Investors looking to take advantage of rising oil prices have turned to crude oil stocks in 2017. But, even though oil prices have risen 16% since the OPEC deal on Nov. 30, not every oil stock is worth owning.

That's why we've listed the top oil stocks to avoid in 2017...

Investors are right to target oil stocks as crude oil prices rise. The NYSE Arca Oil Index (NYSE Arca: XOI) is an index tracking the performance of oil companies across the industry. XOI is up 9.3% since Nov. 30.

But just because oil stocks have risen doesn't mean they are all good investments.

We'll show you some of the best oil stocks to buy, including one with 47% gains in 2016. Before we get to that, these are the crude oil stocks investors should avoid in 2017...

Crude Oil Stocks That Aren't Worth Owning

Savvy oil investors will avoid buying stock in Big Oil in 2017.

Oil "supermajors," or Big Oil, are massive oil companies largely consolidated in the 1990s. These oil companies handle everything from exploration, production, refining, transportation, and even gas stations.

Specifically, the oil supermajors are ExxonMobil Corp. (NYSE: XOM), BP Plc. (NYSE: BP), Chevron Corp. (NYSE: CVX), Royal Dutch Shell Plc. (NYSE ADR: RDS.A), Conoco Phillips (NYSE: COP), Eni SpA (NYSE ADR: E), and Total SA (NYSE ADR: TOT).

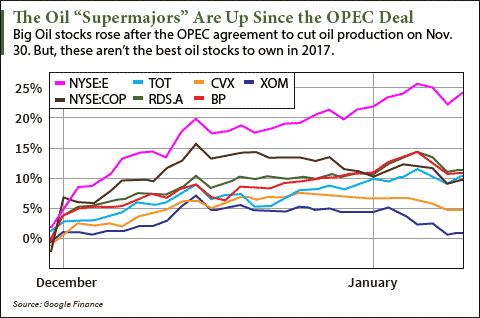

Big Oil is performing well since the OPEC deal was announced on Nov. 30. The chart below shows positive gains for all the supermajor oil company stocks since the end of November. But those gains are misleading...

While these may be some of the biggest and most recognizable oil companies, Money Morning Global Energy Strategist Dr. Kent Moors says investors should avoid these behemoths in 2017.

Moors' analysis comes from 35 years in the oil industry, where he served as an energy policy advisor to countries like the United States and Russia.

Trending Now: My (Bold) 2017 Oil Price Forecast - and Today's Most Profitable Energy Play

The stocks may be up for now, but Moors says oil supermajors are too interested in huge, expensive "megaprojects" that simply drain money.

And Big Oil companies need money to keep paying dividends to shareholders.

You see, one of the biggest perks of owning shares in oil supermajors is their dividend payouts. If Big Oil didn't pay dividends, their stocks would be far less attractive. That's why maintaining their dividends is one of their top priorities.

But, since oil prices have fallen from over $90 a barrel in 2014, the supermajors have shed valuable assets to pay off the debts from their massive projects just to keep their dividends on schedule.

"This may give them the money they need to pay out their dividends in the short run," says Moors, "But in the long term, each one reduces how much money they make in the future."

For instance, Royal Dutch Shell is currently trying to unload $30 billion of its North Sea assets. The Financial Times reports the asset dump "is crucial to Shell's efforts to defend its prized dividends."

Chevron is dumping assets, too.

"Chevron is selling assets, cutting jobs globally, and slashing capital spending to save cash in a bid to preserve its dividend amid weak oil prices," says a Dec. 23 Reuters report. The report details that Chevron just sold $3 billion of its geothermal assets in the Philippines in December 2016.

That's why investors shouldn't be fooled by recent stock price gains. Big Oil companies are making short-term decisions at the expense of their long-term profitably.

If you're investing in oil stocks, you can find better companies that aren't burdened with this kind of debt. Because the supermajors have been selling off assets to raise cash, they've missed out on where the "real money in oil was being made," according to Moors.

That's in places like the tight oil fields of the Permian Basin in Texas. The top three producers there are independent oil companies, not the supermajors.

And as oil prices rise, companies focused on where the "real money" is being made will reward their owners with rising share prices.

We have a few stocks that have done just that, with gains of up to 47% last year alone. These are the best crude oil stocks in 2017...

2 Crude Oil Stocks to Buy in 2017

[mmpazkzone name="in-story" network="9794" site="307044" id="137008" type="4"]

The two American oil companies we're recommending are ready to benefit as American oil production ramps up, and they pay bigger dividends than the oil majors, too.

Magellan Midstream Partners LP (NYSE: MMP) isn't an oil supermajor, but with a market cap of $17.56 billion, it's a major player in the oil industry.

MMP is primarily involved in the transportation and storage of oil and refined oil products. It manages pipelines and storage facilities across the United States.

As oil prices rise, American oil drillers scale up production. And with more production, there's more need for storage and transportation. MMP has already starting adding capacity, beginning with the development of 1.7 million barrels of storage capacity in December.

And because Magellan has an operating margin of 39.69%, it will turn more of its sales into profit. Magellan's operating margin is nearly double the S&P 500 average of 21.07%.

MMP has already been benefiting from higher oil prices. MMP rose 8% since the Nov. 30 OPEC deal, and rose 15% during 2016.

But 2017 is shaping up to be another great year for Magellan. In a Yahoo! Finance survey, 19 financial analysts predicted Magellan's earnings per share (EPS) will grow 8% in 2017.

Magellan also pays a nice dividend yield of 4.12%. That's more than supermajors like Chevron (3.74%), Exxon (3.47%), and ConocoPhillips (1.99%).

MMP currently trades at $73.69 a share.

Plains All American Pipeline LP (NYSE: PAA) has seen even bigger gains.

PAA also transports and stores oil products. As American oil production rises with oil prices, Plains All American Pipeline will be essential to oil drillers who need to transport their products to market. And it's building $15 million worth of new pipeline across North America to meet new demand.

PAA soared 47% during 2016, and it's up 8% since the OPEC agreement on Nov. 30.

And 2017 could be even better for Plains All American. Analysts surveyed by Yahoo! Finance predict EPS will grow 52% in 2017.

PAA also has a dividend yield as high as Royal Dutch Shell, which pays the highest dividend yield of all the oil majors. PAA's dividend yield is 6.84%, the same as Royal Dutch Shell.

PAA currently trades at $32.01.

Editor's Note: Higher oil prices will be good for oil stocks, but prices won't rise if the OPEC deal falls apart. Oil investors will need to pay careful attention to how the OPEC production cut is working. Dr. Kent Moors, Money Morning's Global Energy Strategist, says this is the one reason OPEC's deal might last...