With the Winklevoss Bitcoin ETF, more formally known as the Winklevoss Bitcoin Trust, on track for approval before the end of the year, and an exchange already selected (the Nasdaq), we're waiting on just one more big piece of news: the ticker symbol.

With a product as controversial as a Bitcoin ETF, choosing the right ticker symbol can help foster wider acceptance of the digital currency as well as make the ETF easy for investors to remember.

With a product as controversial as a Bitcoin ETF, choosing the right ticker symbol can help foster wider acceptance of the digital currency as well as make the ETF easy for investors to remember.

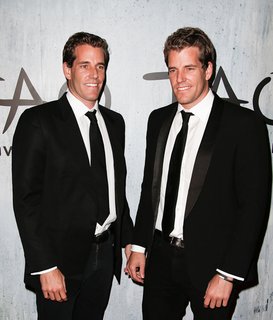

The Winklevoss twins, Cameron and Tyler, filed with the U.S. Securities and Exchange Commission (SEC) for approval of their Bitcoin exchange-traded fund last July.

The twins, best known for successfully suing Facebook Inc. (Nasdaq: FB) founder Mark Zuckerberg for $140 million for stealing their idea for a social network, say the Winklevoss Bitcoin ETF would function much like the popular SPDR Gold Trust ETF (NYSE Arca: GLD).

To duplicate that structure, the Winklevoss Bitcoin ETF will buy one bitcoin for every five shares of the fund. With the current Bitcoin price at about $575, one share of the Winklevoss Bitcoin Trust would today trade for $115.

But what should the ticker be?

The famous twins might be tempted to pick a vanity ticker like WINK, VOSS, or even TWIN. However, TWIN is taken and WINK exists on the London stock exchange (for Winkworth). And does anyone really want to see VOSS?

Another avenue of possibility open to the Winklevoss Bitcoin ETF is tapping into the digital currency theme with something like BIT, COIN, CRYP, or MATH. However, all of those tickers are already being used.

If the Winklevii want to play it straight, they could go for something like BTCF, combining the widely used abbreviation of Bitcoin with an "F" for fund.

But being just a bit more clever might produce better results. This is what the science says...

Why the Winklevoss Bitcoin ETF Ticker Matters

The Winklevoss Bitcoin ETF might benefit from some research a couple of Princeton University professors did a few years ago on the impact of a ticker symbol on stock prices.

They discovered that memorable, pronounceable symbols - like Yum! Brands Inc. (NYSE: YUM) and Southwest Airlines Co. (NYSE: LUV) - actually perform better in the market.

"[Our] research shows that people take mental shortcuts, even when it comes to their investments, when it would seem they would want to be most rational," Professor Daniel Oppenheimer, who co-authored the Princeton study, told Psych Central.

And while the study showed the greatest impact of a clever ticker in the first 10 days of an IPO, the effect lingers over the long term as well.

Another study by Pomona College finance professor Gary Smith found that memorable tickers earned a 23.5% return compounded annually over a 20-year period. That more than doubled the 12% return of a hypothetical index of all NYSE and Nasdaq stocks over the same period.

While the studies were done on stocks, there's no reason to think the research is not equally valid for ETFs.

After all, the whole idea behind the Winklevoss Bitcoin ETF is to create an easy way to invest in Bitcoin. The ticker needs to mesh with that philosophy as well.

And to be sure, many ETFs have clever names, such as the Pimco ETF Trust (NYSE Arca: BOND), the Market Vectors Agribusiness ETF (NYSE Arca: MOO), the Guggenheim Shipping ETF (NYSE Arca: SEA), the ProShares Ultra Australian Dollar ETF (NYSE Arca: GDAY), and the Teucrium Corn Fund (NYSE Arca: CORN).

With most of the obvious choices unavailable, the Winklevoss twins will need to think a little harder to come up with something that makes sense and will appeal to investors.

One suggestion we like is MOON, which ties into the optimistic catchphrase "to the moon" (based on a meme of an astronaut standing on the moon with a flag bearing the Bitcoin symbol), typically uttered by digital currency enthusiasts when prices are rising.

What ticker would you choose for the Winklevoss Bitcoin ETF? Let us know on Twitter @moneymorning or Facebook.

Naysayers have buried Bitcoin many times over, but adoption keeps spreading and the Bitcoin ecosystem continues to strengthen. That's just how disruptive technologies usually work. But most people - even really smart people - fail to recognize such transformative events until after it's obvious to everyone. Here are the 10 worst tech predictions of all time...

Related Articles:

- Psych Central: Stock Performance Tied to Ease of Pronouncing Company's Name

About the Author

David Zeiler, Associate Editor for Money Morning at Money Map Press, has been a journalist for more than 35 years, including 18 spent at The Baltimore Sun. He has worked as a writer, editor, and page designer at different times in his career. He's interviewed a number of well-known personalities - ranging from punk rock icon Joey Ramone to Apple Inc. co-founder Steve Wozniak.

Over the course of his journalistic career, Dave has covered many diverse subjects. Since arriving at Money Morning in 2011, he has focused primarily on technology. He's an expert on both Apple and cryptocurrencies. He started writing about Apple for The Sun in the mid-1990s, and had an Apple blog on The Sun's web site from 2007-2009. Dave's been writing about Bitcoin since 2011 - long before most people had even heard of it. He even mined it for a short time.

Dave has a BA in English and Mass Communications from Loyola University Maryland.