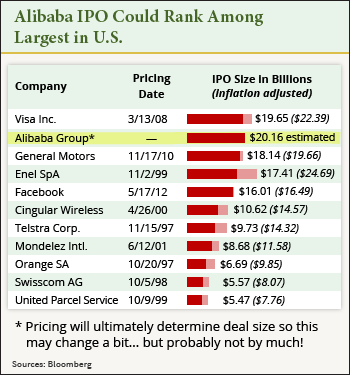

The Alibaba IPO is expected to be one of the largest IPOs of all time, and some forecasts indicate that the Chinese e-commerce firm could raise as much as $20 billion in its initial public offering.

Some reports indicate that the Alibaba IPO date could be scheduled for the first week in August, but no official date has been set.

Some reports indicate that the Alibaba IPO date could be scheduled for the first week in August, but no official date has been set.

One thing is for certain, however: When Alibaba hits the market sometime in late 2014, there will be a lot of people who pocket a lot of profit.

Those following the deal have learned about the huge windfall Yahoo Inc. (Nasdaq: YHOO) is expecting through the Alibaba IPO. Yahoo owns a 24% stake in Alibaba and is expected to sell up to 50% of that stake through the initial public offering. Considering some estimates place Alibaba's value over $150 billion, Yahoo could walk away with an extra $18 billion in cash.

But Yahoo isn't the only one who will be hitting it big thanks to the Alibaba IPO. Here's who else is in line for a major payday.

$400 Million Payday for Alibaba IPO Underwriters

When companies hold initial public offerings, they hire big banks to perform the underwriting services on the deal. The underwriters help the company determine the IPO price, file the necessary paperwork, choose the right exchange, and issue shares, among other tasks.

These underwriters collect a fee for their services, which is proportional to the size of the IPO.

According to the Financial Times, the underwriters of the Alibaba IPO will be entitled to $400 million in fees, if the IPO raises the $20 billion many expect.

That $400 million will be split among the underwriting companies: Credit Suisse Group (NYSE ADR: CS), Morgan Stanley (NYSE: MS), JPMorgan Chase & Co. (NYSE:

JPM), Deutsche Bank AG (NYSE: DB), Goldman Sachs Group Inc. (NYSE: GS), and Citigroup Inc. (NYSE: C), leaving each bank with more than $66 million in fees.

But the money doesn't necessarily stop there for the underwriters...

When underwriters think an IPO might be oversubscribed (higher demand for shares than there is supply), they are allowed to purchase up to an additional 15% of the stock at the initial offer price. From there, they can sell the shares at a higher price following the IPO in what is known as a "Greenshoe" clause.

The underwriters who would like to purchase additional stock before the IPO takes place will be able to, so they'll see a nice payday after the Alibaba stock price climbs following the IPO.

For those six banks, the $66 million they receive in fees may be just the tip of the iceberg.

But the underwriters aren't the only ones who will make money off the Alibaba IPO...

Alibaba Prepares Employees for Payout

According to Reuters, Alibaba officials have been preparing employees for the influx of cash they will receive when the company hits the market.

Alibaba employees currently hold 26.7% of the company's shares, a value that could be worth as much as $41 billion. A recent Reuters survey of 25 analysts concluded that Alibaba could be valued at $152 billion at the time of its IPO.

Following the IPO, shareholding employees will be free to sell their Alibaba stock whenever they choose.

Alibaba has been preparing employees for years for the eventual IPO windfall and advising them not to spend excessive amounts of money on material goods. However, that hasn't stopped some employees from inquiring if luxury cars, like BMWs, can be ordered in Alibaba's signature orange hue.

While the size of the Alibaba IPO could be unprecedented, this won't be the first time Alibaba employees will have had the opportunity to sell shares. The company has previously allowed workers to sell parts of their stakes through structured "liquidity programs."

But the biggest profits don't have to go solely to Alibaba employees and big banks. In fact, your gains could exceed those of the IPO's original investors...

That's because we've uncovered a way for you to make a fortune on the Alibaba deal right now... long before the shares go public. It could be your one and only chance to make the kind of gains normally reserved for the high-net-worth investors and bankers. You can learn more about this Alibaba profit play here.

Do you plan on investing in Alibaba stock after it hits the market? Join the conversation on Twitter @moneymorning using #Alibaba.