Warren Buffett didn't get to be a billionaire by being wrong, but it's clear from what he's been saying about investing in Bitcoin that he just doesn't get the digital currency.

Last Friday on CNBC, Buffett, the chairman of Berkshire Hathaway Inc. (NYSE: BRK.A, BRK.B), unleashed his second dismissal of Bitcoin this month.

"Stay away from it," Buffett said during a panel discussion. "It's a mirage, basically."

While Buffett did concede that Bitcoin is "a very effective way of transmitting money," he said it differed little from older ways of transmitting money, such as checks or money orders.

"Are checks worth a whole lot of money just because they can transmit money? Are money orders?" Buffett scoffed. "The idea that [Bitcoin] has some huge intrinsic value is just a joke in my view."

And two weeks ago, also on CNBC, Buffett had this to say about Bitcoin: "It's not a currency. I wouldn't be surprised if it wasn't around in the next 10 to 20 years."

While investors usually do well following the advice of Warren Buffett, there's more to Bitcoin than the Oracle of Omaha may recognize.

There has been a lot of negative Bitcoin news lately - most notably the bankruptcy of the Mt. Gox Bitcoin exchange - and it is without a doubt going through some growing pains. But the digital currency is still very young, and most of its potential is as yet unrealized.

If Warren Buffett - not to mention all those stories in the mainstream media - were correct, investing in Bitcoin should be waning as people scramble for the exits.

Instead, the statistics tell the opposite story...

Why People Are Still Investing in Bitcoin

The most obvious evidence that Bitcoin is far from dead is the resilience of Bitcoin prices over the past month.

Two weeks ago, we pointed out that Bitcoin prices had rebounded and then stabilized after Mt. Gox went dark on Feb. 25. Since then, Bitcoin prices on the CoinDesk index have settled into the $620 to $630 range. Not only have Bitcoin prices not collapsed, they've shed much of their volatility.

But what's more telling are the numbers that show interest in Bitcoin has actually continued to rise over the past couple of months, regardless of bad news or attacks from critics...

For one thing, Bitcoin mining has continued to rise at a rapid rate. "Mining" is how new bitcoins are created. Specialized computer rigs earn the new coins by solving a difficult math problem.

A couple of years ago, anyone could mine bitcoins on their home computer if they had a better-than-average graphics card that might cost $300 or so. But as Bitcoin prices rose, so did the desire to mine them, setting off an "arms race."

Now rigs to mine Bitcoin cost tens of thousands of dollars - a significant investment that implies a major commitment to the digital currency.

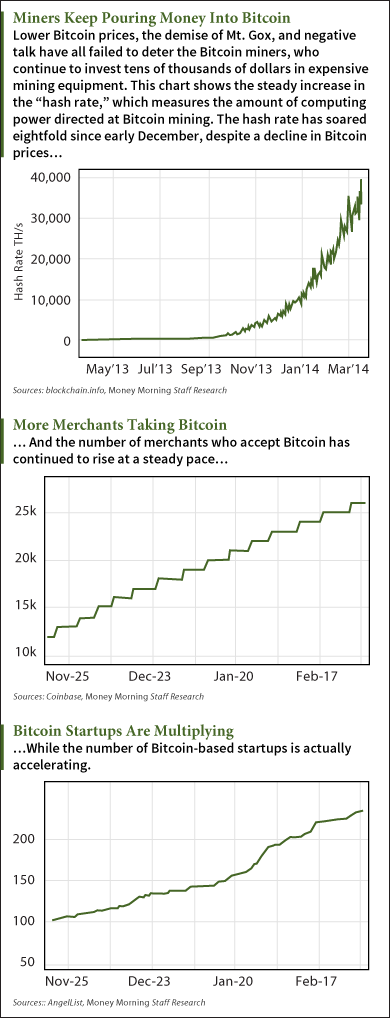

The chart here shows the increase in the "hash rate" - the amount of computer power being used to mine bitcoins. Over the past few months, the hash rate has kept rising rapidly despite all the negative news that was supposed to have "burst the bubble."

If Bitcoin was on the road to becoming worthless, people wouldn't keep plowing tens of thousands of dollars into mining rigs.

Merchants, Venture Capitalists Do More Investing in Bitcoin

The second chart shows the number of merchants that accept Bitcoin going back to November. That line, too, has remained steady. Merchants who accept Bitcoin, like Overstock.com, have found that it has increased their business.

But merchants aren't just interested in attracting tech-savvy customers - a bigger incentive is the very low transaction fees, which make Bitcoin a much cheaper form of payment for them than credit cards.

And there is the third chart, which shows the number of Bitcoin startups on the venture capital website AngelList beginning to enter what appears to be a parabolic rise.

This may be the most profound sign of all that Bitcoin is on the verge of becoming a transformational payment technology.

It's not just that so many people are launching Bitcoin-based startups right now; it's that so much venture capital is pouring into those startups - millions and millions of dollars.

They know that not every startup will succeed, but they also know that the potential of Bitcoin to disrupt all sorts of industries means that some of them eventually will be huge successes.

At last week's South by Southwest Interactive Conference, noted venture capitalist Ben Horowitz explained that his firm, Andreessen Horowitz, was investing in Bitcoin startups because he believes it will enable the digitization of not just money, but all sorts of things, like car keys and door locks.

"As a venture capitalist, you can't afford not to go after ideas that big," Horowitz said.

Have you seen any evidence that adoption of Bitcoin is gaining momentum? Tell us about your experience on Twitter @moneymorning or Facebook using #bitcoin.

Investing in Bitcoin is just one way to profit from cutting-edge technologies. Wearable tech is another. Here are our five favorite wearable tech stocks - and we're not talking about Apple or Google.

Related Articles:

- Business Insider: LEGENDARY VC: Here's The Number One Thing I Look For In An Entrepreneur

- CoinDesk: Warren Buffett: Bitcoin Is Not a Currency

- CNBC: Buffett Blasts Bitcoin as 'Mirage': 'Stay Away!'

About the Author

David Zeiler, Associate Editor for Money Morning at Money Map Press, has been a journalist for more than 35 years, including 18 spent at The Baltimore Sun. He has worked as a writer, editor, and page designer at different times in his career. He's interviewed a number of well-known personalities - ranging from punk rock icon Joey Ramone to Apple Inc. co-founder Steve Wozniak.

Over the course of his journalistic career, Dave has covered many diverse subjects. Since arriving at Money Morning in 2011, he has focused primarily on technology. He's an expert on both Apple and cryptocurrencies. He started writing about Apple for The Sun in the mid-1990s, and had an Apple blog on The Sun's web site from 2007-2009. Dave's been writing about Bitcoin since 2011 - long before most people had even heard of it. He even mined it for a short time.

Dave has a BA in English and Mass Communications from Loyola University Maryland.