Oh, the law of unintended consequences and the opportunities it brings.

Thanks to the new standard of Keynesian Abenomics, the Nikkei has blasted 47% higher since November. The Yen has lost about 25% against the U.S. dollar in the same time.

While we don't know what the future will hold for these trends, there's something else going on that will not fade quickly: The weak Yen has made imports to Japan a whole lot more expensive...including energy.

Since the Fukishima-Daiichi nuclear disasters in March 2011, Japan has compensated for its offline nuclear power plants by importing copious amounts of Liquefied Natural Gas (LNG). It was the fastest way to keep electricity output stable in an economy reliant on non-domestic energy suppliers.

Energy now accounts for about one-third of all Japanese imports. In March, those imports were valued at $17 billion Yen for the month. The following month, that number hit $22 billion.

Not surprisingly, in April Japan set a new record for spending on LNG imports. To be sure, a foundering Yen has contributed greatly. But this nation built on exports needs to keep the lights on. If all of Japan's nuclear plants were up and running at capacity, they'd supply 30% of the country's electricity needs. Instead, they account for just 2%.

And Japan is not alone.

Now its neighbor South Korea, also an export powerhouse, is about to see its demand for LNG soar as well.

A scandal involving falsified certifications for parts has recently caused two of South Korea's nuclear reactors to be taken offline. That brings the total now to 10 reactors out of 23 that are down, thanks to a combination of maintenance, malfunctions and this emerging certification scandal. It could take as long as four months before the scandal-ridden reactors are restarted.

According to a recent report by Platts, "the lost nuclear power will need to be replaced with increased LNG imports and oil burn."

Already, South Korea is the world's No. 2 LNG importer after Japan. Korea Gas Corp. has indicated it will be increasing stocks to 70% of capacity from its current level of 60%.

Such strong and growing demand for LNG begs the question: "Where will it all come from?"

The answer may be just beneath us.

North American Supply

Thanks to the technological innovation that is "fracking" shale gas, North America is dealing with a supply glut. That has weighed on natural gas prices in this part of the world, keeping them at multi-year lows, currently trading at $4 per million cubic feet (Mcf).

In contrast, Asian spot LNG prices have held around $14 per Mcf, and South Korean demand could well push them to the $15 - $16 per Mcf range. Europeans are paying about $10-$11 per Mcf.

That's a massive arbitrage opportunity.

Bloomberg recently reported that "North America will provide 40% of new supplies to 2018 through the development of light, tight, oil and oil sands, while the contribution from the Organization of Petroleum Exporting Countries (OPEC) will slip to 30%, according to the International Energy Agency."

It's no secret North America has been in the midst of a natural gas revolution. The technological advancement of fracking is causing nothing less than a full-on shale boom.

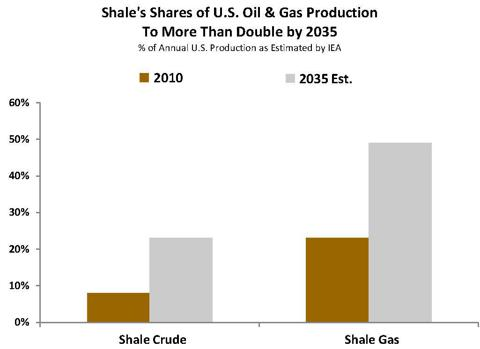

According to the International Energy Agency (IEA), shale's share of U.S. oil & gas production will soar over the next 20 years. By 2035, the agency expects as much as 25% of U.S. oil and 50% of U.S. gas production will come from this one source alone.

Exploration, drilling and production costs are coming down as efficiencies are gained. And this phenomenon will accelerate the rate at which supply hits the market.

LNG Energy: Picks & Shovels Players

The U.S. Department of Energy (DOE) has recently issued a second permit to export LNG. The first went to Cheniere Energy Inc. (NYSE:LNG) to build and operate the Sabine Pass terminal in Louisiana. The most recent one was granted to Freeport LNG, whose terminal is on the Texas Gulf Coast.

Both of these projects are several years from their first exports, but many expect the DOE to award several more of these permits as U.S. gas production continues to grow.

Of course, there are costs involved in liquefying the gas and shipping it around the world. But the price difference is so drastic, the arbitrage opportunity to convert and transport gas from where it's cheap and abundant to where it's expensive and limited has become overwhelming.

Once the gas is extracted, it needs to be moved. If the ultimate consumer is across an ocean, the most efficient way to get it there is by sea. But first it needs to get to port, then be liquefied, transported, and re-gasified at its destination.

Where exceptional potential exists is with those companies that design and build LNG import/export terminals, as well as the equipment to transport the gas or build the tanks to convert it to liquid and store it. And the operators and owners of LNG ships, liquefaction, and re-gasification facilities also look like enticing investment opportunities.

Here are a few that may be worthy of further review.

Fluor Corporation (NYSE:FLR) has its headquarters in Texas, but deals worldwide. FLR's Oil and Gas Segment offers design, engineering, procurement, building and project management to upstream oil and gas producers and downstream refiners.

The Oil & Gas Segment also counts pipelines, chemicals and petrochemicals industries as its clientele. Offshore production facilities and Canadian oil sands both offer FLR significant upside.

Oil & Gas accounts for 35% of revenues, and the company currently trades at a P/E of 22, but projected earnings forecast a forward P/E at an enticing 14, and it yields 1% on its dividend.

Chicago Bridge & Iron (NYSE:CBI) Based in the Netherlands, CBI is an energy infrastructure company which designs, procures, and builds projects for the energy, petrochemical, and natural resources industries worldwide.

Its Steel Plate Structures segment deals with projects for above-ground and elevated storage tanks, LNG tanks, pressure vessels, and so on. The Project Engineering and Construction segment deals with upstream and downstream energy infrastructure, such as LNG liquefaction and re-gasification terminals, gas processing plants, refinery units and petrochemical complexes.

CBI saw $2.3 billion in revenue for Q1 2013, up 87% year over year, due in part to an acquisition. Its current P/E is a bit rich at 22, but its forward P/E is an attractive 12.1. Oh, and Warren Buffet's Berkshire Hathaway recently bought 6.5 million shares, making it one of their largest new portfolio additions.

StealthGas Inc. (Nasdaq: GASS) is a smaller player with a $200 million market cap. From its headquarters in Athens, Greece, GASS provides seaborne transportation to liquefied petroleum gas (LPG) and oil producers, refiners, users and traders worldwide.

They carry a number of liquefied petroleum gas products, as well as refined petroleum products like gasoline, diesel, fuel oil, and jet fuel using their fleet of 33 LPG carriers, three product tankers, and one Aframax crude oil tanker. While paying no dividend, the shares are cheap, trading for a current P/E of just 7.5. I also like the fact that large gas carriers increased rates by 28% in late May.

All of these companies stand to benefit from strong North American natural gas production. The Department of Energy appears to be getting serious about approving a growing number of LNG export projects.

That's paving the way for America's abundant supply of natural gas to reach consumers starving for this energy, and willing to pay a big premium for it.

Related Articles and News:

- Money Morning:

Water Resources Dry Up, Opportunities Arise - Money Morning:

2013 Gold Price Forecast: Expect Gold to Deliver Another Record-Setting Year - Money Morning:

Forget the Punch Bowl, With QE3 Ben's Party is Open Bar - Money Morning:

Seven Ways to Tell if Your Gold is Counterfeit