If you believe anything Goldman Sachs says, their latest report might have you worried.

Even if they're halfway right that earnings for S&P 500 companies could still be crimped all the way up to 2018, it'll be tougher than usual for most investors to profit.

I'm not worried at all, though - and you don't have to be, either.

The sector I'm going to show you how to target today has a proven record of dramatically outperforming broader markets. It outperforms in depressions, recessions, and in the "earnings contractions" like the one Goldman's forecasting.

It's such a powerful group of stocks, it's about to cap another decade of market dominance. And I still see plenty of upside for the "catchall" holding I've found for you today.

Thrashing Broader Markets Year After Year

It's not the best-kept secret in financial media, but the small-cap sector's about to notch another decade of dramatically outperforming the broader markets.

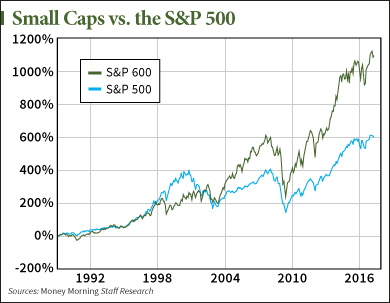

Profits from small caps over the last few decades have thrashed the major indices. The S&P 600 Small-Cap Index, for example, has returned more than 1,130% since 1990, almost double the 623% the S&P 500 has managed in the same time frame.

Over the last 10 years, the beat is 85% to 54%.

What about even more recently? Over the last 12 months, the S&P 600 Small-Cap Index has beaten the S&P 500 by more than two-to-one.

Twenty-seven years, 10 years, five years, one year... it doesn't matter. The small-cap sector is supreme when it comes to growing investors' money.

I've seen the numbers bear out in my own experience, too.

In fact, by focusing on this sector, I've helped readers double their money with four small-cap plays this year, and another one's at 96% as I write. Meanwhile, the S&P 500 is up just 4% for the year. I just love delivering those market beats to readers.

The point is that the small-cap sector abounds with profit potential - if you know where to look and how to scrutinize opportunities.

And the great news is, there's an easy way to capture a lot of the sector's upside, without devoting hour after hour of research into little-known companies.

Even better, you don't have to be obsessed (like me) to capture a good amount of profit in this sector and beat the broader markets, too.

Your Closest Thing to a "Catchall" Small-Cap Sector Bet

[mmpazkzone name="in-story" network="9794" site="307044" id="137008" type="4"]

A great way to save a lot of time while still capturing a lot of the upside in the sector is to target a small-cap ETF like Schwab U.S. Small-Cap ETF (NYSE Arca: SCHA).

The $3.85 billion fund tracks the Dow Jones U.S. Small-Cap Total Stock Market Index, which is made up companies ranging from $48 million to $5.4 billion in market capitalization.

It's diversified across sectors, with a smattering of holdings in healthcare, information technology, and the financial industry. SCHA is also highly liquid, with an average of $17.5 million worth of shares changing hands each day. That makes it highly accessible for anyone with a buy-and-hold strategy.

The ETF is also very inexpensive, with an expense ratio of just 0.08%, or $80 per $10,000 invested. That makes it one of the most efficient ways to position your money to tap into small-cap upside.

And because it's up more than 125% compared with the 101% the S&P 500 managed over the last seven years, SCHA is showing the kind of incremental outperformance that yields market-smashing outperformance over time.

Follow Money Morning on Facebook and Twitter.

About the Author

Sid is the investment community's best-kept secret. Since 2009, he's served at Money Map Press as Director of Research, analyzing thousands of securities and profit opportunities for subscribers. He's an expert in identifying "alpha" potential in a wide variety of industries, but especially the small-cap sector, where he's discovered a pattern of profits that's almost foolproof.