In the spring of 2012, JPMorgan Chase & Co.'s (NYSE: JPM) not-so-rogue trader, Bruno Iksil, better known as the London Whale, made a series of derivatives trades on credit default swaps that only appeared to be unauthorized.

In reality, those trades were just one side of JPMorgan betting against the other in a doom struck hedging strategy.

We're talking about trades so big they made waves across a $10 trillion market.

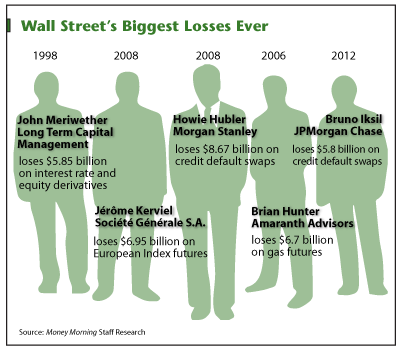

The London Whale lost at least $5.8 billion - perhaps as much as $6.2 billion - on those bets, and it's possible that the losses will head north from there.

As hard as it may be to believe, for his part The London Whale doesn't seem to have done anything illegal. Indeed, Bruno Iksil hasn't been charged with any wrongdoing.

In fact, the Whale is singing like a canary, cooperating fully with U.S. investigators.

London Whale to London Snitch

What appears to be happening is that two of Iksil's colleagues, Javier Martin-Artajo and Julien Grout, are being charged on grounds that they conspired to hide the scope of Iksil's losses.

Martin-Artajo was in charge of a team that made highly speculative trades on credit default swaps, and Grout was responsible for recording the daily values of the positions. In a surprising turn, The Whale has supplied investigators with tantalizing email communications which appear to show that he urged restraint and advocated for proper valuation of the instruments he was handling.

So was Bruno Iksil, the London Whale himself, just the wheelman in these proceedings?

Martin-Artajo and Grout are charged with wire fraud and making false filings with the SEC.

Here again we have the mythical "serious charges" that the SEC and Justice Department like to talk about. But Martin-Artajo, Grout, and perhaps Iksil himself all have the misfortune of being expendable.

As we've seen with all the Justice Department's "investigations," it's not the top-ranking Jamie Dimons who end up falling on their swords, but those in the middling ranks.

In fact, the allegations hint at some tremendous pressure being exerted on the little fish, as Martin-Artajo, Grout, and Iksil were urged to "show smaller and smaller" losses. JPMorgan dramatically understated these losses to begin with, and then they rocketed from a few hundred million dollars up to around $6 billion.

Such is the word from on high, and such are the forces that eventually break markets.

More Dangerous Than They Seem

Very often, news of these huge trades netting huge losses seems to us to be abstract. There exists a (mistaken) sense that this happens so very far above our heads that it has no real effect on individual investors.

After news breaks of another big scandal on Wall Street, regulators vow action... bankers deny responsibility... risk to the system...

Then we shrug it off and get back to our lives, albeit with that much less faith in the system.

But the impact of these scandals in reality hit far closer to home...

Whenever Wall Street undergoes these world-scorching periods of Götterdämmerung, wherein impossibly huge sums are lost and hand-wringing goes into overdrive, there is serious fallout for "small" investors; you know, anyone playing with less than a $97 billion bankroll.

One immediate effect would be for anyone who happens to be holding any of the 3.77 billion shares that JPMorgan has outstanding. News of the London Whale's shenanigans sent shares of JPM tumbling, shedding nearly 10% of the share price in hours.

If you haven't hedged your portfolio against that kind of risk, if it's not risk-balanced properly, you're in a bit of trouble there.

That 10% is not an insignificant loss. In fact, it's this very loss that is driving a class-action lawsuit against JPMorgan and such principals as CEO Jamie Dimon, Ina Drew (chief of the trading unit where Iksil made his mega-trades), and Doug Braunstein.

But there's another, more insidious effect that these games have on individual investors. Ina Drew must have been fully aware that her people were taking up positions that were, in essence, counter to investors at the same firm. Javier Martin-Artajo knew the full extent of the Whale's losses.

The markets work best with maximum transparency and when good information prevails. But JPMorgan's actions run counter to this, in effect undermining the integrity of the entire market. In that sense, anyone who had anything in the market was adversely affected by these activities.

JPMorgan was operating on a different level than the rest of us, but that doesn't mean they're not just scam artists at heart. Click here, and make sure no one's got their eye on you for a mark.