Some of this year's top penny stocks have come out of the little-known or followed fuel cell industry.

The sector garnered a great deal of attention in 2014's first quarter, thanks to lucrative contracts inked by Plug Power Inc. (Nasdaq: PLUG).

Here's a brief refresher.

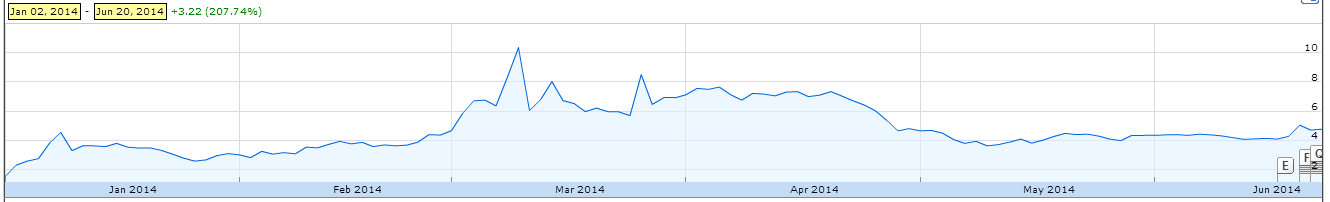

The Latham, N.Y.-based company's shares spiked 68% to a 52-week high of $4.90 in January after securing a deal with FedEx Corp. (NYSE: FDX) to develop hydrogen fuel cell extenders for 20 FedEx trucks. Shares were up a stratospheric 334.19% year over year by March, fueled by a sizable contract signed in late February with Wal-Mart Stores Inc. (NYSE: WMT).

After rising as high as $11.20, PLUG shares fizzled as the stock took a breather and investors moved on to the next hot stock.

But by late April, PLUG stock was climbing again.

In a move aimed at accelerating its aggressive international growth strategy, PLUG announced on April 21 it had entered into a five-year agreement with Hyundai Hysco Co. Ltd. Under the joint venture partnership, PLUG will develop and sell hydrogen fuel cells in countries throughout Asia using Hysco's advanced stack and plate technology.

"This highly anticipated joint venture with Hysco will enable Plug Power to broaden its reach into the Asian market, putting us well on our way toward global market expansion," said Andy Marsh, chief executive officer (CEO) of Plug Power. "The positive impact on our bottom line from fuel cell sales in the region in 2015 and beyond will play a significant role in our achievement of profitability."

PLUG shares were mostly quiet over the month or so until they were back in the news this week.

PLUG Regains Top Penny Stock Status

PLUG shares surged 19% on Wednesday. Some 57.39 million shares changed hands, compared to the stock's average daily volume of 16.26 million. Option activity was also brisk, with traders purchasing a whopping 55,617 bullish calls on Wednesday, compared to the typical daily volume of 8,790 calls.

Driving shares was an announcement from PLUG that retail giants Walgreen Co. (NYSE: WAG) and Family Dollar Stores Inc. (NYSE: FDO) have expressed interest in replacing their lead-acid battery-powered forklifts with hydrogen fuel cells.

And another one of the sector's top penny stocks got a boost this week, too...

Top Penny Stocks: BLDP Surges

Jennings Capital initiated coverage of Ballard Power Systems Inc. (Nasdaq: BLDP) at a "Buy." That was good for a 17% gain in BLDP to $4.19.

Thursday, BLDP climbed another 5% after the company announced it has signed a definitive agreement with Chinese renewable energy company Azure Hydrogen, relating to an assembly license for Telecom Backup Power Systems.

Under terms of the deal, Ballard Power will be the exclusive supplier of subsystem and fuel processors for Azure in the Chinese market. BLDP will also receive royalties for each Telecom Backup Power System sold in China.

"The Telecom Backup Power market is a key growth driver for our business and is also a significant opportunity in China given the scale of the market and China's growing focus on clean energy technology," said Ballard CEO John Sheridan.

Word of the deal, and continued momentum from PLUG's comments regarding Walgreen and Family Dollar Stores, again goosed Plug Power and other top fuel cell penny stocks like FuelCell Energy Inc. (Nasdaq: FCEL).

Stifel just resumed coverage of FCEL this week with a "Buy" rating. Stifel analyst Sven Eenmaa said FCEL has made progress in reducing its technology and manufacturing costs.

FuelCell also recently announced it will install a fuel cell power plant, which will provide about 30% of the electricity for Irvine Medical Center. The California medical center signed a multi-year agreement to buy electricity generated by the plant.

The deal opens up the possibilities for similar deals in the future.

"Due to the highly efficient power generation process, stationary fuel cell power plants are virtually absent of the pollutants that cause smog and acid rain and are exempt from the State of California Cap-and-Trade Program, so UC Irvine Medical Center will see its Compliance Obligation reduced, avoiding carbon tax payments and increasing savings," FuelCell CEO Chip Bottone said in a statement.

With shares of each of these top penny stocks trading so low, there's high profit potential. But investors should only buy if they can handle the risk.

"For now, it is a wait and see situation to find out whether fuel cells can offer a realistic solution to power generation and greenhouse gas emissions or whether its potential is only good on paper," Zacks Investment Research commented.

This week's paper gains, however, looked good indeed. FCEL is up some 13.9%, PLUG has gained 15.9%, and BLDP has tacked on roughly 22% this week alone.

Get more of today's top penny stocks here: Four of the Best Penny Stocks for 2014

Related Articles:

- Zacks Investment Research:

Industry Outlook Highlights: FuelCell Energy, Ballard Power, and Plug Power <

- Plug Power:

- MarketWatch: