Investors seeking to diversify portfolios with a steady income stream need look no further than dividend stocks.

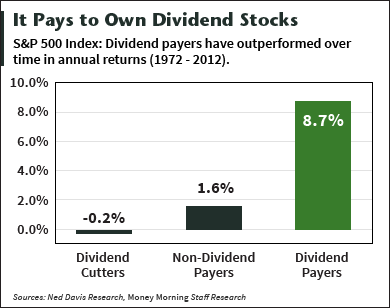

In addition to contributing a meaningful portion of a portfolio's total return, dividend payers tend to outperform non-dividend payers across market cycles and offer higher risk-adjusted returns, according to S&P Dow Jones Indices.

Dividend-paying stocks also play an important role during periods of market volatility. While stock price returns can be either positive or negative, dividend income, by definition, is positive. "Therefore, dividends provide investors with the opportunity to capture the upside potential while providing some level of downside protection in negative markets," S&P writes.

Following are the 23 dividend stocks that increased payouts during the week ending June 20.

Dividend-Paying Stocks That Just Hiked Payouts

Alexandria Real Estate Equities Inc. (NYSE: ARE) upped its quarterly distribution $0.02 to $0.72 a share for a 3.74% yield.

American Capital Senior Floating Ltd. (Nasdaq: ACSF) hiked its quarterly payout a dime, or 55%, to $0.28 a share.

Apollo Residential Mortgage Inc. (NYSE: AMTG) raised its quarterly dividend $0.02 to $0.42 a share for a near 10% yield.

Banco Bradesco S.A. (NYSE: BBDO) boosted its monthly payout 2.2% to $0.084 a share for a 0.54% yield. The Brazilian bank also declared a special $0.01-per-share dividend to shareholders of record July 7, payable on Aug. 8.

Bowl America Inc. (NYSEMKT: BWL.A) increased its quarterly dividend 3% to $0.17 a share for a 4.4% yield.

DTE Energy Co. (NYSE: DTE) sweetened its quarterly dividend 5.3% to $0.69 a share for 3.56% yield. The increase marks the fifth consecutive year of payout boosts from the Detroit-based energy giant since 2009. The average annual increase has been 5.4%. "Dividends have been a significant component of DTE's total shareholder return and dividend growth is a key factor in our ongoing investor philosophy," said Gerard M. Anderson, DTE Energy's chairman and chief executive officer (CEO). "Looking forward, we continue to target 5% to 6% earnings per share growth, with dividends growing in line with earnings."

If you aren't a Money Morning Member, sign up now for free to see 17 more dividend stocks that raised payouts last week. You'll also get this report with three superior dividend picks: The Best Dividend Strategy for Building Fortune in a Low-Yield Era

Eaton Vance Floating-Rate Income Plus Fund (NYSE: EFF) increased its monthly disbursement 1.1% to $0.094 a share for a 6.27% yield.

Eaton Vance Senior Floating-Rate Trust (NYSE: EFR) raised its monthly payout 1.3% to $0.076 a share for a 6.2% yield.

Eaton Vance Floating-Rate Income Trust (NYSE: EFT) upped its monthly dividend 1.4% to $0.73 a share for a 5.87% yield.

The Ensign Group Inc. (Nasdaq: ENSG) boosted its quarterly dividend 83.3% to $0.07 a share for a yield just shy of 1%. The independent operator of skilled nursing and assisted living services has been paying dividends since 2002.

Fifth Third Bancorp (Nasdaq: FITB) fattened its quarterly dividend 8.3% to $0.13 a share for a 2.4% yield.

First Bancorp Inc. (Nasdaq: FNLC) boosted its quarterly payout 5% to $0.21 a share for a yield approaching 5%. It was the Maine-based bank's first dividend enrichment in more than five years. "With improved credit quality and other key metrics, increasing the dividend again is consistent with the improved overall performance we have seen over the past year," said CEO and President Daniel R. Daigneault. "Our generous dividend payout is very important to our shareholders and remains a key component in our total return and the valuation of our shares."

Great North Iron Ore Properties (NYSE: GNI) goosed its quarterly dividend a quarter to $2.50 a share for a 41.75% yield.

John Wiley & Sons Inc. (NYSE: JW.A, Class A shares) juiced its quarterly payout $0.04 to $0.29 a share for a 1.96% yield. The increase marks the 21st consecutive year that the Hoboken, N.J.-based company has raised its quarterly dividend on both "A" and "B" shares. Class A stock holders are entitled to elect 30% of the entire Board of Directors, while Class B holders are entitled to elect the remainder. Each Class B share is convertible into one Class A share.

John Wiley & Sons Inc. (NYSE: JW.B, Class B shares) boosted its quarterly payout $0.04 to $0.29 a share for a 1.92% yield.

Kayne Anderson MLP Investment Co. (NYSE: KYN) upped its quarterly dividend 2.4% to $0.64 a share for a 6.7% yield.

Lexington Realty Trust (NYSE: LXP) raised its quarterly dividend 3% to $0.17 a share for a 5.91% yield.

Medtronic Inc. (NYSE: MDT) hiked its quarterly dividend $0.02 to $0.30 a share for a 1.91% yield. The dividend enhancement came as MDT inked a $42.9 billion deal last week to buy Covidien Plc. (NYSE: COV).

RAIT Financial Trust (NYSE: RAS) raised its quarterly payout a penny to $0.18 a share for an 8.72% yield.

Realty Income Corp. (NYSE: O) increased its monthly distribution 0.2% to $0.182 a share for a 4.88% yield.

River Valley Bancorp (NYSE: RIVR) hiked its quarterly dividend $0.02 to $0.23 a share for 3.6% yield. The dividend, payable July 11, represents the 68th consecutive dividend paid by the Indiana bank.

U.S. Bancorp. (NYSE: USB) upped its quarterly dividend 6.5% to $0.24 a share for a 2.24% yield. The hike follows a March approval from the U.S. Federal Reserve regarding distributions. The Minneapolis bank hit an all-time high of $43.92 intraday Friday.

W.P. Carey Inc. REIT (NYSE: WPC) sweetened its quarterly dividend 0.6% to $0.90 a share for a 5.51% yield. It was the 53rd consecutive quarterly dividend increase from the leading global net-lease real estate investment trust.

Don't forget to claim your free report: The Best Dividend Strategy for Building a Fortune in the Low-Yield Era

Now for Today's Top Story: After 117 years, the London Silver Fix is shutting down, which could pave the way for true price discovery for the white metal. And as an old institution dies, a new bull market is born...