Americans' dreams of the "golden years" have increasingly become tarnished by harsh financial realities.

Indeed, a new survey of U.S. employees and retirees presents a disturbing portrait of the retirement crisis - among both current workers and retirees.

Longer life expectancies, stagnant wages and the uncertainty surrounding Social Security benefits have made it harder than ever to save enough to live comfortably in retirement.

The 23rd annual Retirement Confidence Survey by the non-profit, non-partisan Employee Benefit Research Institute - which polls both workers and retirees -found only 13% of American workers and 18% of retirees are "very confident" they have or will have enough money to retire comfortably. And 49% of workers said they are either "not at all" or "not too" confident they will have enough money to enjoy retirement.

"Not only do workers lack confidence about their ability to secure a financially secure retirement overall, but more and more, they lack confidence in their ability to pay for medical expenses and even basic expenses such as food, clothing and shelter," Jack VanDerhi, research director at EBRI, said in a statement.

These statistics show just how difficult it has become for Americans to save enough for retirement.

The Frightening American Retirement Crisis

Lack of savings:

- 57% of workers have $25,000 or less in savings and investments, excluding the value of their primary homes and benefit plans, and 28% of workers have less than $1,000 saved.

- Among retirees, 55% have $25,000 or less in savings and investments, and 31% have less than $1,000.

- Just 50% of workers and 52% of retirees said they could come up with $2,000 if an emergency or unexpected need occurred within the next month, while 28% of both groups said they probably or definitely could not produce $2,000, if needed.

Inability to afford basic living expenses:

- The percentage of workers saying they're "not too" or "not at all" confident in their ability to pay for basic retirement expenses is 29%, while 52% are "not too" or "not at all" confident they have enough money for basic post-retirement medical expenses and 62% are "not too" or "not at all" confident they can pay for long-term care expenses.

- Among retirees, 23% are "not at all" or "not too" confident they have enough money for basic expenses, 30% are "not too" confident or "not at all" confident they can pay for medical expenses, and 54% are "not too" or "not at all" confident they can pay for long-term care expenses.

- Because of more immediate financial concerns, just 2% of workers and 4% of retirees name saving or planning for retirement as the most important financial issue in their lives.

Reasons behind delaying retirement:

- The top five reasons workers gave for planning to delay retirement were the poor economy (25%), lack of faith in Social Security or government (21%), inadequate finances or inability to afford to retire (21%), a desire to make sure they have enough money to retire comfortably (16%) and change in job situation (13%).

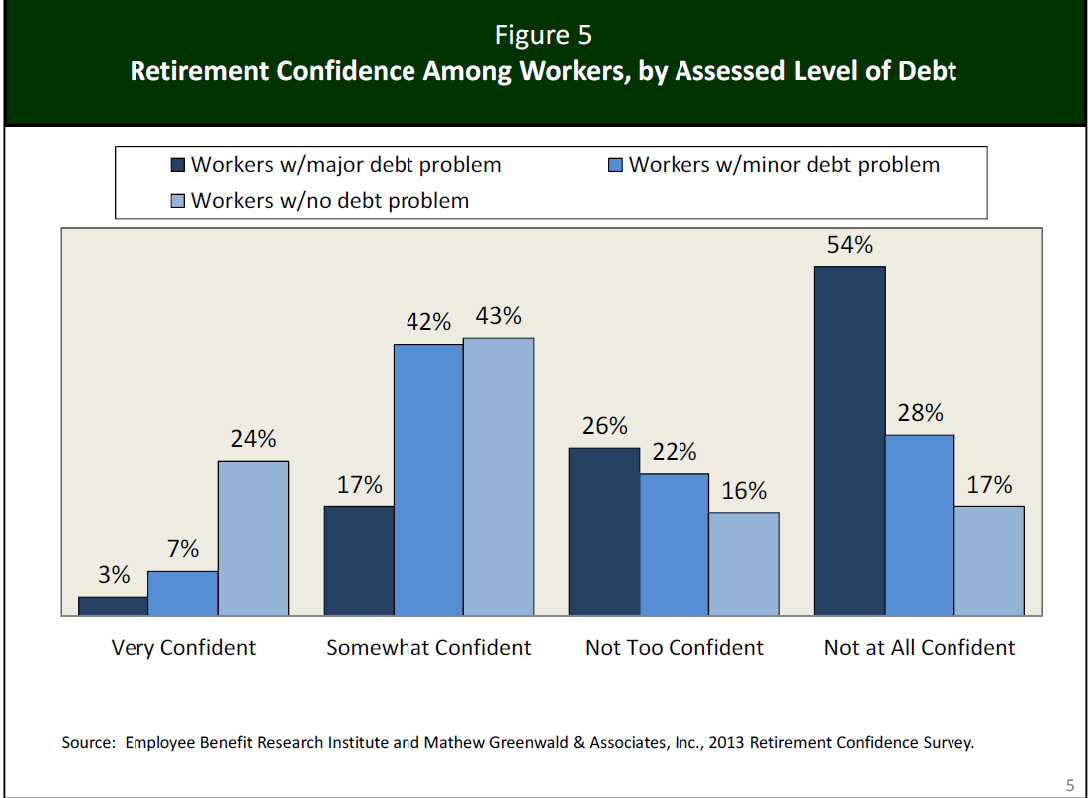

- Debt also weighs heavily on Americans when they consider their retirement, as 55% of workers and 39% of retirees reported having a problem with their level of debt.

- Almost half, 47%, of current retirees were forced to retire early, mainly because of disabilities, poor health, the loss of a job and the inability to get a new one.

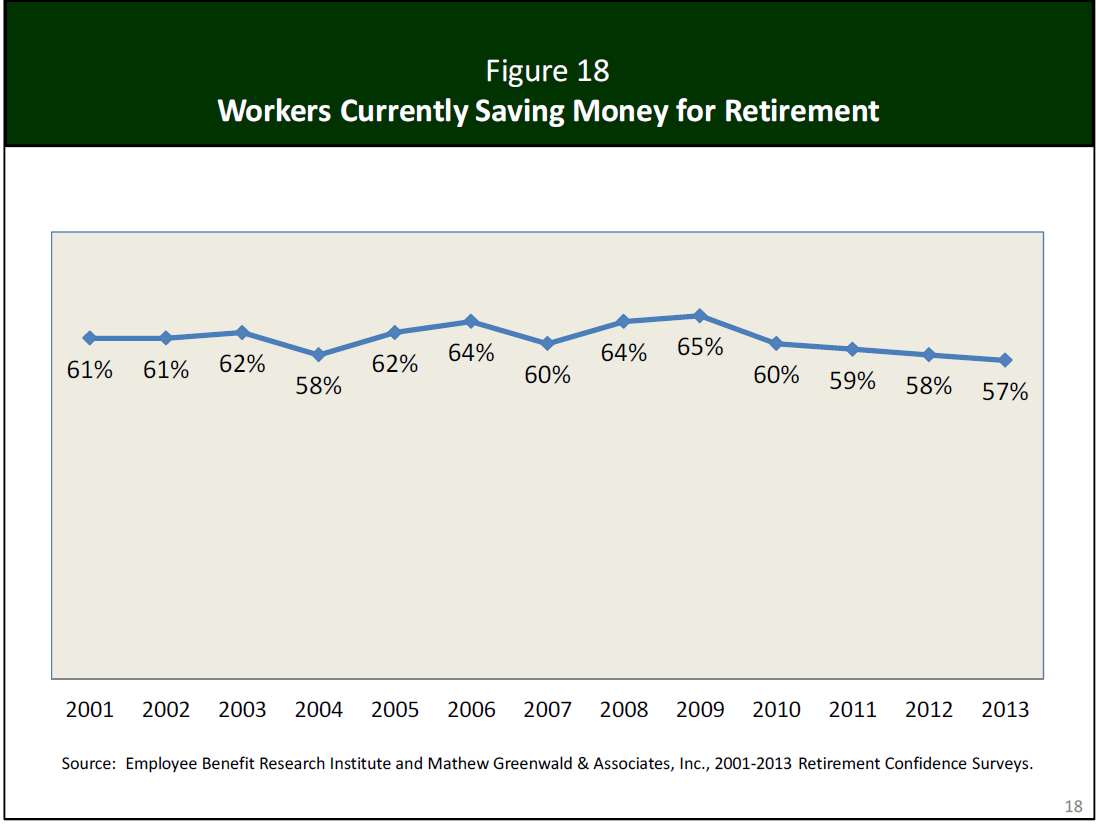

- Finally, the amount of workers saving for retirement is at its lowest level since 2001.

[Editor's Note: We're putting together a group of people interested in seeing investments that could hand you monthly, weekly and sometimes, daily returns far greater than you can normally make in the market. Typically, this information costs over $27,500 a year to see. But for reasons you'll discover here, we're giving members of this group an opportunity to see it for just $99. There are only a couple of days left for this offer - read the details here.]

Related Articles and News:

- Money Morning:

How Millions of Americans Are Ruining Their Retirement Savings - Money Morning:

How to Find the Best Sources of Retirement Income - Money Morning:

The Safe, Sure Road to a Golden Retirement - Employee Benefit Research Institute:

2013 Retirement Confidence Survey

[epom]