Sorry, no content matched your criteria.

Featured Story

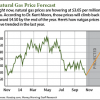

Time to Buy This Natural Gas Stock

Oil prices have tanked since June, with WTI and Brent crude both hitting multi-year lows this month.

But that doesn't mean investors should go running from the energy sector. In fact, this natural gas stock is presenting a major profit opportunity as we look toward the end of 2014.

Oil prices have tanked since June, with WTI and Brent crude both hitting multi-year lows this month.

But that doesn't mean investors should go running from the energy sector. In fact, this natural gas stock is presenting a major profit opportunity as we look toward the end of 2014.