Stock market today, June 9, 2014: The Dow Jones is set to kick off the week after reaching a record high on Friday along with the S&P 500. A positive jobs report and increased support from the European Central Bank factored into the climb.

Here's what you should know to make your Monday profitable:

- The Big Split: This morning, Apple Inc. (Nasdaq: AAPL) will adjust the pricing of its shares when it begins trading. AAPL will engage a seven-for-one stock split. A Friday closing price of $645.57 should now reflect a price of roughly $92 per share. This is the first time that Apple stock has been available for under $100 since early 2009.

- Healthcare M&A Heating Up: In the latest pharma megadeal, Merck & Co. Inc. (NYSE: MRK) announced it would purchase Idenix Pharmaceuticals Inc. (Nasdaq: IDIX) for $24.50 per share, up from the company's Friday closing price of just under $7 per share. The deal values Idenix at approximately $3.85 billion and was approved by both companies' board of directors.

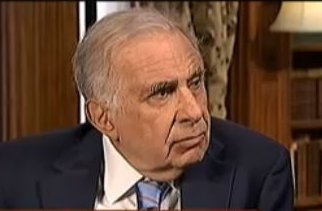

Discount Dollars: Activist investor Carl Icahn announced he purchased a 9.4% stake in Family Dollar Stores Inc. (NYSE: FDO). Shares of the company rose by nearly 10% in after-hours trading on Friday. Icahn, who spent $265.8 million on the stake, said that he will seek changes in the discount retailer's management and strategy. Shares of Family Dollar surged more than 12% in premarket hours this morning.

Discount Dollars: Activist investor Carl Icahn announced he purchased a 9.4% stake in Family Dollar Stores Inc. (NYSE: FDO). Shares of the company rose by nearly 10% in after-hours trading on Friday. Icahn, who spent $265.8 million on the stake, said that he will seek changes in the discount retailer's management and strategy. Shares of Family Dollar surged more than 12% in premarket hours this morning.

- Winner Winner: After two weeks of bidding, Tyson Foods Inc. (NYSE: TSN) emerged as the winner in the Hillshire Brands (NYSE: HSH) stakes. The New York Times reports that Tyson will pay $63 per share, setting Hillshire's valuation at $7.7 billion. Tyson outbid Pilgrim's Pride Corp. (NYSE: PPC) in its pursuit of the company. In addition, the Tyson deal will effectively end Hillshire's deal to purchase Pinnacle Foods (NYSE: PF). Due to the new deal, Pinnacle will receive a $163 million breakup fee.

- Closed on Monday: In observation of Whit Monday, multiple European exchanges will be closed today. There will be no trading in Austria, Switzerland, Denmark, Greece, Iceland, Norway, Cyprus, Hungary, or Ukraine.

Keep reading for some shocking real estate news out of China, today's economic calendar, the top earnings reports on deck, and more...

- Bubble Fallout: There could be a problem in China. According to real estate monitor Soufun.com, real estate transactions plummeted more than 45% year over year in May. According to a report, total land sales in May slipped to 1,767 transactions in 300 Chinese cities. The figure represents a 19% decline from April. China's real estate market has been a growing concern on the international market, and a massive source of the nation's economic growth, despite high vacancy rates around the country.

- Today's Economic Calendar: A quiet schedule features three speeches by members of the Federal Reserve and the TD Ameritrade IMX at 12:30 p.m. EDT.

- Earnings Reports: Stay tuned for earnings reports from Ferrellgas Partners L.P. (NYSE: FGP), Comverse Inc. (Nasdaq: CNSI), Layne Christensen Company (Nasdaq: LAYN), Synergetics USA Inc. (Nasdaq: SURG), and Pep Boys-Manny Moe & Jack (NYSE: PEP).

Full U.S. Economic Calendar June 9, 2014 (NYSE: all times EDT)

- St Louis Federal Reserve Bank President James Bullard speaks at 9:10 a.m. ET

- 4-Week Bill Announcement at 11 a.m.

- 3-Month Bill Auction at 11:30 a.m.

- 6-Month Bill Auction at 11:30 a.m.

- TD Ameritrade IMX at 12:30 p.m.

- Federal Reserve Gov. Daniel Tarullo speaks at 12:45 p.m.

- Boston Federal Reserve Bank President Eric Rosengren speaks at 1:30 p.m.

Get ready. There's more trouble ahead for home buyers, home builders, and especially homeowners who took out home-equity lines of credit before the housing crisis. That's why we're short a bunch of housing-related plays at Money Morning Capital Wave Strategist Shah Gilani's Short-Side Fortunes newsletter. We will be patient - our trades aren't going to pop overnight - but when the roof comes down, our house will be rockin'...

About the Author

Garrett Baldwin is a globally recognized research economist, financial writer, consultant, and political risk analyst with decades of trading experience and degrees in economics, cybersecurity, and business from Johns Hopkins, Purdue, Indiana University, and Northwestern.