Investing in gold is a great way to diversify investment portfolios, hedge against a financial crisis, and even protect against inflation. But with so many different types of gold to buy, finding the right gold investment can be a difficult task for retail investors.

Money Morning's Resource Specialist Peter Krauth is a 20-year veteran of the resource market with special expertise in precious metals and gold, and he recently gave Money Morning readers a snapshot at some of the best ways to invest in physical gold.

Best Types of Gold Coins to Buy

One of the most popular types of gold investments is gold coins.

There are numerous types of gold coins traded throughout the world, and they all have different weights, fineness, face values, and intrinsic values.

"When looking to buy gold coins, it's usually the gold content that differentiates various types," Krauth said.

Certain gold coins contain different types of metals, often copper, which add to the durability of the coin. That's why not all one-ounce (1 oz.) gold coins can be compared directly. They all may contain an ounce of gold, but they won't necessarily weigh the same.

Certain gold coins contain different types of metals, often copper, which add to the durability of the coin. That's why not all one-ounce (1 oz.) gold coins can be compared directly. They all may contain an ounce of gold, but they won't necessarily weigh the same.

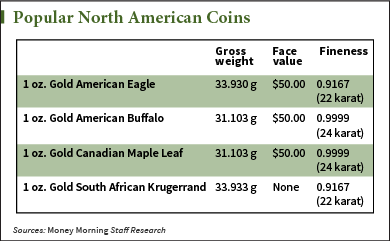

For North American investors, gold coins are usually narrowed down to the four most popular: the Gold American Eagle, the Gold American Buffalo, the Gold Canadian Maple Leaf, and the Gold South African Krugerrand.

"Both of the American coins typically command somewhat higher premiums than either their Canadian or South African brethren, thanks to their level of recognition in North America," Krauth said. "Nonetheless, the Maple Leaf and Krugerrand are both among the most popular coins worldwide."

Each of these coins is produced by their national mint, and all except for the Krugerrand carry a face value of $50. Those three are guaranteed by their respective governments for their content and purity.

While their face values are all $50, their intrinsic value is actually much higher. Currently, the Gold American Eagle can be purchased through the Canadian metal dealing company Kitco for just over $1,372. The Gold American Buffalo is currently valued at $1,375, while the Gold Canadian Maple Leaf is $1,355.

Even though the Gold South African Krugerrand has no face value, a one-ounce coin is currently worth $1,351.

These coins can also be purchased in 1/10-ounce, 1/4-ounce, and 1/2-ounce amounts. Additionally, these gold coins are widely traded, meaning they can be sold easily if the need arises.

But gold coins aren't the only popular option when it comes to buying gold...

Buying Gold Bars

Another popular way of investing in gold is purchasing gold bars. Bars come in various sizes, including one ounce, 10 ounces, 10 grams, 100 grams, and one kilogram.

The most common type of gold bar is called "good delivery," which is a gold bar that meets numerous requirements set by the London Bullion Market Association and weighs 400 troy ounces, or 12 kilograms.

"One very significant characteristic here is to consider whether the bars are 'good delivery' or not," Krauth said. "Essentially, good delivery bars are sourced from a reputable refiner who is on the 'good delivery' list of the industry standard London Bullion Market Association (LBMA) and the New York Mercantile Exchange (NYMEX). Bars bearing the stamp and fineness of these refiners are typically readily accepted by gold dealers, allowing the seller an easier transaction and higher value."

Buying gold bars is a great way to buy large quantities of the precious metal. Like coins, gold bars can be traded easily, especially if they are good delivery. Moreover, gold bars usually have lower price premiums than coins.

One downside - gold bars do typically have a higher rate of forgery.

But that shouldn't dissuade investors from buying gold bars, because Peter Krauth has created a guide for determining whether gold bars are counterfeit.

If buying gold bars and coins doesn't appeal to you, there are still other ways to invest in the precious metal...

Other Ways to Invest in Gold Now

One area where Krauth sees huge profit opportunities in 2014 is in gold mining stocks.

As gold prices dipped in 2013, many mines were forced to shutter operations. Now that prices have rebounded, the strong gold mining companies that survived are set to cash in.

"The best mining companies met these challenges by controlling and lowering costs, focusing on the most viable projects, reining in capital expenditures, and even divesting suboptimal assets," Krauth said.

One gold mining stock Krauth has been recommending in 2014 is Goldcorp Inc. (NYSE: GG). GG is a major mining firm that operates, explores, develops, and acquires precious metal properties in Canada.

GG is up 24% year to date.

"Goldcorp is one of the world's top gold miners," Krauth said. "Over the next three years, gold-equivalent production for the company is expected to grow by 44% through organic growth and the startup of two new mines, Cerro Negro in Argentina and Eleonore in Quebec, Canada."

For those looking for a broader play on the gold market, there are also numerous gold ETFs.

One of the most popular is the SPDR Gold Trust (NYSE Arca: GLD), which was founded in 2004 and is designed to mirror the price of gold.

GLD has total net assets of $31.9 million, total outstanding shares of 262.1 million, and a market capitalization of $31.7 billion. It has a price-to-earnings ratio of 17.52.

Year to date, shares of GLD have climbed 9%.

Money Morning recently detailed for our Members the importance of owning gold now - and delivered a two-part "cheat sheet" that outlines the right amount of gold for your portfolio. You can get that gold investing guide - for free - here.

Do you own any physical gold or are you planning on buying any? Join the conversation on Twitter @moneymorning using #Gold.