Small-cap stocks don't get much attention, but in 2013 they've certainly outshined their larger brethren.

While the financial media focused its daily attention on The Dow Jones Industrial Average, and to some extent the Standard & Poor's 500 Index, the best stocks to buy in terms of largest gains were in the Russell 2000 index.

The performance of small-cap stocks this year has been nothing less than remarkable.

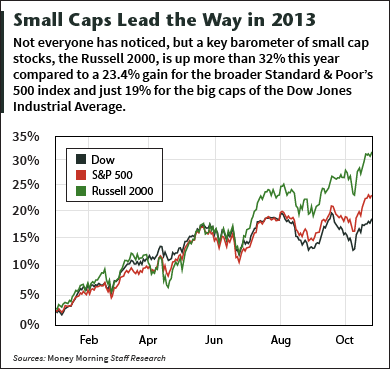

The Russell 2000, the domain of small-cap stocks, is up 32% in 2013, far outpacing the 19% gain of the Dow as well as the 23.4% gain of the S&P 500.

Since the current bull market started in March 2009, small caps are up 226% compared to 138% for large caps.

Since the current bull market started in March 2009, small caps are up 226% compared to 138% for large caps.

Strong gains among small caps frequently presage more robust economic activity and strong gains in the broader market.

Over the past 34 years, such outperformance by small-cap stocks foreshadowed faster growth in the economy and an extension of the bull market three out of four times, according to Bloomberg News.

Actually, that's part of the answer to why small-cap stocks have done so well this year.

Because smaller companies tend to derive most or all of their profits from U.S. sales, they make a good bellwether for an improving U.S. economy. The average Russell 2000 company gets 84% of its revenue from the United States, compared to 55% for the typical DJIA company.

"U.S. small-cap companies generate significantly less revenue outside the U.S. than do U.S. large-cap companies. This close connection with U.S. economic improvement has likely been an important component of small-cap stocks' outperformance year-to-date over large-cap stocks, as reflected by the Russell U.S. Indexes," said David Koenig, investment strategist for Russell Indexes.

Why Small Caps Are the Stocks to Buy Now

Another positive sign for investing in small-cap stocks: Russell 2000 companies are beating earnings estimates at twice the rate of DJIA companies, Bloomberg News says.

But the reason small caps are still the stocks to buy is that this trend is expected to accelerate in 2014...

Profits at small caps are expected to grow four times faster next year than profits at large caps.

That could translate to stellar performance, given what some of the top small-cap stocks have done so far this year:

- Gray Television Inc. (NYSE: GTN), up 275%.

- Lannett Co. Inc. (NYSE: LCI), up 400%.

- National Technical Systems (Nasdaq: NTSC), up 189%.

- SunPower Corp. (Nasdaq: SPWR), up 465%.

- Biocryst Pharmaceuticals Inc. (Nasdaq: BCRX), up 353%.

Most investors would be thrilled to get returns like that, but sorting through the thousands of small-cap stocks for the handful of big winners is daunting, to say the least.

Now imagine if you could not only identify those winners, but do so before almost everyone else. You could snag gains of not only 300% or 400%, but a mind-blowing 900%, 1,300%, or even 1,700%.

Gains like that could change your life.

And thanks to a breakthrough strategy developed by Money Morning Chief Research Analyst Sid Riggs, such gains are now within reach.

Riggs has identified seven "sparks" that determine which of the myriad small caps are the best stocks to buy to deliver spectacular profits.

Very few people even know what these sparks are, much less how to find them. That's what makes Rigg's Small-Cap Rocket strategy so special. You have to see for yourself just how powerful this strategy really is...

Related Articles:

- Money Morning:

Spark #1: Game-Changing New Contracts - Money Morning:

One of the Best Small-Cap "Sparks" You Can Find - Bloomberg:

Small-Caps Double Dow in Signal Economy Gaining Speed

About the Author

David Zeiler, Associate Editor for Money Morning at Money Map Press, has been a journalist for more than 35 years, including 18 spent at The Baltimore Sun. He has worked as a writer, editor, and page designer at different times in his career. He's interviewed a number of well-known personalities - ranging from punk rock icon Joey Ramone to Apple Inc. co-founder Steve Wozniak.

Over the course of his journalistic career, Dave has covered many diverse subjects. Since arriving at Money Morning in 2011, he has focused primarily on technology. He's an expert on both Apple and cryptocurrencies. He started writing about Apple for The Sun in the mid-1990s, and had an Apple blog on The Sun's web site from 2007-2009. Dave's been writing about Bitcoin since 2011 - long before most people had even heard of it. He even mined it for a short time.

Dave has a BA in English and Mass Communications from Loyola University Maryland.