Data revealed last week showed a job market that's careening down a steep street with no breaks. Yet investors shrugged off concerns and t stock market actually ended the week up 1.5% due to that rockin' Monday on the first day of the month.

That's because there is growing speculation that the Democrats are plotting a surprise stimulus in the run up to November's mid-term elections.

Let me explain...

Stocks fell with all the forcefulness of cotton balls tumbling onto kitten fur on Thursday and Friday as investors shrugged off dire news regarding unemployment. While the unemployment rate was flat with the prior month, the main lesson from the report was that people are withdrawing from the labor force at an alarming rate.

It would make sense that stocks would feel grumpy about this state of affairs because it suggests that U.S. economic growth is sputtering. But Mr. Market has a twisted way of looking at the world, as you might have guessed by now.

Mr. Market, you see, loves free money. And what he sees in weak economic numbers is the likelihood that the government will keep interest rates at 300-year lows, and most likely begin some sort of new stimulus program in the next month or two. And if there is one thing that Mr. Market likes as much as free money in the form of interest rates as close to zero as possible, it's more fiscal stimulus.

European stocks continue to dominate as they recover from their springtime disaster - as have my recommended bond funds. One worrisome matter, though, is that total volume also has been waning, a sign of investor complacency - not to mention fatigue - normally seen near market tops. Trading activity in the PowerShares Nasdaq QQQ Trust (NYSE: QQQQ) has dropped to levels not seen since the Christmas and Thanksgiving holidays. It's even dropped below the levels seen around the July Fourth weekend.

Stocks probably still have another week or two of life in them, at least, so this flattish stretch will only amount to a rest stop on the way toward a test of May highs. After that, by the end of this month, it may be time for darkness to descend.

Mining and retail stocks have helped lead the way higher with my recommended Market Vectors Gold Miners (NYSE: GDX) exchange-trade fund (ETF) perking up to gain 2.7%.

There is plenty to be happy about this week once you get past the gloom of the jobs market. For one, the Gulf of Mexico oil spill is finally coming to an end. BP successfully conducted the "static kill" operation on the damaged well while the government reported that just 26% of the spilt oil remains -- the rest has been cleaned, burned, evaporated, or biodegraded. Oil is, after all, a natural substance.

And there are signs Washington is pulling its fiscal austerity punches as the mid-term elections approach: The Senate passed a $26 billion jobs bill to keep state and local government from cutting jobs. Next up will be debate on extensions to the Bush tax cuts. If they are all expanded, expect a 1,000-point rally in the Dow.

SUMMER SURPRISE?

A big story swirling around the rumor mill is that President Obama, acutely aware of the dire predictions that his party is poised to lose control of the Congress to the Republicans, is about to launch a surprise attack this month or next to turn the tide.

With the Democrats lacking a filibuster proof majority in the Senate, his options for pushing through legislation to address concerns about the economy are limited. But there is one option: Channeling more money to the housing market via government-controlled Fannie Mae (NYSE: FNMA) and Freddie Mac (OTC: FMCC).

Specifically, word has it that Obama could order the lenders to forgive a portion of the mortgage debt owed by citizens whose mortgages are larger than the depressed value of their homes. The key date to mark on your calendars is Aug. 17, which is when the Treasury Department holds a highly anticipated meeting to discuss the future of Fannie and Freddie.

Wall Street analysts are already beginning to anticipate action on this front, according to a Reuters report. Mizuho Securities pointed to the government's recent approval of the purchase of a sub-prime auto lender by General Motors as a way to pump up car sales. The brokers said that increased the risk "the government will use its control of Fannie and Freddie to increase consumer cash flow and juice the economy again."

Goldman Sachs Group Inc. (NYSE: GS), meanwhile, said that policies for Fannie and Freddie "are one of a dwindling number of policy levers the administration has left to pull."

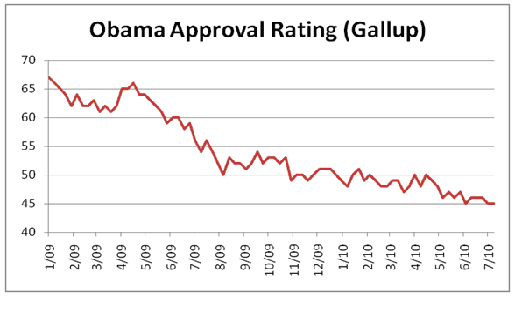

The motivation is there. The economy has hit a wall as its growth rate slows. Unemployment, especially long-term unemployment, remains far too high. And Obama's approval ratings have plunged to just 45% according to the latest Gallup poll -- well under the high of 69% enjoyed in the days after his inauguration.

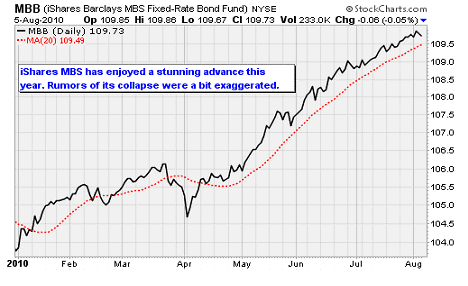

If the administration were to try to pull this off, it would obviously be very popular with people facing foreclosure, and as a massive new stimulus package would goose the stock market. However it could be a big negative for mortgage bond holders, as they might be the ones forced to take a haircut.

No one can say with any certainty how the program would be financed, but the money has to come from somewhere. It could theoretically cause the net asset value of an ETF such as iShares Barclays MBS Bond Fund (NYSE: MBB), now trading around $109, to sink all the way back to par at $100. It's hard to imagine that the government would let this happen, but I'm just throwing out the possibility.

Most of our bond funds in Yield Seeker are either primarily corporates and foreign sovereigns, like Barclays Intermediate Credit (NYSE: CIU), or entirely overseas sovereigns, like PowerShares Emerging Market Sovereign Debt (NYSE: PCY), or preferreds, in the case of PowerShares Preferred (NYSE: PGX). Only Vanguard Total Bond Market (NYSE: BND) has a small amount of Ginnie Maes for sure, and could have some Fannie and Freddie debt.

We live in very unusual times, and nothing that the government would do at this point would shock me. Few people ever thought the Federal Reserve would buy mortgage bonds, and yet it did so for more than a year. Then it was widely believed that the mortgage bond market would fall apart when the Fed stopped buying them in March, and yet MBB is up $4 since then, a huge amount.

I recommended MBB for a long time during the turbulent spans of 2008 and 2009, and then moved on to the more lucrative CIU, PCY and PGX this year. Keep holding them, but beware of the coming debate.

ECON WEEK IN REVIEW

Monday: The ISM Manufacturing Index slipped less than expected, eurozone purchasing managers indices increased more than expected, and two of Europe's biggest banks reported strong earnings as credit costs declined.

Tuesday: Pending home sales for June fell 2.6% month over month. That was less than the 5% decrease that the consensus expected, which would normally be good for a jump in prices. But this time it turns out that the whales had expected an increase, so this fell into the worse-than-expected category. Factory orders in June also fell by a relatively hefty 1.2%, and orders for May were revised lower as well.

Personal income, spending and core consumption were all logged as flat in June, which was worse than the slight increase that was expected.

Wednesday: The ADP Employment report reported a stronger than expected job gain, pushing up hopes for Friday's important July payrolls report. The ISM Service Index also lifted more than expected and signaled that the services sector is now adding jobs for the first time since the recession began.

Thursday: Initial weekly jobless claims increased more than expected at 479,000 versus the consensus estimate of 455,000.

Friday: The July employment situation came in under already lowered expectations. Payrolls were cut by 131,000 -- building on June's downwardly revised loss of 221,000. The firing of temporary government Census workers again were the main drag on jobs for the month. But there was some good news too: The factory sector has added jobs every month so far this year; we haven't seen a seven-month positive streak in manufacturing since 1998. Given the high multiplier associated with manufacturing, this is a rare bit of good news in an otherwise bleak job market.

THE WEEK AHEAD

Monday: No major economic releases.

Tuesday: The Federal Reserve concludes its interest rate policy meeting. Look for indications the Fed will start a new round of quantitative easing as its portfolio of Treasury and mortgage bonds bought over the past year and a half start to mature.

Wednesday: Retailer Macy's Inc. (NYSE: M) reports quarterly results.

Thursday: Initial weekly jobless claims will be reported.

Friday: Retailer J.C. Penney Co. Inc. (NYSE: JCP) reports quarterly results. Consumer sentiment, retail sales, and the Consumer Price Index will be reported.

[Editor's Note: Money Morning Contributing Writer Jon D. Markman has a unique view of both the world economy and the global financial markets. With uncertainty the watchword and volatility the norm in today's markets, low-risk/high-profit investments will be tougher than ever to find.

It will take a seasoned guide to uncover those opportunities.

Markman is that guide.

In the face of what's been the toughest market for investors since the Great Depression, it's time to sweep away the uncertainty and eradicate the worry. That's why investors subscribe to Markman's Strategic Advantage newsletter every week: He can see opportunity when other investors are blinded by worry.

Subscribe to Strategic Advantage and hire Markman to be your guide. For more information, please click here.]

News and Related Story Links:

- Money Morning:

Why Second Quarter Earnings Haven't Spurred a Stock Market Rally - Money Morning:

We Want to Hear From You: Are You Preparing for a Double-Dip Recession? - Money Morning:

Wall Street's Mood Shift Is Signaling a Profit-Making Price Push Ahead - Money Morning:

Slight Job Gains Won't Shrink the High Unemployment Rate - Money Morning:

Strong Second-Quarter Earnings Can't Keep the Bears at Bay