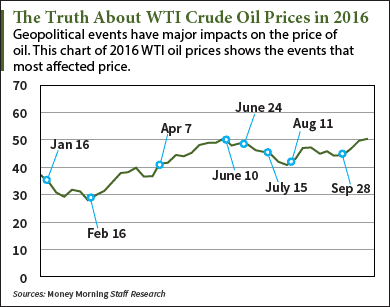

This WTI crude oil price chart shows what really affects oil prices, and it isn't as obvious as you think.

Many observers make the mistake of assuming the price of oil is determined by simple supply and demand, like many other products.

However, Dr. Kent Moors, Money Morning's Global Energy Strategist, explains that "when it comes to the international oil market, geopolitics always trumps market dynamics."

Below, we've put together a chart that shows exactly how important geopolitical events are to the price of oil...

The 2016 WTI Crude Oil Price Chart Shows the Impact of Geopolitics

The chart below shows the WTI crude oil prices for 2016 and how key geopolitical events have moved oil prices. Each of these events correlate to significant changes in the crude oil price.

These are the major geopolitical events identified on the 2016 WTI crude oil chart:

Jan. 16 - International sanctions against Iran were lifted. Between Jan. 15 and Jan. 20, WTI crude oil prices fell by 11.5%.

Jan. 16 - International sanctions against Iran were lifted. Between Jan. 15 and Jan. 20, WTI crude oil prices fell by 11.5%.- Feb. 16 - Russia and Saudi Arabia publicly agree to freeze oil production. WTI crude oil prices jumped 6.7% by the next day.

- April 7 - The struggle for control of Libya's oil reaches its climax. The oil price climbed 12.3% in three days of trading.

- June 10 - Reports that China hit its oil storage capacity. Oil prices fell by 8.8% in one week.

- June 24 - Brexit: The United Kingdom voted to leave the European Union. Crude oil prices dropped 6.4% by the end of the day.

- July 15 - An attempted military coup takes place in Turkey on Friday. By Monday oil fell 3.2%, and by the end of the week it had fallen 6.5%.

- Aug. 11 - Saudi Arabia announces a plan to lead an OPEC production cap. Crude oil prices soared 15% in the week after the announcement.

- Sept. 28 - OPEC agreement to cap oil production. Crude oil rose 9.2% by the end of the week.

These geopolitical events corresponded with some of the biggest shifts in the price of crude oil in 2016. Simply looking at raw numbers to calculate supply and demand isn't enough to understand changes in the price of oil.

And geopolitical events will continue to be the biggest driver of oil prices. Below we've analyzed the next major geopolitical event that will shake up the oil market...

The Next Major Geopolitical Event to Impact Oil Prices in 2016

The members of OPEC are set to meet in Vienna, Austria, on Nov. 30. This could be the biggest OPEC meeting this year. The cartel is trying to finalize a deal to cut oil production after announcing their plans to at the Sept. 28 meeting.

[mmpazkzone name="in-story" network="9794" site="307044" id="137008" type="4"]

As the chart above shows, the last two meetings of OPEC members corresponded to major swings in the price of crude oil. This won't be any different.

If the cartel members agree to cut production, then oil prices could be bolstered and potentially head above $60 a barrel.

However, OPEC is far from having a deal in place. Iraq and Iran are both demanding exemptions to any production cut. If these two sit out, Moors expects the OPEC agreement to fail.

The participation of non-OPEC members is also shaky. Russia, one of the world's top oil-producing countries, originally said it would participate in a production cut. Now Russia is taking a wait-and-see approach.

This is the big geopolitical event of 2016 oil investors need to keep their eyes on. Continue to check back to Money Morning for frequent updates.

Find Out More: Read Our 2017 Oil Price Forecast and Learn How to Beat the Energy Markets