly, the gold price moved alongside the DXY, which typically doesn't happen in the short term. Unfortunately, that meant gold prices followed the dollar downward in late afternoon trading. The metal eventually fell 1.1% to close at $1,278 on the day.

The weakness continued through to this morning. As of 10:05 a.m., the gold price today (Friday, June 17) is down 0.3% to $1,295. That puts it on track for a weekly gain of 1.5%.

While the Fed meeting was a big influence on gold prices this week, the UK referendum next week will have an even bigger influence.

Here's why the Brexit could provide a huge boost to the price of gold...

The Brexit's Bullish Effect on Gold Prices

[mmpazkzone name="in-story" network="9794" site="307044" id="137008" type="4"]

The approaching UK referendum appears to have caused investors and traders to flock to gold to seek shelter from potential market volatility.

Heightened concerns about the unknown risks of Britain exiting the EU has also led investors to buy bonds over the last couple weeks.

But the Brexit debate came to a halt yesterday after Jo Cox, a British lawmaker who had campaigned for Britain to remain in the EU, was shot and killed. The suspect was apprehended and is believed to be politically motivated after reports found he shouted "Britain first" as he shot her.

As a result of this sad and dramatic event, both sides of the Brexit debate decided to stop campaigning for a day or two. That triggered rumors the vote itself may even be delayed, which in turn led gold to sell off as the immediacy of the referendum was thought to be put on hold.

But investors are expected to keep buying gold in the coming week. In fact, London-based firm ETF Securities predicts gold prices will rise by a whopping 8% if the UK votes to leave the EU. It believes the expected decline in currencies like the euro and pound would send the price of gold above $1,400 an ounce.

These bullish expectations should give the price of gold some exciting momentum next week.

Follow us on Twitter and like us on Facebook for updates on the Brexit referendum and gold prices.

Readers - don't miss details on this bonus stock pick... the best "retirement stock" of 2016...