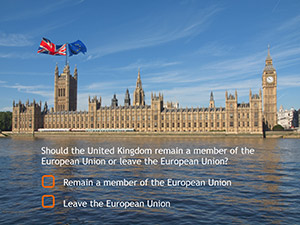

Dow Jones Industrial Average News, 7/05/2016: The markets are back in Brexit worry mode, with Dow futures sliding triple digits this morning. But despite the panic, Money Morning guru Keith Fitz-Gerald found five stocks that are trading at a discount because of Brexit concerns.

The British sterling also fell to a 31-year low today as investors turned bearish about the potential aftermath of Britain's pending exit from the European Union.

Trending: Brexit Triggers Rush to "Insure" Life Savings: Billionaires are sinking millions into "crash insurance" in an effort to protect themselves against another 2008-style meltdown. If you haven't shielded your holdings you better act now before all hell breaks loose. Read more...

The Bank of England has reversed its March decision that requires banks to hold more capital during upticks in the credit cycle, a somewhat staggering and concerning decision about the health of the nation's financial sector.

Today, the markets will still focus on the impact of the Brexit and its ties to global growth. But investors should be aware of a number of other important stories that can impact trading and offer profits in the process.

Here are today's top stock market news, stocks to watch, ways to profit, and economic calendar for July 5, 2016.

What's Moving the Dow Jones Industrial Average Today: Brexit Rally Cools

Dow Jones futures projected a 110-point decline as global growth concerns rattled investors sentiment. In addition, shares of Ford Motor Co. (NYSE: F) and General Motors Co. (NYSE: GM) were both off more than 1.1% after the June annual sales rate for automobiles fell far short of analyst expectations. Shares of Fiat Chrysler Automobiles NV (NYSE: FCAU) were trending down the sharpest - off 6.5% - early this morning.

Meanwhile, shares of Tesla Motors Inc. (Nasdaq: TSLA) were off 4.3% after the company fell short of its quarterly vehicle delivery target. The company tried to say that it had a large number of vehicles in transit, but analysts believe that the company's production troubles are on display.

The Federal Reserve is in focus this afternoon when New York Fed Bank President William Dudley gives a speech. Traders will be interested in any clues on the timing of the next interest rate hike and what to expect during the Fed Open Market Committee meeting later this month.

Silver prices are on a tear, pushing past $20 per ounce. Silver added more than 1.5% so far on July 5 trading. Gold prices are up 0.5%.

Crude oil prices were sliding this morning as global growth concerns weigh again on trader sentiment. Concerns about Chinese data and rising production in regions like Canada and Nigeria are pushing oil prices lower for now. WTI crude prices were off 3%, while Brent crude slipped 2.6%. Nigeria is weighing most on crude prices as the nation continues to recover from a series of militant attacks on its infrastructure.

Now here's your list of top stocks to watch in today's market, plus today's economic calendar:

Companies to Watch in the Stock Market Today

- Apple Inc. (Nasdaq: AAPL) stock was off 0.7% this morning. Investors are clamoring for information about the company's new iPhone 7, which is set to be released later this year.

- It's been a tough environment for airline stocks in the wake of the Brexit. But Barron's gave a boost to Southwest Airlines Co. (NYSE: LUV) over the weekend. Shares of LUV stock were up 1.4% in pre-market hours after the financial publication pushed the stock as a value buy given its lack of exposure to Europe.

- Office retailer Staples Inc. (Nasdaq: SPLS) will be in focus today. The company is considering an exit from the British market in the wake of the Brexit vote. According to a report from The Sunday Telegraph, the firm is preparing to depart England as part of a larger reconsideration about its presence in all of Europe. The firm has been exploring its options after U.S. regulators blocked its merger with rival Office Depot Inc. (Nasdaq: ODP).

- Shares of Walt Disney Co. (NYSE: DIS) were off slightly in pre-market hours despite news that its Pixar film "Finding Dory" was the No. 1 film at the box office over the July 4 weekend. The film pulled in $41.9 million in North America and marked its third straight weekend as the top film in the United States. Most investors are overlooking these DIS price catalysts, but here's what our readers need to know...

- On the earnings front, International Speedway Corp. (Nasdaq: ISCA) gained 2.2% in pre-market hours after the firm topped analyst expectations. Additional companies reporting earnings on Monday include AZZ Inc. (NYSE: AZZ).

Today's U.S. Economic Calendar (all times EDT)

- Gallup US ECI at 8:30 a.m.

- Factory Orders at 10:00 a.m.

- 3-Month Bill Auction at 11:30 a.m.

- 6-Month Bill Auction at 11:30 a.m.

- TD Ameritrade IMX at 2:30 p.m.

- Gallup US Consumer Spending Measure at 1 p.m.

- 4-Week Bill Auction at 1 p.m.

- New York Federal Reserve Bank President William Dudley speaks at 2:30 a.m.

Follow Money Morning on Facebook and Twitter.

Up Next: It's the Ultimate "Must-Have" Investment... And yet millions of investors have never even considered it, let alone know how to play it for maximum profits. This could make the oil rush to $140 a barrel in 2008 look like amateur hour. Read more...

About the Author

Garrett Baldwin is a globally recognized research economist, financial writer, consultant, and political risk analyst with decades of trading experience and degrees in economics, cybersecurity, and business from Johns Hopkins, Purdue, Indiana University, and Northwestern.