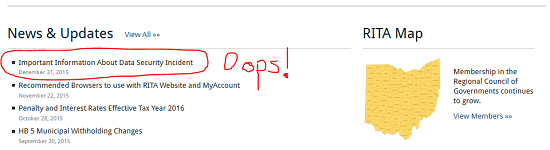

The Regional Income Tax Agency of Ohio (RITA) -- a state municipality-run tax collection service -- rang in the new year by revealing it lost 50,000 taxpayers' personal data:

Even more outrageous is that news of the loss came out on Dec. 31 -- two full months after employees at RITA realized the information went missing.

The documents contained sensitive materials such as names, Social Security numbers, personal incomes, and birth dates.

According to a report released yesterday by a small community news source, Delaware News, RITA admitted that the transition to a new data system is what exposed the breach.

You see, RITA originally kept classified material backed-up on DVDs.

That's right - DVDs.

Mid-transition to an actual computerized data-storing system, a RITA employee noticed that a DVD was missing from the archives. The disc held tax documents from June 2012.

According to Delaware News, RITA representative Amy Arrighi said employees at the agency tried to "physically locate the DVD" after realizing it had gone missing. They did so by checking the agency's main office in Brecksville, Ohio, and by checking "the jewel case, maybe in front and in back of it," during the process.

However, the disc remains lost.

To alleviate fears of identity fraud, RITA has offered those affected a full year of identity protection services and credit monitoring from Experian.

Have you ever been affected by loss of personal data? Tell us on Twitter @moneymorning, or like us on Facebook.

A Tempest in the South China Sea: While getting little attention in the mainstream media, China's territory grab in the South China Sea is making many of its Asian neighbors uneasy and is a direct threat to U.S. influence in the region. Here's an overview of what's been happening, and how it could impact the markets...

Related Articles:

- Delaware News: RITA: No Need to Worry About Missing Tax Info

[mmpazkzone name="end-story-hostage" network="9794" site="307044" id="138536" type="4"]