Stocks clicked around the flat line much of the past week until the tumblers of the lock finally fell into place and prices were freed to go higher on Thursday and Friday.

The Standard & Poor's 500 Index quietly gained 1.2% over the week to close at a new two-year high, while the Nasdaq Composite Index rose 1.7% to a three-year high and the Russell 2000 small-caps rose 2.7%.

Although the action was a little gnarly at times, take a step back and check out the weekly five-year chart of the S&P 500 above. I've talked for years about the importance of the 200-week average, which is the red line. It tends to serve well as the barrier between bull and bear cycles.

The last bear market only really got serious once the S&P 500 plunged down through the 200-week line in July 2008, having first touched there briefly in March of that year. Then the S&P 500 was repelled at the 200-week average in April this year. And finally that the line acted like an electric fence as recently as early November.

Well, after past two weeks we're back above the line. So it really is incumbent upon bulls to stay up here and not dunk under the line again, which is now at 1,188. We could see a lot of skirmishing back and forth before anything is really settled. But once bulls manage to maintain three or four solid weeks above the line, we can probably look back over our shoulders at the 1,175 level as an area that may not ever be visited again.

In 2004, bulls and bears spent about ten months battling around the 200-week average -- spending about six weeks above, then dipping to it; then rising for several weeks before doing that once more, and then twice more. But finally bulls managed to yank back control right at the 1,175 level in December that year, ironically enough, and were off to the races for the next three years.

It's really a dividing line between world views as much as it is simply a mathematical average. Will world governments' attempt to stimulate growth through monetary and fiscal spending prod companies and consumers to succeed, or will the forces of entropy overwhelm their efforts?

Metaphorically, that is the battle that we are witnessing in studying this chart. Keep an eye on it.

Bank On It

The most successful stocks last week were banks and financial services, led by a stirring advance of Bank of America Corp. (NYSE: BAC), as shown above. Banks are getting back in a groove now that 2011 economic growth assessments are being revised upward due to the titanic stimulus package embedded in President Obama's tax compromise.

Still, the banks have disappointed us so many times we need to make sure not to get overly excited.

Why get excited at all?

Well you know it's been a long time since this happened but way back in olden times you needed banks and semiconductors at the front of the parade to make sure that a bull market was legit. The bulls need banks to lead just like the Miami Heat need LeBron James to lead. They're a confidence booster, they're the funding agents, they're the artillery and ammo and guts of any major rally.

If the banks will resume their leadership role by earning bigger profits from lending than handouts, the rally can go places. If not, well, it's back to the spin cycle. Watch BAC and other brokerages like a hawk. For fundbuyers, my preferred pony in this race is SPDR KBW Capital Markets exchange-traded fund (NYSE: KCE).

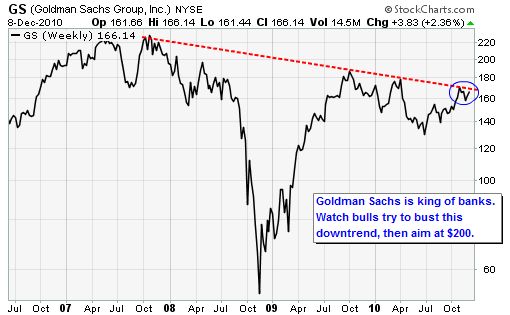

A key reason for the improvement in banks was a comment from Goldman Sachs Group Inc. (NYSE: GS) that noted that several are making plans to return capital to shareholders via dividends and share repurchases. Among the best performers were the super-regionals that are still deeply discounted, such as Zion Corp. (Nasdaq: ZION), Regions Financial (NYSE: RF) and Fifth Third Bancorp. (Nasdaq: FITB), all up 5% to 6.5%.

Large brokers such as Goldman Sachs and Morgan Stanley (NYSE: MS) rose 2% to 3% on that comment. This group is the most hated in America because of its poor judgment in the mid-2000s boom time and the resultant government bailouts. With that distaste comes low valuation, so once these companies can claw their way out of the doghouse they can lead the market.

So while you are watching BAC for its importance to banks, watch GS for its importance to brokerages. It is a ringleader. It has been hemmed in by a heavy downtrend since October 2007. A weekly close for GS above $172, and then $180, would be a strong sign that this entire sector is on track to be rehabilitated.

Meanwhile, the most unusual change last week came in the price of U.S. Treasury bonds, which plunged again as market participants came to believe that the White House tax compromise might be effective at stimulating the economy.

In the twisted world of bonds, that's a bad thing because it causes inflation, which is a debt killer. Of course the White House effort would also lead to a need to sell a lot more bonds to finance the government in lieu of taxes, which would further lead to lower prices.

Moreover, the credit ratings agencies Moody's Corp. (NYSE: MCO) and Fitch Ratings Inc. both commented that the United States needed to consolidate its finances -- i.e. bring revenue in line with expenditures -- in order to maintain its AAA sovereign rating.

This is not as much of a negative as you might expect. Because there are a lot of pension fund managers that need to buy long-term assets like bonds to match against their long-term liabilities, they are shifting over to corporate bonds. And that money is helping the financial situations of major industrial companies, including semiconductor makers and chip equipment makers.

Case in point: One of the most successful chip makers in the world has been tiny Atmel Corp. (Nasdaq: ATML), which was recommended in my portfolio in January this year. It's up 150% since. Atmel makes integrated circuits for a wide range of applications including touch screens on mobile devices, remote keyless entry devices for cars, and temperature sensors in washing machines. These are the little brains that make all of our cool electronics work, and will be an important part of the recovery. To participate in the recovery via chips, the best fund to own is SPDR S&P Semiconductor ETF (NYSE: XSD).

ONE FOR THE ROAD

Goldman Sachs was out last week with a positive view of the next year. A lot of GS equity research is terrible, but their big-picture stuff tends to be good.

Let me save you from reading a 21-page report. The upshot is that economist Jan Hatzius believes gross domestic product (GDP) growth will clock in at 2.7% in 2011 and 3.6% in 2012. Those are both below the long-term trend of 4%, but this is still considered a rosy picture.

His reasons:

1) Solid if unspectacular, growth in consumption.

2) Moderate gains in industrial activity.

3) Anemic recovery in housing.

4) Modest improvement in unemployment.

5) Persistently low core inflation.

More specifically, GS Research sees the S&P 500 rising to 1,450 by the end of next year, representing 21% total return. That would come from equal parts 12% earnings growth (to $94 for S&P 500 companies in 2011 and $104 in 2012) and price/earnings (P/E) multiple expansion to 13.9-times. The team sees a large "investable gap" between many portfolio managers' perception of investment risk and their constructive outlook. The best way to pursue this line of reasoning is to buy profitable, high-growth, cyclicals and shun consumer staples, health care and utilities.

The Week Ahead

Monday: No major economic releases scheduled. Earnings: Spartech Corp. (NYSE: SEH), BRT Realty Trust (NYSE: BRT).

Tuesday: NFIB Small Business Index; ICSC-Goldman Chain Store index; Producer Price Index; and retail sales. And then at 2:15 p.m. ET will come the results of the latest meeting of the Federal Reserve's rate-setting committee. At 4:30 p.m. comes the API crude oil inventories report, and at 5 p.m., the ABC Consumer Comfort report. Earnings: Best Buy Co. (NYSE: BBY), Fact Set Research Systems Inc. (NYSE: FDS), Mechel OAO (NYSE ADR: MTL), Sanderson Farms Inc. (Nasdaq: SAFM), Hovanian Enterprises Inc. (NYSE: HOV).

Wednesday: Before the bell come the MBA Mortgage Purchase Applications report; consumer price index; Empire State manufacturing; a report on industrial production and capacity utilization. Then at 10::30 a.m., the NAHB Housing Market Index, and the DOE crude oil inventories report. Earnings: Joy Global Inc. (Nasdaq: JOYG).

Thursday: Before the bell come reports on housing starts and building permits, and jobless claims. At 10 a.m., the Philadelphia Fed reports on activity in its region, and at 10:30 comes the EIA natural gas inventories report. Earnings: Actuant Corp. (NYSE: ATU), Discover Financial Services (NYSE: DFS), FedEx Corp. (NYSE: FDX), General Mills Inc. (NYSE: GIS), Pier 1 Imports Inc. (NYSE: PIR), Williams Pipeline Partners LP (NYSE: WPZ), Oracle Corp. (Nasdaq: ORCL), Research in Motion Ltd. (Nasdaq: RIMM), Quicksilver Inc. (NYSE: ZQK).

Friday: Leading Indicators.

[Editor's Note: Money Morning Contributing Writer Jon D. Markman has a unique view of both the world economy and the global financial markets. With uncertainty the watchword and volatility the norm in today's markets, low-risk/high-profit investments will be tougher than ever to find.

It will take a seasoned guide to uncover those opportunities.

Markman is that guide.

In the face of what's been the toughest market for investors since the Great Depression, it's time to sweep away the uncertainty and eradicate the worry. That's why investors subscribe to Markman's Strategic Advantage newsletter every week: He can see opportunity when other investors are blinded by worry.

Subscribe to Strategic Advantage and hire Markman to be your guide. For more information, please click here.]

News & Related Story Links:

- Money Morning:

Chilly Winter Will Offer Hot Stock Buys As Market's Bull Run Still Has Legs - Money Morning:

Are Mid-Cap Stocks Set to Lead the Market Higher? - Money Morning:

Buy, Sell or Hold: Joy Global Inc. (NYSE: JOYG) Could Be a Gold Mine for Investors - Money Morning:

Buy, Sell or Hold: General Mills Inc. (NYSE: GIS) is a Wholesome Company with Profit Coming Down the Pipeline