Paying $830 for one share of stock seems unreasonable for most retail investors. But that's what you'll pay for one share of Amazon now.

Paying $830 for one share of stock seems unreasonable for most retail investors. But that's what you'll pay for one share of Amazon now.

So why is Amazon stock so expensive?

To answer that question, you have to judge whether Amazon.com Inc. (Nasdaq: AMZN) stock actually is expensive, or just seems expensive.

If you look at just the price/earnings (P/E) ratio for the Amazon stock price, it would seem drastically overpriced. It's trading 208.15 times more than its earnings.

In comparison, Apple Inc. (Nasdaq: AAPL) has a P/E ratio of 13.75 and made $12 billion more than Amazon in its last earnings report.

But there are three reasons why the AMZN stock price has skyrocketed to over $830 per share.

And after we show you the three reasons, you'll see why many investors believe today's opening price of $839.30 is actually a discount compared to where it could trade in the next few years...

Why Is Amazon Stock So Expensive? Reason No. 3: Future Profitability

The first reason Amazon stock is expensive is its future profitability.

Amazon is known for aggressively reinvesting profits. That limits its net profit totals each year.

For example, Amazon reported a profit of $857 million in Q2. But CEO Jeff Bezos announced in June that he would spend $300 million in India to fund movies and series ideas.

That's 35% of Amazon's profit from one quarter.

But long-term investors understand why Amazon is such an appealing investment, even as it aggressively spends. At some point in time, Amazon's spending on new facilities and acquisitions will slow down when there is simply no more need or room to grow.

When that happens, Amazon's operating expenses will go down. That means Amazon's profits should increase.

Because of that, long-term investors are willing to pay over $830 per share for AMZN stock today.

Most investors know Amazon is an online retailer. In 2015 alone, its shipping revenue amounted to $6.52 billion, according to research site Statista. From clothes to toothpaste, Amazon is a one-stop shop for everything you need.

Trending Story: These 6 Retail Companies Are Toast

But Wall Street is overlooking Amazon's creation of an ecosystem through hardware and software that will make billions...

You see, Amazon sells hardware like its tablet, the Kindle Fire, and the speaker system Amazon Echo. And once someone owns these devices, the e-commerce giant is able to upsell its Amazon Prime services.

For $99 a year or $10.99 a month, Prime subscribers have access to unlimited movie and TV streaming, music, photo storage, free two-day shipping, and free same-day shipping in select ZIP codes.

Amazon doesn't share how many customers pay for Prime. But according to Fortune, analysts believe as of February 2015 it had between 40 and 50 million subscribers worldwide.

That means Amazon potentially generates between $3.9 billion and $4.9 billion per year from Prime.

And that's not all...

Amazon also generates revenue through:

- Amazon Studios: a developer of television shows and movies that are distributed through Amazon Video

- Amazon Fresh: a grocery delivery service that costs Prime members an additional $14.99 per month

- Audible.com: a source for digital audiobooks, radio, TV programs, and audio versions of newspapers and magazines

- ComiXology: a cloud-based digital comic platform

- Zappos: an online shoe and clothing shop

- Twitch.tv: a live-streaming video platform

- Internet Movie Database (IMDb): an online database for films, television shows, and video games

Amazon's revenue sources are diverse and impressive, and will help the Amazon stock price continue to climb.

But that's only one of the reasons why Amazon stock seems so expensive. These are the two other key reasons why investors are willing to pay for one of the most expensive stocks on the market...

Why Is Amazon Stock So Expensive? Reason No. 2: CEO Jeff Bezos' Vision

[mmpazkzone name="in-story" network="9794" site="307044" id="137008" type="4"]

The second reason Amazon stock is so expensive is because Bezos has proven himself as a visionary.

He first showed this skill in 1994 when he saw the potential of the internet. Bezos left a high-paying job at a hedge fund to start Amazon in his garage.

When it was just a bookseller, Wall Street pundits didn't think Amazon stood a chance against brick-and-mortar stores like Borders and Barnes and Noble Inc. (NYSE: BKS).

But long-term AMZN shareholders have been rewarded by Bezos' ability to correctly spot an emerging market...

You see, Bezos correctly identified shopping online would become the norm instead of just a trend.

He added a music store to Amazon in 1998, and Amazon started selling toys and electronics in 1999 to make it an even more convenient online marketplace.

By 2001, brick-and-mortar retailers like Circuit City and Borders who were slow to adapt to online shopping were actually using Amazon to sell their products. Eventually, Circuit City and Borders were forced to close, while Amazon has flourished. It now has a market cap over $405 billion.

Amazon continues to be the leader in online shopping, and it's constantly finding ways to make the online shopping experience more convenient.

But Bezos believes there is a growing need on the internet for one particular service, and it already generated Amazon $2.88 billion in revenue just for Q2.

And as this revenue source continues to grow, the Amazon stock price will become even more expensive.

Why Is Amazon Stock So Expensive? Reason No. 1: Amazon Web Services

To make investing profitable, you have to be forward-looking.

"Part of knowing how to beat the market means knowing where the money will flow," Money Morning Chief Investment Strategist Keith Fitz-Gerald said.

[Editor's Note: These are the six unstoppable trends that will beat the market...]

And money is flowing into Amazon because it's a leader in cloud computing.

Long-term investors who understand just how big of a market this can be are loading up on Amazon stock. They know that as Amazon generates billions through cloud computing, the Amazon stock price will only climb higher.

You see, there's a growing market known as the Internet of Things (IoT). This market uses cloud-computing technology to connect devices with the internet.

For example, a smart thermostat can collect data and store it on the cloud. It can then adjust the temperature and when you're not home, helping cut down on energy costs.

You can also use a smartphone to raise or lower the temperature on your way home from work through IoT.

By 2022, Cisco Systems Inc. (Nasdaq: CSCO) projects the IoT industry will have $14.4 trillion in sales.

Bezos entered the market with Amazon Web Services (AWS) IoT last October.

Amazon's CEO has made another bet on the internet, believing that companies would rather pay to rent out the infrastructure of AWS than to build their own.

And so far, he appears to be right...

Netflix Inc. (Nasdaq: NFLX), for example, pays Amazon to use AWS. So even though Amazon Video is a competitor with Netflix, Amazon is making money off of Netflix and will make more money as Netflix grows and needs more storage.

AWS generated $7.88 billion in revenue in 2015, which was over 7% of Amazon's total revenue for 2015. AWS generated $2.88 billion in Q2, and a total of $5.44 billion so far in 2016.

That means AWS revenue has accounted for 9.13% of Amazon's total 2016 revenue.

While the Amazon stock price may seem expensive today, it will just keep climbing because of AWS IoT.

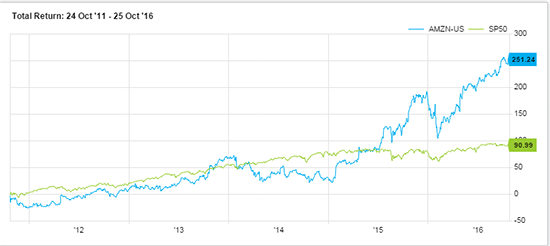

As you can see in the chart below, AMZN stock has climbed over 251% in the last five years. In comparison, the S&P 500 has climbed 90%.

Money Morning Director of Tech & Venture Capital Michael A. Robinson named Amazon as part of his "Dream Team" at the end of 2015, and we expect these types of market-beating gains to continue.

The Bottom Line: Investors have been asking us why is Amazon stock so expensive, but Amazon stock only seems expensive. When you look at the diverse revenue sources, CEO Jeff Bezos' leadership, and the massive profits from the growing IoT market, Amazon stock should continue to climb. That means it's currently trading at a discount from its trading price within the next few years.

Up Next: Get the Best Investing Research Today to Grow Your Money