From the Editor: You're receiving special access to Private Briefing today because Bill has found a must-see chart we want to share with everyone, given what's happening (or not happening) in D.C. He also reminds his readers to invest in the American firm "flying" above all this nonsense. The story begins in Bill's living room, of all places, back in 1966...

When the Batman TV series debuted in 1966, my family was no different than most other American households - and quickly grew to like the campy-but-cool action/comedy.

My folks bought me toy Batmobiles - including one that pulled the "Bat Boat" on a trailer. And my Dad - always looking for ways to spend time with his son (something that continues to this day) - brought home model kits of the crime-fighting duo's sleek black hotrod, and even an exciting looking "Batplane."

And the program episodes themselves - with their tongue-in-cheek humor and "special guest villains" - were an absolute hoot. The cliff-hanger structure used in many of the episodes is something I remember to this day: I would watch, enrapt, as the "Dynamic Duo" of Batman and Robin fell into the clutches of such evildoers as The Riddler, Catwoman, and The Joker, who would capitalize on their temporary advantage to taunt the "caped crusaders."

One particular scene has always stayed with me. In it, The Joker (actor Cesar Romero), is slipping away from his pursuers. He turns one last time, faces the two heroes, and with a hearty laugh challenges them to "Catch me if you can, Dynamic Dunderheads!"

I thought of this scene again yesterday - and with good reason. As investors we're trying to make our escape from a ballooning mess that could take down the U.S. economy. But in this "scene," you and I are the "good guys."

And Congress and the Obama administration are the "Dynamic Dunderheads."

Fortunately, there are ways for you to escape the onrushing crash whose violence will be magnified by America's burgeoning debt load and lack of financial discipline, by Washington's inability to focus on the issues that really matter - and by the unforeseen "X-Factors" that will continue to jump from the shadows in the months and years to come.

And here's the best escape to get clear of Washington's "Dynamic Dunderheads"...

Most Dividend Payers Will Outperform. But This First One Will Soar...

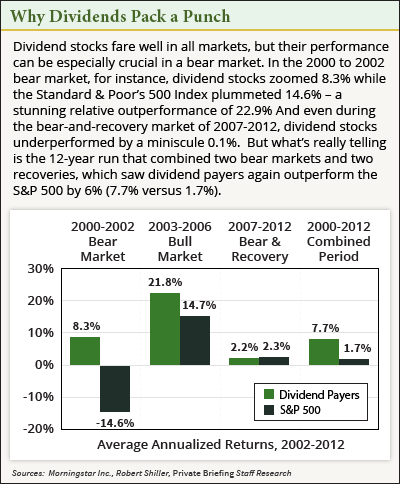

We've all seen the statistics that extoll the virtues of the dividend payers - for instance, that from 1980 to 2005, Standard & Poor's 500 Index dividend payers outperformed their non-dividend-paying counterparts by more than 2.6 percentage points a year (an outperformance that, over a long period, translates into major additional gains in a portfolio).

And there's lots of research that underscores the fact that dividend payers gain more than the market averages in bull markets and lose a lot less in bear markets.

But a chart (see below) depicting some recent research by Morningstar Inc. really caught my eye: It very nicely illustrates that dividend stocks will deliver this "outperformance" over the course of multiple bull-and-bear markets. From 2000 to 2012, a 12-year run that combined two bear markets and two recoveries, dividend payers outperformed the S&P 500 by 6% (7.7% vs. 1.7%).

Now we just had to pick the right stocks.

And we've targeted three that we believe will create a nice long-term payoff - meaning you'll escape the evil clutches of the "Dynamic Dunderheads" who live inside the Beltway.

Let's take a look.

Opportunity No. 1

Flying First Class

We'll start with The Boeing Co. (NYSE: BA), a longtime favorite of ours that's up 90% (96% including dividends) since we first recommended it two years ago. It's also up 57% since Jan. 18 - when we told subscribers to ignore the whole "Dreamliner battery" media frenzy and buy the stock while it was trading down.

Boeing recently hit a record high of $120.38, but this is a great company with powerful global trends acting as a tailwind, and is a stock we believe you'll want to own for the long run.

This is a company that I've followed for years and know well - which is why it was one of the first stocks we recommended after launching Private Briefing. It clearly had some issues to work through, but has tackled most of them.

And Boeing's own projections show us the aerospace firm is pushing its throttles "to the stops" as it heads for the stratosphere.

In Boeing's latest annual forecast - a highly read document the company updates each year - the Chicago-based venture says there will be $4.8 trillion worth of passenger-jet sales over the next 20 years. That represents a 20% increase over the prediction that Boeing made just two years ago.

Boeing sees a need for 35,280 new passenger jets between now and 2032 - 41% of which will replace older, less-fuel-efficient jets. The rest are new airplanes that global carriers need to expand their fleets as worldwide travel continues to grow.

That tells us that there will continue to be a big-and-growing market for the commercial jets that Boeing builds. In the jumbo market, there are right now only two players - Boeing and rival Airbus NV. (Although Mainland China has announced its intent to get into the jumbo market, that won't be an easy move to make. And even if it succeeds in building a jumbo jet, it may have trouble finding buyers outside its own market.)

In a recent story about dividend-paying stocks, Barron's screened for companies that were "modest" payers, but that could likely be counted on for above-average payout growth.

It came up with three stocks - one of which was Boeing.

The experts that I work with here at Money Map Press are some of the best "thinkers" that I've ever dealt with. And by that I mean they're original thinkers. So while we make a special point about not following Wall Street's lead, we love to see it when the sell-siders follow ours. And that's what we've been seeing with Boeing, which has benefitted from a lot of ratings upgrades and target-price increases in July, August, and September.

Late last month, for instance, Sterne Agee analyst Peter Arment told clients in a research note that he sees a big upside for Boeing. Arment boosted his target price by $44 a share - all the way up to $164.

According to Arment, the Boeing story is all about free-cash-flow (FCF) generation. Arment now sees higher deliveries "resulting in very favorable FCF during 2014-2018." His $164 target price is based on a reasonable valuation multiple of 12 times 2015 cash flow.

But here's the real grabber: The company has $410 billion in order "backlog" - a number that's nearly five times Boeing's market cap. That gives investors a whole lot of "visibility" (predictability) when it comes to projecting company revenue.

Boeing has "5,000 aircraft in backlog and unmatched visibility," Arment said - ending his research note by stating that the stock is a "must-own."

Arment's target price is 38% higher than Boeing's recent market price.

Although the yield is only 1.65%, Boeing has boosted the dividend twice since we recommended the stock. Combine that with the strong fundamentals and big upside and you have yourself the makings of a hefty long-term winner.

Arment says Boeing is a "must own" - and we couldn't agree more.

Opportunity No. 2

An Exclusive Club

Every "analyst" or guru has a favorite company or two that they've made a point of following for years - even decades. For me, one of those companies is Boeing. But for resident tech guru Michael Robinson, that company...

- Full Story: To access Bill's latest Private Briefing in its entirety, log in to your members-only dashboard. Not a member? Get all three companies Bill recommended Wednesday - plus daily access to $28,000 worth of our best investing ideas - for $7.99 a month. You're joining just in time, thanks to Bernanke's "deal with devil...

About the Author

Before he moved into the investment-research business in 2005, William (Bill) Patalon III spent 22 years as an award-winning financial reporter, columnist, and editor. Today he is the Executive Editor and Senior Research Analyst for Money Morning at Money Map Press.