Gold investing 2014 update: Gold prices have had a strong first half in 2014. At the midpoint in July, the yellow metal had gone up 9.2% in value.

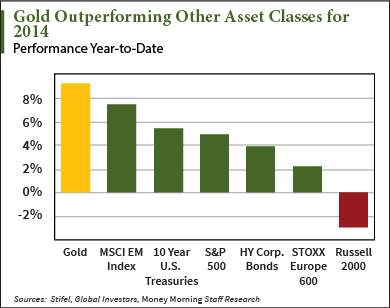

That rise has led gold to be the best performer among major asset classes this year, gaining more than U.S. Treasuries and equities.

According to The Short Side of Long research, in 2014's first quartergold returned over 13% for the rolling three-month period. In comparison, alternative asset classes U.S. equities, U.S. Treasury Long Bond, and GEM equities only returned 0%, 6%, and -7% in the same period.

Gold's outperformance isn't ending anytime soon. Money Morning Resource Specialist Peter Krauth sees more gains on the horizon - which makes now the perfect time for gold investing...

"Gold looks set to head higher," Krauth said last week. "Gold's 50-day moving average recently pushed above the 200-day moving average, completing what's known in technical analysis as a bullish golden cross."

Krauth's referencing a crossover of gold's short-term moving average breaking above its long-term moving average, or "resistance level." The golden cross is indicative of an impending bull market, and the effect is reinforced by high trading volumes.

"Gold is trading around $1,300 which seems to be providing support. Both the 50-day and 200-day moving average prices have acted as a magnet in the gold price forming a bottom," said Krauth.

Krauth also pointed to another bullish signal for gold prices the remainder of the year - he said gold's on an uptick after completing a drawn-out head and shoulders cycle that began in July 2013.

In fact, Krauth sees gold reaching around $1,600 an ounce by early 2015...

"The next target for gold is around the $1,380 level, which it touched but reversed from in mid-March. If it can close above that level and sustain it, the next target will be $1,425 followed by $1,475, and finally around $1,600, a level it may reach late this year or early next."

Much like the first half of 2014, as gold prices rise, gold will continue to outperform - and these recent sector facts and figures make gold investing look even more attractive this year...

Gold Investing 2014: More Strength in These Numbers

In early August, gold futures reached the highest level in six weeks. Futures were also up 1.9% in Q2 - the most recent quarter. According to Bloomberg, gold traders have become the most bullish in seven months.

In July, exchange traded fund (ETF) gold holdings climbed 0.9%, notching their largest monthly gain since 2012 and climbing out of June's four-year low.

U.S. Global Investors CEO and chief investment officer Frank Holmes noted in early August that BullionVault's Gold Investor Demand Index has rebounded from the rise in gold holdings. The Index, which measures western household sentiment towards physical gold, rose to 51.9 from a four-year low of 51.2 in June. BullionVault's customer holdings of gold climbed to 33.03 tons, exceeding the previous peak last March of 32.9 tons.

In July, the World Gold Council (WGC) indicated that gold should continue to outperform in coming months due to the low interest rate environment.

"Volatility appears too low to us and may create an opportunity for investors to buy portfolio protection as a means of prudent and long-term risk management," the WGC stated. "Looking forward, we believe investors can benefit by adding gold as a hedge in their portfolios. In our view, gold can provide much of the same protection as volatility-based vehicles, with the added benefit that gold investment vehicles are usually cheaper, more liquid, accessible, transparent, and without credit. Some investors may see the current low volatility environment as an opportunity to add gold; we consider that, in addition, gold should be seen as a strategic portfolio component."

As gold investing in 2014 looks bright, enrich your portfolio with these two "high quality" junior miners poised to boom...

Related Articles:

The Short Side of Long: Gold's Short vs. Long Term View

U.S. Global Investors: Investor Alert - Managing Expectations