Today's gold price was modestly lower Wednesday after Tuesday's rout left the yellow metal at its lowest level in 15 weeks.

In morning trading, the most active contract, August Comex gold, slipped $8.40, or 0.67%, at $1,257.10. Spot gold was lower by $6.90, or 0.55%, at $1,256.40.

Traders are treading cautiously after gold futures for June ended Tuesday's session at its lowest level since Feb. 7, down 2%, or $26.20, to settle at $1,265.50. Spot gold also slipped 2%, to end yesterday's session at $1,265.76 an ounce, its lowest level since Feb.10.

Traders are treading cautiously after gold futures for June ended Tuesday's session at its lowest level since Feb. 7, down 2%, or $26.20, to settle at $1,265.50. Spot gold also slipped 2%, to end yesterday's session at $1,265.76 an ounce, its lowest level since Feb.10.

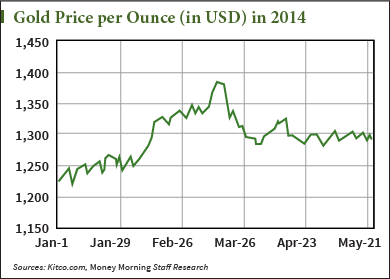

Gold prices have been stuck in a tight trading range for weeks, struggling to consistently trade above the key $1,300 an ounce level.

Signs of economic improvement in the United States and hopes of a more politically stable Ukraine have both taken some of the shine off safe-haven asset gold. Indeed, the Standard & Poor's 500 Index logged its second straight record Tuesday. The index added 11.38, or 0.6%, to 1911.91. Year to date, the broad-based benchmark has enjoyed 12 record-high closes.

But there are multiple forces at play weighing down today's gold price, according to Money Morning Resource Specialist Peter Krauth.

Here's what's behind the yellow metal's recent struggles...

The Three Forces Driving Today's Gold Price Down

First, the U.S. Dollar Index (USDX) is strengthening.

"Keep in mind that the Index is made up of 57% euro. Right now, the euro is weakening because it's widely expected the European Central Bank will soon take measures to weaken its currency," Krauth said. "That will, in turn, strengthen the U.S. dollar, which we are now seeing priced in."

A stronger dollar weighs on gold, because it is priced in dollars.

Krauth attributed the second reason driving today's gold price down to technical trading and sentiment.

"The $1,280 support level was breached to the downside, which encourages traders to short the metal, while fostering negative sentiment," Krauth explained. "The next support level appears to be $1,240, and then around the $1,200 level."

The third major reason why gold is down today: demand.

You see, the World Gold Council (WGC) recently reported that Q1 demand was stable at 1,074 tonnes in Q1 2014, versus 1,077 tonnes the same quarter a year earlier. But Bloomberg pointed out yesterday that April imports to China from Hong Kong were down to 65.4 tonnes, compared to 80.6 tonnes in March and 75.9 tonnes a year ago.

"It's thought that Chinese consumers have slowed their buying somewhat due to higher prices than last year," Krauth said. "The country's overall gold demand was down 18% in Q1 over last year."

But, things are beginning to look a bit brighter for gold...

Despite the import drop, China is committed to becoming the number one global gold hub. Already the world's top producer and importer of the yellow metal, China has approached foreign banks and gold producers to participate in a global gold exchange in Shanghai.

Meanwhile, in India - the world's second-largest gold consumer - investors are hopeful the country's new government will lift heavy tax levies imposed last year on gold imports. Such a move would make it cheaper for Indian investors and jewelers to buy gold and is likely to spark pent-up demand. It would also likely support prices globally.

"I think [gold] could show a huge comeback, depending on how the [new Indian government] policy shapes up," P.R. Somasundaram, managing director at the WGC's India office, told The Wall Street Journal.

The WGC currently projects India's 2014 gold demand will be between 900 and 1,000 metric tons, compared with 975 tons in 2013. That could be revised sharply higher if the situation in India changes.

NEXT: According to Barron's, a whopping 85% of all investor "sell" or "exchange" decisions are wrong. But you can beat the 85% with these simple steps...

Related Articles:

- Wall Street Journal:

- Bloomberg:

- Reuters: