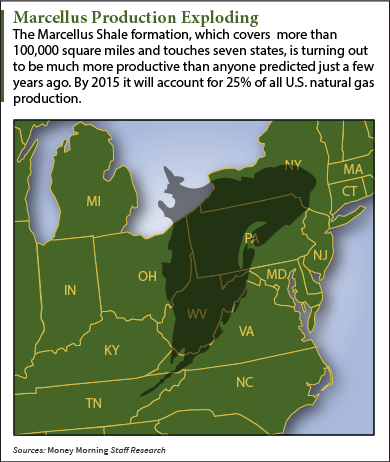

As much as the shale oil and gas boom is transforming the U.S. energy industry, production from one play in particular - the Marcellus in the eastern United States - is growing faster than expected.

And for five natural gas stocks that were early to the Marcellus party, that's going to spell bigger-than-expected profits.

No less than three recent studies - one from the U.S. Energy Information Administration, one from Morningstar, and one from Moody's Investor Service - have concluded that over the next few years, the Marcellus shale gas fields will be the most productive shale gas play in the United States.

No less than three recent studies - one from the U.S. Energy Information Administration, one from Morningstar, and one from Moody's Investor Service - have concluded that over the next few years, the Marcellus shale gas fields will be the most productive shale gas play in the United States.

"Technological advancements since the early 2000s have allowed U.S. natural gas producers to reshape the industry largely through the development of the Marcellus," wrote Moody's analyst Michael Sabella in a March 3 report. "The Marcellus has emerged as one of the most profitable regions in the U.S. for producing natural gas, so even if prices return to the weak levels of 2012, [natural gas stocks] will be rewarded."

And Morningstar predicted that the Marcellus will account for one-quarter of all U.S. natural gas production by 2015, with production increasing from 14 billion cubic feet per day to 20 billion.

"The growth of the Marcellus over the next several years is likely to be nothing short of astounding," said the Morningstar report, which attributed the rapid growth to efficiency improvements.

According to the EIA report, Marcellus shale gas production even now has grown to the point where if it were its own country, it would rank third behind Russia and the rest of the United States.

And the good news for natural gas stocks in the Marcellus gets even better.

"For a variety of reasons - including the high initial production rates and relatively shallow declines of wells, the ongoing application of new technologies, and a continued focus on more productive areas of the play - we don't believe Marcellus natural gas production will reverse course anytime soon," the Morningstar report says.

With the Marcellus estimated to have between 30 and 75 years' worth of natural gas reserves, companies operating there stand to make decades worth of profits.

The only wild card is natural gas prices, which plunged to near $2 per million British thermal units (BTUs) in 2012, have since more than doubled to well over $4 per million BTUs. But Moody's said that those companies with well-established operations in the Marcellus could operate at a profit even if prices returned to 2012's historic lows.

Basically, Moody's said, the companies best positioned to profit from the growth in the Marcellus are those that took a chance by moving into the region early - like these five companies...

Five Natural Gas Stocks That Will Get a Boost from the Marcellus

Here are five natural gas stocks that will benefit the most:

- Chesapeake Energy Corp. (NYSE: CHK): Chesapeake's fourth-quarter natural gas production in Marcellus grew 36% year over year to 880 million cubic feet of gas per day, making it the company's single-largest hydrocarbon play. CHK was trading at about $25.81 on Monday and has a dividend yield of 1.30%.

- Antero Resources Corp. (NYSE: AR): You may not have heard of Antero; it just had its initial public offering (IPO) last October (and is up a healthy 23.46% since). But it is already a major force in the Marcellus - the company expects production to grow 60% to 65% this year and 30% to 50% through 2016. AR was trading at about $64.14 on Monday and does not yet pay a dividend.

- Anadarko Petroleum (NYSE: APC): Anadarko was operating 61 wells on 260,000 acres in the Marcellus last year, which helped it grow sales volume from the play by 58%. APC was trading at $97.29 on Monday and has a dividend yield of 0.70%.

- Range Resources Corp. (NYSE: RRC): Range Resources owns approximately 1 million acres in the Pennsylvania section of the Marcellus. Last year, the company increased output 37% from the prior year to 968 million cubic feet of natural gas per day, and has several projects in the works that will ramp up production further in the years ahead. RRC was trading Monday at $85.59 and has a dividend yield of 0.20%.

- EQT Corp. (NYSE: EQT): EQT recently announced plans to spend $1.1 billion this year to drill 186 wells on the 560,000 acres it owns in the Marcellus. The success from its Marcellus operations pushed EQT's production operating income up 98% in 2013 and drove an earnings increase of 66%. EQT was trading at $101.37 on Monday, and it has a dividend yield of 0.10%.

Do you have any opinions on investing in natural gas stocks in the Marcellus? Share them with us on Twitter @moneymorning or Facebook using #naturalgasstocks.

With natural gas production accelerating in the Marcellus formation and elsewhere in the United States, it will mean much more than domestic energy self-sufficiency. Here's why the Russians are worried about the U.S. shale gas boom...

Related Articles:

- Morningstar:

Morningstar Equity Analysts Publish Framework for U.S. Natural Gas Production - Natural Gas Intelligence:

'Marcellus Bounty' to Benefit Leading Operators for Years, Moody's Says - Associated Press:

Marcellus Shale Gas Growing Faster Than Expected

About the Author

David Zeiler, Associate Editor for Money Morning at Money Map Press, has been a journalist for more than 35 years, including 18 spent at The Baltimore Sun. He has worked as a writer, editor, and page designer at different times in his career. He's interviewed a number of well-known personalities - ranging from punk rock icon Joey Ramone to Apple Inc. co-founder Steve Wozniak.

Over the course of his journalistic career, Dave has covered many diverse subjects. Since arriving at Money Morning in 2011, he has focused primarily on technology. He's an expert on both Apple and cryptocurrencies. He started writing about Apple for The Sun in the mid-1990s, and had an Apple blog on The Sun's web site from 2007-2009. Dave's been writing about Bitcoin since 2011 - long before most people had even heard of it. He even mined it for a short time.

Dave has a BA in English and Mass Communications from Loyola University Maryland.