With the government shutdown upon us and the debt ceiling deadline approaching, investors should brace for some upcoming market rough patches.

But smart dividend investing will ease the pain. That's because dividend payments are a fairly predictable cash-flow generator for investors.

Additionally, dividend-paying stocks tend to hold up better in all kinds of markets than non-payers.

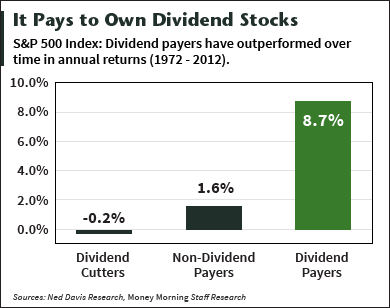

Research from Ned Davis Research shows that over the last 36 years, dividend stocks have beaten the rest of the broad-based S&P 500 Index by 2.5% annually. Furthermore, in addition to doling out cash to shareholders, dividend payers still outperform non-dividend-paying stocks.

Scores of companies have taken note of dividend stocks' attraction by initiating, increasing, or paying special dividends in 2013. Following is a list of some notable dividend-paying stocks that increased their payout in September.

Dividend Stocks That Increased Payout in September

- Accenture plc (NYSE: ACN) announced a 14.8%, or $0.12 per share, increase to its semiannual dividend. The management consulting firm will now pay a semiannual dividend of $0.93. Shares yield 2.53%.

- Agruim Inc. (NYSE: AGU) boosted its dividend by $1.00 per share to a total dividend of $3.00 on an annualized basis. Shares of the global retailer of agricultural products now sprout a 3.54% yield.

- Air Industries Group Inc. (NYSE: AIRI) doubled its dividend to $0.125 per share. The maker of airplane and helicopter parts now floats a lofty yield of 6.6%.

- Alexandria Real Estate Equities Inc. (NYSE: ARE) upped its dividend 4.6% to $0.68 per quarter for a yield of 4.21%.

- Banner Corp. (Nasdaq: BANR) boosted its quarterly dividend 25% to $0.15 per share. The parent company of Banner and Islander Bank serves the Pacific Northwest region.

- Brady Corp. (NYSE: BRC) lifted its quarterly dividend 2.6% to $0.78 per share. It was the 28th straight dividend increase from the identification solutions company. Shares yield 2.57%.

- Campbell Soup Co. (NSE: CPB) raised its quarterly dividend to $0.31 per share, up from $0.29. The company last raised its dividend in November 2010. Shares yield a hearty 3.06%.

- CLARCOR Inc. (NYSE: CLC) raised its quarterly dividend 26% to $0.17 per share. It's the largest percentage increase from the Tennessee-based diversified marketer of mobile filtration and packaging products in the last 20 years, and it continues the company's consecutive streak of increasing dividends for the last 30 years.

- Franklin Resources Inc. (NYSE: BEN) boosted its quarterly dividend 2.6% to $0.10 per share.

- Frisch's Restaurants Inc. (NYSE: FRS) increased its quarterly dividend 12.5% to $0.18. Shares yield 3.10%

- The Goodyear Tire & Rubber Company (NYSE: GT), in a move that suggests good times are ahead, reinstated its dividend at $0.05 per share. Goodyear last paid a dividend on common stock in December 2002.

- Hess Corp. (NYSE: HES) hiked its dividend 150% to $0.25 per share. The oil behemoth also has a share buyback program in efforts to increase shareholder value.

- Host Hotels and Resorts Inc. (NYSE: HST) raised its quarterly dividend 9.1% to $0.12 a share for a hospitable 2.64% yield.

- International Paper Co. (NYSE: IP) upped its quarterly 15% to $0.35 per share, for a noteworthy yield of 3.13%.

- Lockheed Martin Corp. (NYSE: LMT) raised its quarterly dividend 15.60% to $1.33 per share, logging the 11th consecutive annual dividend increase for the defense stock. Over the past decade, LMT has lifted dividends at a rate of 24.7% annually.

- McDonald's Corp. (NYSE: MCD) raised its dividend 5.20% to $0.81 per share. Shares yield an appetizing 3.43%. The fast-food giant's five-year dividend growth rate is 13.90% per year.

- Microsoft Corp. (Nasdaq: MSFT) boosted its dividend 21.7% to $0.28 per share. The tech giant has raised its dividend for 11 consecutive years. The five-year dividend growth rate is 15.10%.

- New Jersey Resources Corp. (NYSE: NJR) increased its quarterly dividend 5% to $0.42 per share for a fist-pump worthy 4% yield.

- Philip Morris Intl Inc. (NYSE: PM) hiked its dividend 10.64% to $0.94 per share, giving shares a smoking 4.33% yield. Since it spun-off from Altria Group Inc. (NYSE: MO) in 2008, the average rate of dividend increases from PM has been 12.7% annually.

- Realty Income Corp. (NYSE: O) lifted its monthly dividend to 18.185 cents per share. This publicly traded real estate investment trust has increased distribution for 19 straight years.

- Sanderson Farms Inc. (Nasdaq: SAFM) increased its dividend 17.6% to $0.20 per share.

- Scholastic Corp. (Nasdaq: SCHL) raised its quarterly dividend 20% to $0.15 per share. The stock carries a yield of 2.09%.

- Texas Instruments Inc. (NYSE: TXN) raised its quarterly dividend 7.1% to $0.30 per share. The stock yields 2.98%.

- Verizon Communications Inc. (NYSE: VZ) lifted it dividend quarterly dividend 2.9% to $0.53 per share. On an annual basis, this increases Verizon's dividend by $0.06 per share, from $2.06 to $2.12. Shares now yield 4.55% - but Verizon is not one of the most reliable dividend stocks right now - see here for details.

- W.P. Carey Inc. (NYSE: WPC) raised its quarterly dividend to $0.86 per share, marking 16 straight years of increased dividends. The REIT now carries a yield of 5.17%.

- Yum! Brands Inc. (NYSE: YUM) sweetened its quarterly dividend a yummy 10.40% to $0.37 per share. This global quick-service restaurant operator has raised distributions for 10 years in a row. The five-year dividend growth rate is 17.80% per share.

Dividend-paying stocks are a key part of your portfolio thanks to the circus in Washington - and our Private Briefing investment service just put together this must-see analysis on why and how to find the best ones: How to Outrun the "Dynamic Dunderheads" of Washington

Related Articles:

- Morningstar:

Dividend Increases - Yahoo! Finance:

Verizon Communications Raises Quarterly Dividend 2.9% to 53 Cents per Share - The Wall Street Journal:

Lockheed Boost Buyback, Dividend